In 2026, federal student loan wage garnishments will resume for borrowers in default, marking the end of temporary relief measures that were enacted during the COVID-19 pandemic. This change will affect millions of borrowers, many of whom have already been financially strained due to the ongoing student debt crisis.

The resumption of garnishments is part of the broader U.S. government effort to collect on federal student loans that have remained in default for extended periods.

Federal Student Loan Garnishments Set to Restart

| Key Fact | Detail |

|---|---|

| Garnishment Start Date | January 2026 |

| Borrowers Affected | Estimated 5-6 million borrowers in default |

| Maximum Garnishment | 15% of disposable income |

| Minimum Income Protection | Borrowers retain at least $217.50 per week |

The Department of Education has confirmed that garnishment will apply to individuals who have defaulted on their loans for 270 days or more. Once garnishment resumes, up to 15% of a borrower’s disposable income could be deducted from their paycheck or tax refund to repay the loan.

This change raises questions about how such a policy will affect the millions of people who owe federal student loan debt and are already struggling to make ends meet.

The Return of Garnishments: What It Means for Borrowers

The return of wage garnishments represents a significant shift in U.S. student loan policy. Borrowers who have defaulted on their loans will see a portion of their wages deducted to repay the federal government.

During the pandemic relief period, many federal student loan collections were paused, and borrowers were temporarily shielded from garnishment, tax refund offsets, and other penalties. But with the national student loan repayment freeze ending and several policy changes taking effect in 2025, the Department of Education is ready to resume garnishments.

This will impact millions of borrowers, particularly those who have fallen behind on their payments. As a result, more borrowers are now at risk of seeing up to 15% of their disposable income garnished from their paychecks or tax refunds each month.

Who Will Be Affected by the Restart of Garnishments?

Borrowers in Default

The restart of wage garnishment will specifically target borrowers who are in default on their federal student loans. A loan is generally considered in default after a borrower has failed to make payments for 270 days (about nine months).

Currently, over 5 million borrowers are in default on their student loans, and they are most vulnerable to wage garnishment. If these borrowers do not take steps to resolve their defaults before the garnishment resumes, their paychecks or tax refunds could be reduced to fulfill their loan obligations. This is a significant concern for those who are already struggling financially.

How Does Wage Garnishment Work?

Under federal law, the government can garnish up to 15% of a borrower’s disposable income if they are in default. This means that for every paycheck, borrowers could lose up to 15% of their income to help pay down the loan. However, the government is required to allow borrowers to retain a minimum income, equivalent to 30 times the federal minimum wage per week, or about $217.50 per week.

The garnishment applies to wages, salaries, bonuses, and commissions. It does not apply to certain types of income, such as Social Security or disability benefits, although it may be applied to other federal benefits, including tax refunds.

What Borrowers Can Do to Avoid Garnishment

For those who are at risk of default, there are several steps that can be taken to avoid garnishment. Borrowers do not need to wait for garnishment to begin before taking action. There are several options available that could potentially prevent wage garnishment, including:

1. Loan Rehabilitation

Borrowers in default can enter into a loan rehabilitation program, which requires them to make nine consecutive monthly payments on the loan. If successful, the loan will be removed from default status, and garnishment will stop.

Rehabilitation is one of the most effective ways to restore eligibility for federal student aid and avoid garnishment. However, borrowers must commit to a payment plan and must keep up with payments to remain out of default.

2. Loan Consolidation

Another option for borrowers is loan consolidation. Consolidating a defaulted federal student loan into a Direct Consolidation Loan can reset the loan to a non-default status, which could stop the garnishment. However, consolidation could mean losing certain borrower benefits, such as borrower protections under the original loan terms.

3. Income-Driven Repayment Plans

For those struggling with high monthly payments, enrolling in an income-driven repayment (IDR) plan may help. These plans base the borrower’s monthly payment on their income and family size. While this option does not directly remove the default status, it can prevent garnishment by lowering the required monthly payment.

Economic and Social Impact of Wage Garnishment

The resumption of student loan wage garnishment will have widespread financial and social implications, especially for low-income borrowers. Critics argue that wage garnishment exacerbates the financial strain on borrowers who are already struggling with rising living costs, stagnating wages, and a lack of affordable housing.

