The IRS Fresh Start Program 2026 update clarifies how Americans with unpaid federal taxes can qualify for relief as the Internal Revenue Service resumes full-scale collections after years of pandemic-era disruption.

While the program’s core structure remains intact, stricter enforcement, clearer payment expectations, and renewed compliance scrutiny now shape how taxpayers access installment plans and settlements.

What the IRS Fresh Start Program Is — and What It Is Not

The IRS Fresh Start Program is not a single law or temporary amnesty. It is a collection of administrative policies introduced in 2011 to help taxpayers resolve overdue federal tax liabilities while avoiding severe enforcement actions.

The initiative expanded access to installment agreements, eased federal tax lien practices, and updated hardship standards following the Great Recession. According to the IRS, the goal was to improve voluntary compliance while recognizing financial reality.

However, the program does not guarantee tax forgiveness. Every form of relief requires eligibility, documentation, and continued compliance with future tax obligations.

Why the 2026 Update Matters Now

The IRS Fresh Start Program 2026 update arrives as the agency exits a prolonged enforcement slowdown. During the COVID-19 pandemic, the IRS suspended many collection actions, creating a backlog of unresolved tax debt.

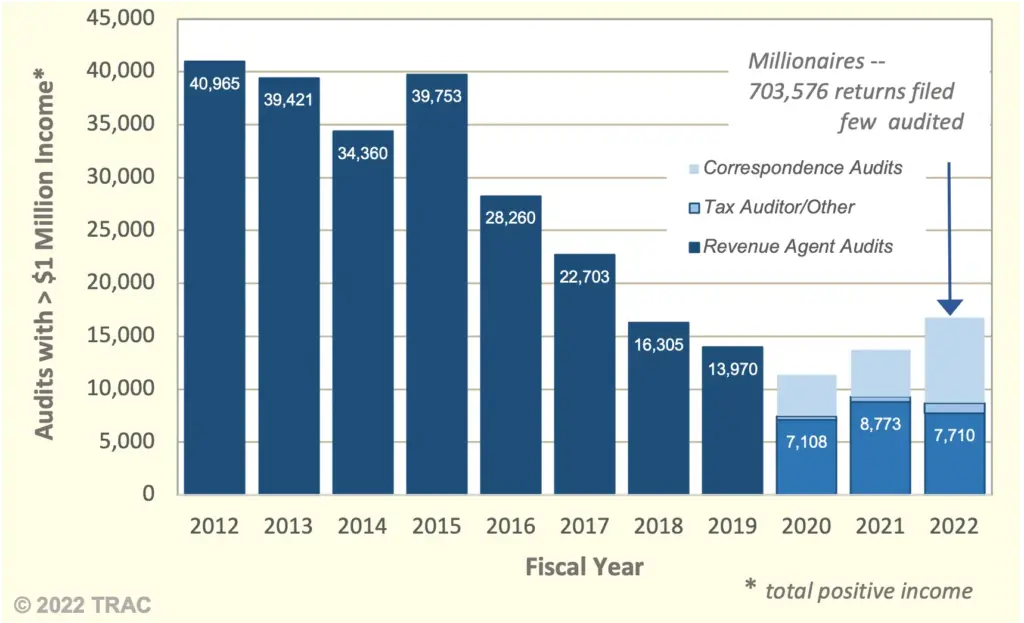

That pause has ended. Backed by tens of billions of dollars in modernization funding approved by Congress, the IRS has increased staffing, reopened dormant cases, and resumed liens, levies, and payment plan reviews.

“Taxpayers should expect more consistent enforcement going forward,” said Erin Collins, the National Taxpayer Advocate, in her most recent annual report to Congress. “But the IRS still prefers resolution over confrontation.”

Eligibility Rules Under the IRS Fresh Start Program in 2026

Filing Compliance Is the First Requirement

Taxpayers must have filed all required federal returns to qualify for Fresh Start relief. The IRS typically requires at least the last six years of returns, depending on the resolution option requested. Unfiled returns generally halt any relief consideration until processed.

Debt Thresholds and Financial Disclosure

For individuals, the streamlined installment agreement threshold remains $50,000 or less, including penalties and interest. Within this limit, many taxpayers can avoid detailed financial disclosures.

Taxpayers owing more than $50,000 may still qualify, but must submit financial statements detailing income, expenses, assets, and liabilities.

Bankruptcy and Prior Defaults

Active bankruptcy cases disqualify taxpayers from Fresh Start installment agreements. Those who defaulted on recent payment plans may face additional scrutiny or higher required payments. Self-employed taxpayers must also stay current on estimated quarterly tax payments.

How Monthly Payment Limits Are Determined

There is no universal monthly payment cap under the Fresh Start framework. Instead, the IRS calculates payments based on statutory timelines and verified ability to pay.

Streamlined Installment Agreements

Under streamlined rules, balances must generally be paid in full within 72 months or before the collection statute expiration date. A $24,000 balance, for example, typically results in a minimum monthly payment of about $333, excluding ongoing interest.

Partial Payment Installment Agreements

Taxpayers who cannot afford full repayment may qualify for Partial Payment Installment Agreements, allowing smaller payments that may not satisfy the entire balance before the statute expires. These agreements are reviewed every two years, and payments may increase if financial circumstances improve.

Offer in Compromise: Settlement Still Possible, but Scrutinized

The Offer in Compromise (OIC) program remains available in 2026, allowing eligible taxpayers to settle for less than the full amount owed. The IRS evaluates OICs using “reasonable collection potential,” a calculation that considers income, assets, allowable living expenses, and future earning capacity.

IRS data show acceptance rates typically below 50 percent, reflecting the program’s strict financial standards.

How the IRS Calculates “Ability to Pay”

The IRS uses national and local expense standards to determine allowable living costs. These standards cap expenses such as housing, transportation, food, and healthcare.

Taxpayers whose actual expenses exceed those standards must justify the difference, or the IRS may calculate a higher payment amount than expected.

Individual vs. Business Taxpayers: Key Differences

Business taxpayers face additional risks, especially those with unpaid payroll taxes. The IRS can assess the Trust Fund Recovery Penalty, making owners and officers personally liable for withheld employee taxes.

Unlike income tax debt, payroll tax enforcement is often faster and more aggressive, even under Fresh Start policies.

Enforcement Risks for Non-Participation

Taxpayers who ignore IRS notices face escalating consequences. These may include wage garnishment, bank account levies, seizure of refunds, and, for debts exceeding statutory thresholds, passport revocation.

According to IRS guidance, proactive engagement significantly reduces the likelihood of forced collection.

Warnings About Misleading Marketing Claims

Consumer advocates continue to warn against companies that advertise “guaranteed” Fresh Start relief. “The program exists, but it is often oversold,” said Nina Olson, former National Taxpayer Advocate. “There are no shortcuts, and eligibility matters.”

Federal regulators have previously sanctioned firms for deceptive tax relief advertising.

Related Links

Trump $2,000 Tariff Dividend Update – Current Status, Who May Qualify, and How SNAP Fits In

Florida SNAP Benefits January 2026 – Extra Payments Still Going Out in the Final Days of the Month

How Taxpayers Can Apply

Many installment agreements can be requested directly through the IRS Online Payment Agreement system. More complex resolutions, such as Offers in Compromise, require extensive documentation and lengthy review. Professional representation is optional but not required.

What to Expect Going Forward

IRS officials say enforcement will remain consistent through 2026 as modernization efforts continue. Relief options under the Fresh Start framework remain available, but compliance expectations are rising.

For taxpayers with unresolved balances, early communication with the IRS remains the most effective way to limit penalties and enforcement exposure.