The Internal Revenue Service (IRS) has issued its official 2026 direct deposit schedule, detailing the timeline for tax refunds, Social Security payments, and other federal benefits. Amid the release, rumors about a $2,000 IRS payment have circulated, leading many to believe a new round of stimulus checks has been approved.

However, official guidance from the IRS clarifies that these claims are inaccurate. The IRS’s direct deposit schedule for January 2026 relates to tax refunds, child tax credits, and other eligible payments, but there is no authorized $2,000 universal relief check for most taxpayers.

What the IRS Actually Announced for January 2026

Direct Deposit Schedule and Refund Processing

The IRS has set a January 26, 2026 start date for the tax filing season. This means that the IRS will begin accepting and processing tax returns for the 2025 tax year on that day. For most taxpayers who choose direct deposit for their refunds, the processing time is typically 21 days, though this may vary depending on the complexity of the return and other factors.

The IRS also confirmed that paper checks will be phased out in favor of direct deposit, which the agency has deemed more secure and faster. As a result, those expecting refunds should ensure their bank account details are up-to-date with the IRS.

No $2,000 Stimulus Payments Authorized

Despite circulating rumors of a $2,000 direct deposit being issued in January 2026, there is no official stimulus program currently approved by the U.S. government. The IRS has emphasized that refunds taxpayers will receive are tied to 2025 tax filings and existing credits, not a new federal payment.

Taxpayers should note that the $2,000 figure may stem from misleading reports about potential stimulus measures that have been discussed in some political circles but are not yet formalized or enacted into law.

The IRS has made it clear that no new direct payments are set to be distributed as part of any stimulus relief plan in 2026.

Understanding the Types of Payments Issued

Tax Refunds and Refundable Credits

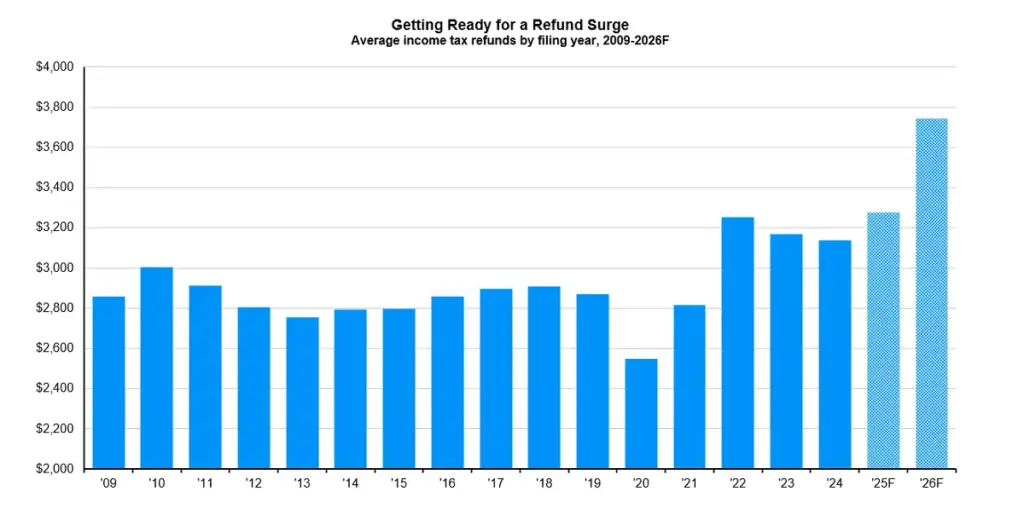

One reason for the confusion is the typical refund amount. For many taxpayers, their tax refund may approach $2,000 depending on income levels, the Earned Income Tax Credit (EITC), and the Child Tax Credit (CTC), both of which are refundable credits. These are not new payments, but routine tax refunds or credits for qualifying individuals.

- Earned Income Tax Credit (EITC): A refundable credit designed to help lower- to moderate-income workers. For many eligible families, the EITC can result in a substantial tax refund.

