The Internal Revenue Service has confirmed that the 2026 federal tax filing season will begin on January 26, opening the window for Americans to submit returns for the 2025 tax year.

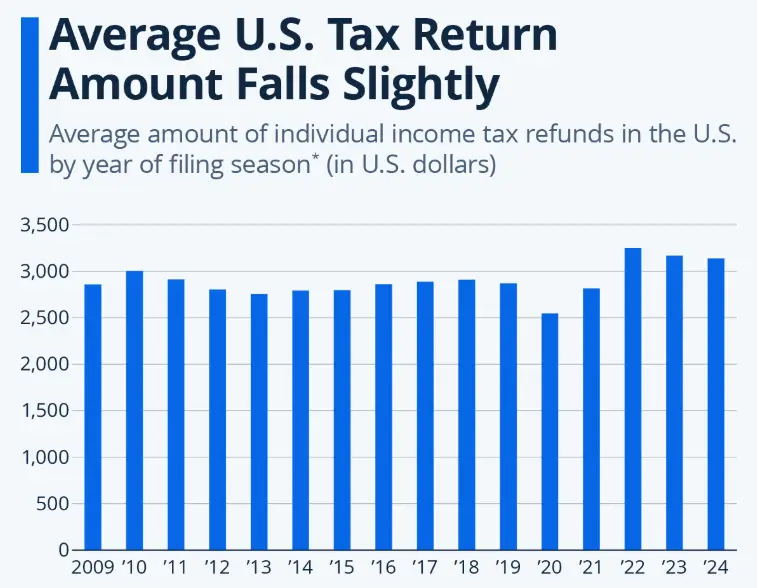

While the timeline follows historical norms, refund amounts in 2026 may differ sharply from recent years due to tax law adjustments, income reporting changes, and withholding mismatches.

IRS Tax Season 2026 Start Date

| Item | Confirmed Detail |

|---|---|

| Filing Season Opens | January 26, 2026 |

| Tax Year Covered | 2025 income |

| Early Free File Access | Mid-January |

| Typical Refund Processing | ~21 days (e-file) |

| Refund Size | Varies significantly |

IRS Tax Season 2026 Start Date Announced

The IRS stated that it will begin accepting and processing federal income tax returns on January 26, 2026, applying to both electronic and paper filings. The agency said the date reflects system readiness, staffing capacity, and coordination with financial institutions.

As in prior years, some taxpayers will be able to prepare and submit returns earlier through the IRS Free File platform. Those early submissions will be held and processed once the official season opens.

Why Refund Amounts May Surprise Filers in 2026

Although the filing calendar looks familiar, refund outcomes may not. Refunds are shaped by how much tax was paid during the year compared with actual liability—and several 2025-specific factors are altering that balance.

Key influences include:

- Updated standard deductions

- New or expanded credits

- More precise income reporting

- Shifts in wage withholding accuracy

For many taxpayers, the result will be refunds that diverge sharply from prior years, either upward or downward.

How Refunds Are Really Calculated

A refund is not a government benefit. It represents overpayment.

Refund size depends on:

- Total tax liability

- Federal withholding throughout the year

- Credits claimed

- Accuracy of reported income

A larger refund may simply indicate that too much tax was withheld in 2025.

Who Is Most Likely to See Larger Refunds

Tax professionals expect some filers to benefit more than others, particularly:

- Seniors eligible for expanded deductions

- Families claiming dependents

- Workers with overtime or irregular income

- Taxpayers who did not update W-4 forms after law changes

These groups may see refunds increase due to mismatched withholding, not lower tax rates.

Who May See Smaller Refunds—or Owe Money

Other filers could experience the opposite effect, including:

- Dual-income households

- Gig and contract workers

- Self-employed taxpayers

- Individuals receiving advance credits incorrectly

Under-withholding is the most common reason for unexpected tax bills.

Refund Timing: What the IRS Says

The IRS continues to advise that most error-free, electronically filed returns with direct deposit are processed in about 21 days.

However, refunds may be delayed if:

- Returns contain errors

- Identity verification is required

- Certain refundable credits are claimed

- Paper filing is used

Refunds tied to the Earned Income Tax Credit or Additional Child Tax Credit cannot be released before mid-February by law.

Federal Refunds vs. State Refunds

Federal and state refunds operate independently.

Key points:

- Filing a federal return does not trigger a state refund automatically

- State processing times vary widely

- Some states delay refunds until federal data is verified

Taxpayers should check state revenue department guidance separately.

Identity Theft and Fraud Safeguards in 2026

The IRS has increased scrutiny around refund fraud and identity theft.

Protective measures include:

- Expanded identity verification

- Refund holds when data mismatches occur

- Encouragement of Identity Protection PIN (IP PIN) enrollment

While these safeguards reduce fraud, they may slow refunds for some filers.

International and Expat Filers

U.S. citizens living abroad are also affected by the January 26 opening date.

Important notes:

- Filing deadlines differ for expats

- Foreign income reporting requirements remain strict

- Refund timing may be longer due to verification steps

Expat filers are advised to file electronically whenever possible.

IRS Digital Tools: What Helps and What Doesn’t

The IRS continues expanding digital services, including:

- Online account access

- Automated transcript retrieval

- “Where’s My Refund?” tracking

However, taxpayer advocates caution that complex returns still require manual review, limiting speed improvements.

Economic Context: Why Refund Variability Matters

Economists note that refund volatility can affect household cash flow, particularly amid:

- Elevated housing costs

- Higher consumer debt

- Inflation-adjusted wage growth

Unexpected refunds—or bills—can materially impact financial stability for lower- and middle-income households.

Common Refund Myths—Clarified

Myth: A bigger refund means you paid less tax

Fact: It often means you overpaid during the year

Myth: Filing early guarantees faster refunds

Fact: Accuracy matters more than timing

Myth: Refund delays mean audits

Fact: Most delays are administrative, not audits

What Taxpayers Should Do Now

Experts recommend:

- Gather all income documents before filing

- Avoid filing until W-2s and 1099s arrive

- Use direct deposit

- Review eligibility for updated credits

- Consider professional help for complex returns

Early preparation reduces delays and correction notices.

Looking Ahead

Although the IRS has locked in the January 26, 2026 start date, refund outcomes will continue to evolve as:

- Final guidance is issued

- Courts rule on tax provisions

- Economic conditions shift

Taxpayers are urged to rely on official IRS communications, not viral refund claims.

Related Links

Trump Food Aid Rules Impact – Why Oregon Faces a $340 Million Cost Under New Medicaid Requirements

SNAP Payment Accuracy Update – How Kansas Is Fixing Errors to Avoid a $41 Million Penalty

The IRS’s announcement that tax season 2026 begins January 26 provides clarity on timing, but not on outcomes. Refund amounts may surprise many filers due to changes in deductions, withholding accuracy, and reporting requirements. Filing carefully, electronically, and with complete documentation remains the most reliable way to ensure timely refunds.

FAQs About IRS Tax Season 2026

When does tax season 2026 start?

January 26, 2026.

Will refunds be bigger this year?

Some may be, but results vary by taxpayer.

How long do refunds take?

About 21 days for most e-filed returns.

Can fraud checks delay refunds?

Yes, identity verification may extend processing time.