The idea of a flat $1,660 Social Security benefit has emerged as a proposed solution to the long-term financial challenges faced by the program. This flat benefit would significantly alter the way Social Security benefits are calculated, offering the same monthly payment to all retirees, regardless of their lifetime earnings.

While proponents argue it could simplify the system and reduce poverty, critics warn it may unfairly reduce benefits for middle- and high-income retirees. This article explores what a flat $1,660 monthly Social Security benefit would change, delving into its potential benefits, challenges, and the broader implications.

What Is the $1,660 Flat Social Security Benefit Plan?

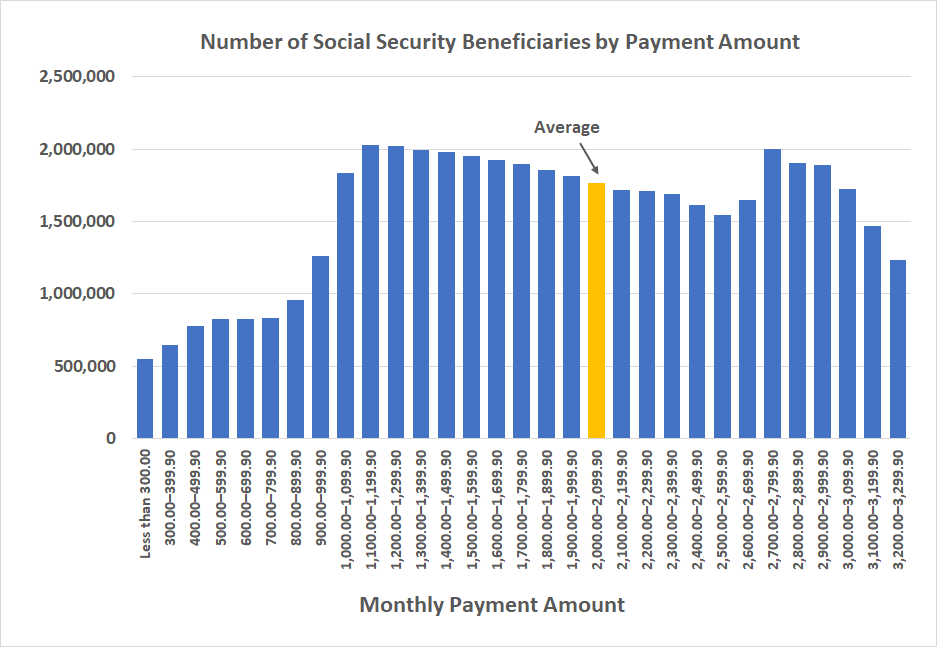

The $1,660 flat benefit proposal suggests that all Social Security beneficiaries, regardless of their lifetime earnings, would receive the same monthly payment of $1,660. This contrasts with the current system, which calculates benefits based on an individual’s work history and earnings.

The proposal seeks to replace the progressive wage-based formula that rewards higher lifetime earnings with a standardized benefit for everyone, with the aim of ensuring basic financial security for all retirees.

Why $1,660?

The figure of $1,660 is based on 125% of the Federal Poverty Level (FPL), which advocates argue would ensure that no one falls below the poverty line in retirement. In 2026, this would result in an increase in benefits for low-income workers, while reducing payments for those who have contributed more to the system.

However, the financial implications would differ drastically for higher-income earners, who stand to lose the most under this proposal.

Potential Benefits of the $1,660 Flat Social Security Plan

1. Simplification of the System

One of the most compelling arguments for a flat Social Security benefit is the simplicity it offers. The current system requires complex calculations based on an individual’s earnings history, work history, and cost-of-living adjustments (COLAs).

A flat benefit removes the need for these calculations, making the system easier for the public to understand and for the Social Security Administration (SSA) to administer. This simplification could also reduce administrative costs and make the program more transparent.

2. Poverty Reduction for Low-Income Retirees

The $1,660 flat benefit would especially benefit low-income retirees who currently struggle to make ends meet with Social Security benefits that don’t fully cover basic living expenses. By guaranteeing a higher baseline benefit, the plan would lift many retirees above the federal poverty line.

This would be especially crucial for people who spent their working years in low-paying jobs and didn’t have access to supplementary retirement savings plans like 401(k)s or individual retirement accounts (IRAs).

3. Financial Sustainability of Social Security

Proponents argue that moving to a flat benefit would reduce overall benefit payouts, which could extend the solvency of the Social Security Trust Fund. Under the current system, the program faces a significant funding shortfall, with projected deficits starting in the early 2030s.

