The U.S. Medicaid program, which provides health coverage to millions of low-income Americans, has faced significant challenges over the years. One of the most persistent problems has been improper payments — funds paid to ineligible recipients, often due to administrative errors or outdated records.

A new law has recently been passed in response to these long-standing issues, with the goal of reducing waste and ensuring that taxpayer dollars are spent more effectively.

At the core of this legislation is the effort to recover some of the $207 million in improper payments identified in recent audits, particularly those made on behalf of deceased beneficiaries. With an estimated $207 million in Medicaid payments being made to individuals who were already deceased, a new approach to eligibility verification is being implemented.

The hope is that this reform will lead to more efficient management of Medicaid funds, protecting the integrity of the system and ultimately benefiting the program’s beneficiaries.

What the New Law Means for Medicaid Beneficiaries

The new law targeting improper Medicaid payments is focused on ensuring that only eligible individuals receive benefits. A central component of the law involves enhancing eligibility verification methods. Medicaid agencies will now be required to cross-check their rolls with official death registries on a regular basis to prevent payments being made to deceased individuals.

For beneficiaries, this means fewer errors in their enrollment status and more accurate data. There will be fewer instances where individuals continue receiving benefits they are not entitled to, allowing resources to be better allocated.

Additionally, the law ensures that those who genuinely qualify for Medicaid benefits continue to receive coverage without unnecessary delays or complications. The law also introduces automated checks, which should speed up the process of verifying eligibility and ensure more seamless operations across state lines.

Key Provisions of the New Law

The new law incorporates several provisions to help reduce improper payments and improve the overall efficiency of Medicaid’s administration:

- Quarterly Death Record Checks: States will be required to regularly verify Medicaid beneficiaries against the Social Security Administration’s Death Master File. This will allow states to remove deceased individuals from Medicaid rolls quickly and reduce the possibility of improper payments.

- Automation of Eligibility Updates: Medicaid will implement automated systems that will update eligibility records more efficiently, reducing the risk of human error and administrative delays.

- Enhanced Audit Processes: The law mandates a more robust auditing system for Medicaid, ensuring better tracking of payments and identification of issues before they become widespread.

- Public Transparency: The law also includes a requirement for states to publicly report improper payments and corrective actions, fostering greater accountability within the program.

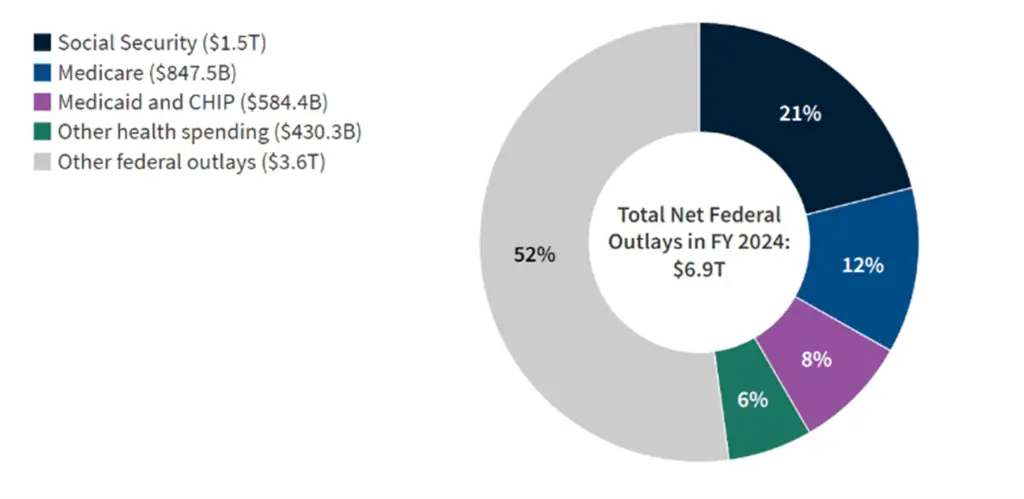

The $207 Million Budget Fix: Financial Implications

The $207 million in improper payments identified in recent audits highlight the severity of the issue and the need for reform. These improper payments were primarily due to payments made on behalf of deceased beneficiaries, an issue that has plagued the Medicaid program for years.

