The first Social Security “stimulus” payment of 2026 will hit accounts starting on January 14, marking the start of the annual cost-of-living adjustment (COLA) for Social Security and Supplemental Security Income (SSI) recipients.

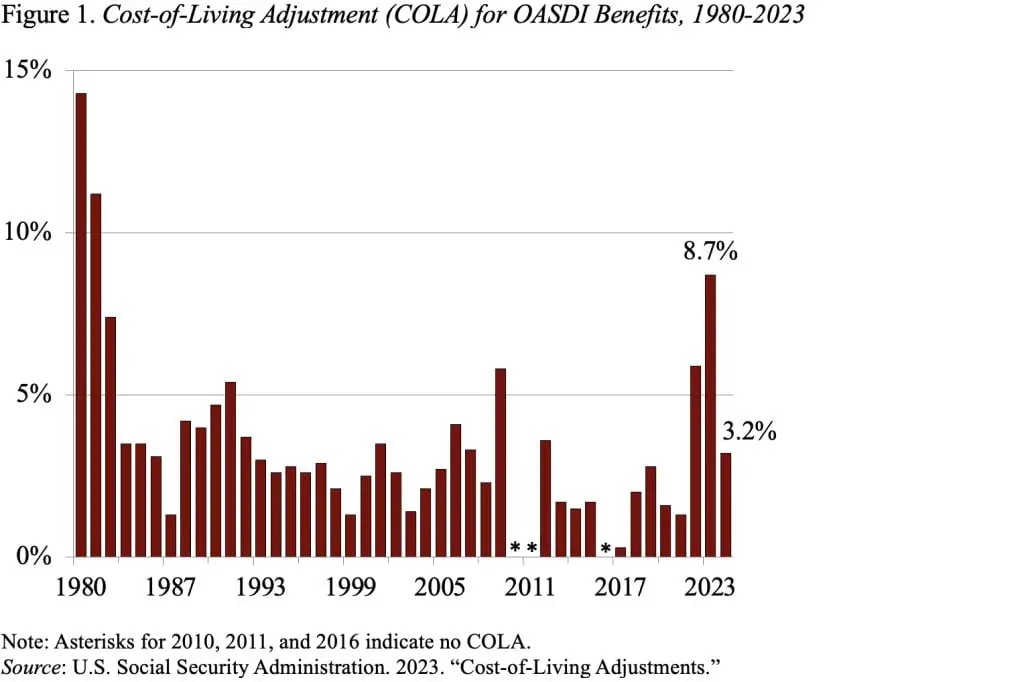

For those who rely on Social Security, the 2.8% COLA increase is critical to keeping up with rising living costs, such as food, healthcare, and transportation. While often called a “stimulus” in the media, the 2.8% COLA is not a one-time stimulus payment, but rather a legally required increase to Social Security payments that automatically adjusts for inflation.

This article explains the COLA adjustment, who benefits from it, and the real impact of these changes on Social Security recipients in 2026. We’ll break down what to expect, eligibility criteria, and important considerations to help you plan accordingly.

What Is the Social Security ‘Stimulus’ Payment and Why Is It Important?

The term “stimulus” refers to the COLA adjustment to Social Security benefits, which is often described as a way to offset the effects of inflation on beneficiaries. However, unlike the stimulus checks issued by the government during the COVID-19 pandemic, this is not an additional one-time check.

Instead, it’s an annual adjustment that happens automatically for Social Security and SSI recipients. This adjustment is designed to ensure that the benefits maintain their purchasing power despite inflation.

The 2.8% COLA for 2026 represents the increase needed to reflect the rising costs of living — mainly related to goods like food, medical care, and housing. Since many Social Security recipients rely on their benefits as their primary source of income, it’s crucial that these payments reflect the cost of maintaining a basic standard of living.

How Much Will Social Security Payments Increase in 2026?

In 2026, Social Security benefits will increase by 2.8% for most recipients. This increase will vary based on the type of benefit and the individual’s specific situation.

For example:

- The average retired worker will see a $56 monthly increase, raising their benefit from $2,015 to $2,071.

- For couples both receiving Social Security, their monthly benefit will increase by $88, from $3,120 to $3,208.

- Disabled workers will receive an additional $44, bringing their average monthly benefit to $1,630.

The 2.8% COLA also affects SSI recipients, though these payments tend to be lower. In 2026, SSI payments will increase according to the same 2.8% adjustment, helping the most vulnerable members of society. Here is a breakdown of the typical monthly benefit increase for various groups:

| Beneficiary Type | 2025 Monthly Payment | 2026 Monthly Payment (After COLA) |

|---|---|---|

| Average Retired Worker | $2,015 | $2,071 |

| Aged Couple (Both Receiving) | $3,120 | $3,208 |

| Disabled Worker | $1,586 | $1,630 |

| Widowed Mother & Children | $3,792 | $3,898 |

| Aged Widow(er) | $1,867 | $1,919 |

Who Qualifies for the COLA Increase in 2026?