- Child Tax Credit (CTC): The CTC provides families with children under the age of 17 a potential $2,000 per child credit. This can significantly increase the total refund amount.

These credits, combined with overpaid taxes, often result in refunds that approach or exceed $2,000 for eligible taxpayers.

Social Security and Other Federal Payments

Alongside tax refunds, other federal payments are distributed in January 2026, including Social Security and Supplemental Security Income (SSI) payments. For those who rely on these payments, cost-of-living adjustments (COLA) can result in payments close to $2,000 per month for qualifying recipients.

However, it’s important to note that these are regular benefit payments and not related to the IRS’s annual tax refund process. These payments follow a fixed schedule and are not considered part of a new stimulus initiative or IRS-directed relief check.

Why $2,000 Payments Are Being Mentioned

Rumors and Misinformation

The rumors of a $2,000 IRS payment likely stem from the familiarity of past stimulus payments and the potential for a new round of relief proposed by certain lawmakers. However, these claims are based on speculation and have not been authorized by Congress or signed into law by the President.

The idea of a “$2,000” stimulus has become a part of online discussions, especially as the IRS release date for tax filings approaches. These discussions often confuse the regular tax refunds with something extraordinary, leading to a misunderstanding of the true nature of the payments.

It’s important for taxpayers to understand that stimulus payments are typically tied to a specific piece of legislation that needs approval from Congress, followed by President’s approval. No such legislation for a new round of $2,000 direct payments has been enacted or proposed in a formal capacity at the time of this writing.

Who Qualifies for Refunds Close to $2,000?

While no universal $2,000 payment exists for 2026, many taxpayers may still receive refunds that approach or exceed that amount. The qualifying criteria for these refunds include:

1. Income Level

Taxpayers who overpaid during the 2025 tax year will receive a refund based on their tax withholding and credits. Those who qualify for the EITC or CTC are more likely to see larger refunds.

2. Filing Status

- Single filers with no dependents are less likely to receive a $2,000 refund unless they qualify for specific credits.

- Married filing jointly and head of household filers who qualify for the EITC or CTC may see refunds of $2,000 or higher.

3. Dependents

Families with dependent children may qualify for the Child Tax Credit, which could result in $2,000 per child in refunds.

For taxpayers under the filing threshold, you can still receive refunds for specific credits or overpayments, but these are based on existing tax rules rather than a special relief program.

Key Dates for 2026 Tax Filing and Refunds

The IRS has set the 2026 tax season to open on January 26, 2026. For those expecting refunds:

- Direct deposits will typically be processed in 21 days, although the timing may vary depending on the return and potential verification delays.

- Paper checks may take longer to process.

If you have filed for 2025 taxes before January 26 and have your direct deposit information updated with the IRS, you could receive your refund as early as mid-February 2026.

Scams and Misinformation: Protect Yourself

Given the widespread rumors about a $2,000 IRS payment, it’s important to be cautious about potential scams. The IRS will never send unsolicited messages asking for personal information. If you receive suspicious calls or emails, be aware that they may be phishing attempts.

Protect Yourself:

- Check the IRS Website: Always confirm official information on the IRS’s official website at IRS.gov.

- Don’t Share Personal Info: Never provide sensitive information via unsolicited emails or phone calls.

- Report Suspicious Activity: If you believe you’ve been contacted by scammers, report it to the IRS phishing email reporting service.

Related Links

Trump $2,000 Tariff Dividend Update – Current Status, Who May Qualify, and How SNAP Fits In

Florida SNAP Benefits January 2026 – Extra Payments Still Going Out in the Final Days of the Month

As January 2026 unfolds, the IRS direct deposit schedule and tax filing season have officially begun. However, the $2,000 payments many have heard about are not new relief measures but regular tax refunds or child tax credits tied to the 2025 tax filings.

Taxpayers expecting a refund of $2,000 or more should understand that these funds come from regular tax processing and credits, not new stimulus payments authorized for 2026.

To stay informed and avoid falling for scams, rely only on official IRS channels and ensure your tax filing is completed accurately and timely.