The flat benefit system could be a way to reduce the program’s long-term financial burden, ensuring its continued operation while addressing issues of inequality and accessibility.

Challenges and Criticisms of the $1,660 Flat Benefit Plan

1. Reduced Benefits for Middle- and High-Income Retirees

A significant drawback of the flat benefit is the reduction in benefits for middle- and high-income workers. Under the current wage-based system, those with higher lifetime earnings receive larger monthly benefits. However, under the $1,660 flat benefit plan, these individuals would receive the same amount as those with much lower earnings, effectively cutting their expected benefits.

For many middle-class retirees, this could represent a significant loss in their retirement income, which could potentially be seen as unfair given their larger contributions to the program over their working years.

2. Reduced Incentives for Lifetime Earnings and Work

The flat benefit could also reduce incentives for high earners to work more, earn higher wages, or contribute additional funds to Social Security. The current system rewards individuals who earn more by providing them with a higher return on their contributions.

By switching to a flat benefit, there may be fewer incentives for individuals to maximize their earnings, as there would be no additional benefit to paying more into the system. This could have broader implications for labor force participation, savings behavior, and overall economic productivity.

3. Potential Increase in Taxes for Higher Earners

To fund the flat benefit system, the proposal might require an increase in payroll taxes or adjustments to the income subject to Social Security taxation. In the current system, only income up to a certain cap (around $160,000 in 2025) is subject to Social Security taxes.

Raising this cap or increasing the overall tax rate could disproportionately affect high-income earners, adding to their financial burden and possibly leading to political resistance.

Who Would Gain — and Who Would Lose?

The $1,660 flat benefit plan would drastically change the financial landscape for Social Security beneficiaries:

- Low-income retirees, especially those who earn less during their careers or have had interrupted work histories, would see a net benefit from the flat benefit, as they would receive a higher amount than they would under the current system.

- Middle-income workers, whose earnings have been above average, would likely see their benefits reduced significantly under the new plan.

- Higher-income retirees would be most impacted, as they would experience a sharp reduction in their expected benefits.

Overall, the shift would represent a redistribution of benefits, with some beneficiaries gaining more and others losing. The key question remains whether this redistribution is fair and sustainable, and whether it addresses the broader challenges facing the program.

Historical Context and Comparison to Other Countries

The flat Social Security plan is a significant departure from the way the system has operated since its inception in 1935. Traditionally, Social Security was designed to provide earnings-related benefits that replaced a higher percentage of income for lower-income workers.

The shift to a flat benefit would reduce this progressive nature and potentially create new equity issues. Several other countries, such as Australia and New Zealand, have adopted more universal pension systems that provide flat benefits to all retirees, funded through general taxation.

These systems are designed to reduce poverty among retirees while simplifying administration. The U.S. Social Security program, however, has always been built around the principle of earned benefits, which makes any shift to a flat benefit a radical change.

While other countries have successfully implemented universal or flat benefit systems, the U.S. faces unique challenges due to its large, diverse population and the existing Social Security system’s reliance on earnings-based entitlements.

Public Reaction and Political Considerations

The flat benefit plan is a contentious issue. While some advocates argue that a flat benefit could make the Social Security system more equitable and efficient, others view it as an unfair policy that penalizes hard-working, middle-class Americans.

Furthermore, the political feasibility of such a proposal is uncertain, as it would likely face opposition from higher-income groups, as well as from those who view the traditional, earnings-based system as a core American principle.

Public opinion on Social Security reform is divided, with some individuals supporting more progressive benefits that favor lower-income retirees, while others emphasize the need to preserve the earned benefits system.

The debate over the flat Social Security plan is likely to intensify as the U.S. faces continued budget deficits and demographic shifts that strain the current system.

Related Links

Social Security $994 Payment – February 2026 Deposit Timeline and Who Is Eligible

Texas Social Security Schedule – January 2026 Payment Dates and How the System Works

The Future of Social Security Reform

The $1,660 flat benefit proposal represents one of many potential reforms to the U.S. Social Security system. While it promises to simplify the program and provide a basic income floor for all retirees, it would also reduce benefits for many middle- and high-income workers.

The question of whether such a drastic change is necessary and fair remains open for debate. As the U.S. government continues to examine potential reforms, it will be essential to balance the need for equity with the goal of ensuring the financial sustainability of Social Security for future generations.

The flat benefit proposal will remain a focal point in ongoing discussions about how best to structure a program that serves both the economic security and the financial realities of the nation’s aging population.