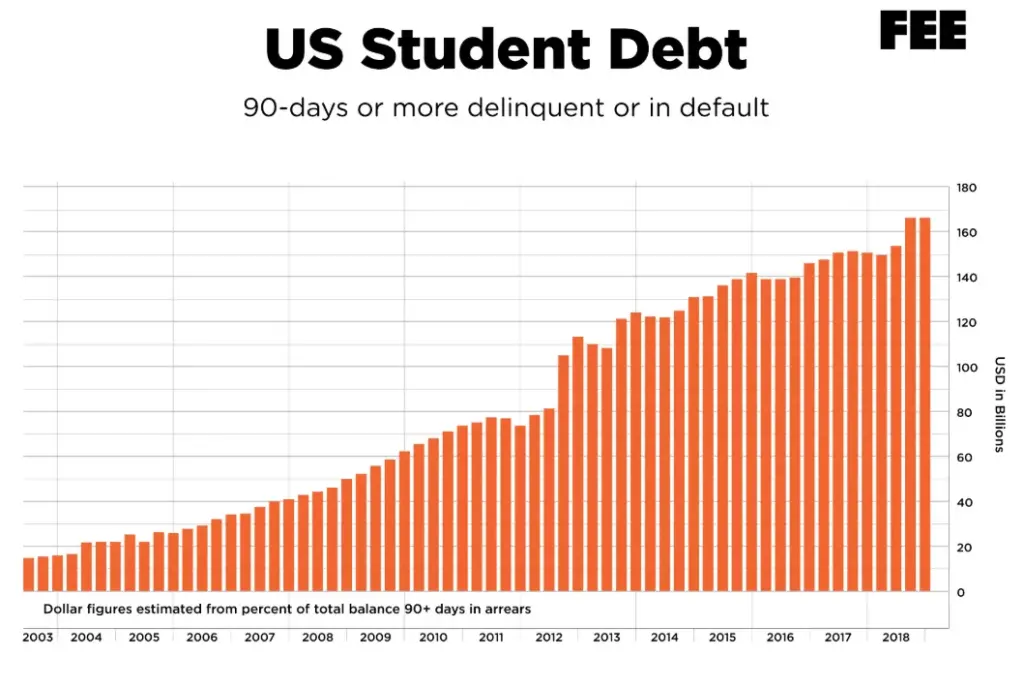

The U.S. student loan crisis is one of the largest consumer debt issues in the country. As of 2023, federal student loan debt exceeds $1.7 trillion, affecting more than 45 million Americans.

The vast majority of these loans are held by borrowers who are unable to make their monthly payments, which can lead to default. Research from the Federal Reserve has shown that over 20% of borrowers are currently in default, and many struggle to pay back even a portion of their loan balance.

As wage garnishment resumes, many borrowers are likely to experience significant financial hardship. Wage garnishment can leave borrowers with limited disposable income to meet their basic living needs, such as housing, food, and healthcare. This can contribute to long-term financial instability, perpetuating the cycle of debt for millions of Americans.

What Are the Alternatives to Garnishment?

While garnishment is a legal method to enforce student loan repayment, experts argue that there should be more comprehensive solutions to prevent default in the first place. These alternatives could help reduce the number of defaults and alleviate the burden on borrowers:

1. Student Loan Forgiveness Programs

One of the most widely discussed solutions to the student loan crisis is the expansion of student loan forgiveness programs.

For example, the Public Service Loan Forgiveness (PSLF) program allows certain borrowers working in qualifying public sector jobs to have their loans forgiven after 10 years of qualifying payments. Expanding this program and others could reduce the total amount of loan debt carried by borrowers and prevent defaults from occurring in the first place.

2. Financial Counseling and Education

Many borrowers default because they do not understand the repayment options available to them. Financial counseling and education programs could help borrowers better understand their debt and the repayment options available to them. This could reduce the likelihood of default by providing borrowers with the tools to make informed financial decisions.

3. More Income-Driven Repayment Options

Expanding income-driven repayment (IDR) plans and offering borrowers more affordable options to manage their debt could help reduce the need for garnishment. This approach would allow borrowers to make payments based on their ability to pay, rather than forcing them into default.

Looking Forward: What’s Next for Borrowers and Policymakers?

As federal student loan wage garnishments resume in 2026, the broader conversation about the student loan crisis is intensifying. While the government is focusing on enforcing repayment through garnishment, lawmakers, educators, and debt relief advocates are calling for more comprehensive solutions to help struggling borrowers.

If you are in default on your federal student loans, it is critical to take proactive steps to resolve your loan status before garnishment begins.

Understanding your rights, exploring options such as loan rehabilitation or consolidation, and seeking help from financial advisors can significantly improve your financial situation and prevent garnishment from impacting your paycheck.

Related Links

Which 8 States Will Still Tax Social Security in 2026 — And What It Could Cost You

$460 Monthly Cuts? Why Seniors on Social Security May Be Hit Harder Than Ever

Navigating the Restart of Federal Student Loan Garnishments

The restart of wage garnishments in 2026 highlights the challenges millions of American borrowers face in paying off their student loans. As garnishment resumes, borrowers must be proactive in addressing their loan defaults and seeking solutions that work for their financial circumstances.

Policymakers must also continue to find ways to balance loan enforcement with meaningful relief for those most burdened by student debt.

FAQs About Federal Student Loan Garnishments

What is wage garnishment for student loans?

Wage garnishment is a debt-collection tool that allows the U.S. Department of Education to withhold part of your paycheck to repay defaulted federal student loans.

How much can be garnished from my paycheck?

The government can garnish up to 15% of your disposable income. However, borrowers are allowed to keep at least $217.50 per week.

What should I do if I am in default on my student loan?

You can rehabilitate your loan, consolidate it into a new loan, or enter an income-driven repayment plan to stop garnishment and resolve your default.