The COLA increase applies to all Social Security beneficiaries and SSI recipients. However, your payment date will depend on several factors, such as:

1. Birth Date:

Social Security payments are distributed on a specific schedule based on your birthdate. Here’s the breakdown:

- 1st–10th of the Month: Payment is issued on January 14, 2026 (Second Wednesday).

- 11th–20th of the Month: Payment is issued on January 21, 2026 (Third Wednesday).

- 21st–31st of the Month: Payment is issued on January 28, 2026 (Fourth Wednesday).

2. Type of Benefit:

Social Security payments may include retirement benefits, disability benefits (SSDI), survivor benefits, and Supplemental Security Income (SSI). All types of benefits are subject to the COLA adjustment.

While retirement and disability benefits follow the birthdate-based payment schedule, SSI payments are typically issued earlier in the month (e.g., December 31 for January payments, due to the New Year’s holiday).

How Will the COLA Adjustment Affect Your Monthly Payment?

While the 2.8% COLA increase provides a much-needed boost, it’s important to consider factors that may offset the increase:

1. Rising Medicare Premiums:

For many Social Security recipients, Medicare premiums are automatically deducted from monthly payments. The Medicare Part B premium is expected to increase in 2026, which means that the net gain from the COLA increase could be smaller than expected.

The projected Part B premium for 2026 is approximately $202.90, a rise from previous years. For some beneficiaries, this could reduce the net effect of the COLA increase.

2. Taxes on Benefits:

Social Security benefits are subject to federal income tax depending on your total income. Individuals earning above a certain threshold will have up to 85% of their benefits taxed. This could result in a reduced net increase from the COLA adjustment, particularly for high-income beneficiaries.

3. Inflation and the Cost of Living:

Despite the 2.8% COLA, inflationary pressures continue, especially on healthcare costs, housing, and food. Beneficiaries in areas with high living costs might find that the COLA barely covers the rising prices.

Additionally, the COLA is calculated based on past inflation, so future cost increases could outpace the adjustment in subsequent years.

When Will You Receive Your Payment in 2026?

Social Security payments will continue to follow the same schedule, but knowing your specific payment date is important. For example:

- If your birthday falls between the 1st and 10th of the month, you’ll receive your payment on January 14.

- If your birthday falls between the 11th and 20th, your payment will be on January 21.

- If your birthday falls between the 21st and 31st, you’ll receive your payment on January 28.

For SSI recipients, payments will be issued on December 31, 2025, due to the January 1, 2026, holiday. The COLA adjustment will automatically apply to all eligible payments starting in January.

How Do Medicare Premiums and Taxes Impact the COLA?

The COLA increase is intended to help beneficiaries keep pace with rising costs. However, there are some deductions that can affect the overall increase:

- Medicare Part B Premiums: These premiums are deducted from Social Security payments, and any increase in premiums will reduce the net gain from the COLA adjustment.

- Income Taxes: Social Security benefits may be subject to taxation, which further reduces the amount beneficiaries actually receive.

These factors underscore the importance of careful financial planning for Social Security recipients, as the COLA increase may not fully cover all rising costs.

Related Links

USDA SNAP Funding Cut – What the Minnesota Decision Means for Benefits and Who Could Be Affected

SNAP Food Ban 2026 – Full List of States That Will Restrict Certain Foods From Benefits

Understanding the Impact of COLA on Your Social Security Benefits

The first Social Security ‘stimulus’ payment of 2026 refers to the 2.8% COLA increase that will help millions of Americans keep up with inflation. While the COLA adjustment provides an important financial boost, beneficiaries should remain aware of additional factors such as Medicare premiums and taxation that may offset the increase.

For many recipients, this annual COLA increase is vital to maintaining purchasing power in a challenging economic environment. However, with rising healthcare costs, inflation, and potential changes to tax policies, the COLA increase is not always enough to make up for the full rise in living expenses.

FAQs About First Social Security ‘Stimulus’ Payment of 2026

Q: What is the 2.8% COLA increase in 2026?

A: The 2.8% COLA increase is an adjustment to Social Security and SSI payments to help recipients keep up with inflation. It starts with payments made in January 2026.

Q: Will the COLA increase be enough to offset rising costs?

A: For many beneficiaries, the increase may help, but rising Medicare premiums and higher living costs may offset the full benefit of the COLA adjustment.

Q: When can I expect my Social Security payment in January 2026?

A: Payments are made based on your birthdate:

1st–10th: January 14

11th–20th: January 21

21st–31st: January 28

Q: How does Medicare affect my Social Security payment?

A: Medicare Part B premiums are deducted from your Social Security benefits, which could reduce the net gain from the COLA adjustment.