Through a series of audits, it was revealed that Medicaid has been inefficient in updating records and verifying eligibility in a timely manner. The new law is expected to help recover some of these misallocated funds, creating a potential budget fix for both federal and state Medicaid budgets.

By eliminating these errors and improving financial oversight, the Medicaid program can redirect funds toward eligible recipients and improve its long-term sustainability. The legislation also calls for states to adopt technology solutions that could prevent similar issues in the future.

By reducing wasteful spending, these reforms will ultimately lead to savings, allowing Medicaid to serve more beneficiaries without increasing costs.

The Broader Impact on Medicaid Recipients

For Medicaid recipients, this new law promises more efficient and streamlined service. The bill’s provisions for better eligibility checks and automated data updates will result in fewer delays and fewer errors in the Medicaid system.

People who qualify for benefits can expect smoother enrollment and fewer disruptions to their coverage. Furthermore, the increased auditing could make it easier for recipients to prove their eligibility, as states will have more reliable, up-to-date information on who qualifies for coverage.

The reforms should help ensure that Medicaid funds are allocated where they are needed most, improving care and access for eligible recipients.

Potential Challenges and Drawbacks

Despite the positive changes, there are challenges and risks associated with implementing the new law. One potential concern is the administrative burden that may fall on state agencies. Some states may lack the necessary resources or infrastructure to carry out these regular checks and audits efficiently, leading to delays or even errors in removing ineligible individuals from Medicaid rolls.

Additionally, there is the risk of beneficiaries being mistakenly removed from Medicaid if their records are not properly updated or cross-referenced. The law does include provisions for an appeals process, but there may be an increase in complaints or confusion among recipients if they are inadvertently disenrolled.

Another challenge will be ensuring that state compliance with the new regulations is consistent. States with more outdated Medicaid systems may struggle to meet the quarterly verification requirements, which could delay the full implementation of the law’s provisions.

A Look at Historical Medicaid Payment Issues

The issue of improper payments in Medicaid is not new. Historically, Medicaid has struggled with inefficiencies in eligibility verification, resulting in billions of dollars in misallocated funds. Early audits revealed significant challenges with maintaining up-to-date records, particularly when it came to verifying the eligibility of enrollees.

State agencies have often lacked the resources to perform real-time eligibility checks, which has led to systemic errors. The issue of payments being made to deceased individuals highlights a broader problem with outdated systems, and the new law seeks to address these issues through modernisation and better data-sharing processes.

Impact on Medicaid’s Future

The new law is part of a larger effort to ensure the long-term viability of Medicaid. Given the program’s size and importance, making sure that funds are spent correctly is critical to its success. By reducing improper payments, the law will help ensure that Medicaid continues to serve millions of Americans without being burdened by financial inefficiency.

The hope is that this reform will set a precedent for future improvements in other government programs, encouraging greater transparency, efficiency, and accountability across the board.

Related Links

January SSI Payment Comes Early in 2026: Why the Date Shifts and What Changes

December 24 Social Security Payments: Who Is Scheduled to Receive a Check

The new law to stop improper Medicaid payments is a crucial step in making the Medicaid program more efficient, accountable, and sustainable. By improving eligibility verification, increasing audits, and recovering millions in wasted funds, the law addresses a longstanding issue that has cost taxpayers and compromised the integrity of the Medicaid system.

For Medicaid recipients, the new law promises more reliable service and a streamlined process. For taxpayers, it offers greater assurance that their money is being spent effectively. While challenges remain, this legislative change has the potential to dramatically improve the Medicaid program for years to come.