The January SSI payment comes early in 2026, landing on December 31, 2025, after a federal holiday alters the Social Security payment calendar.

The change affects millions of low-income seniors and people with disabilities and marks the first Supplemental Security Income payment to include the new annual cost-of-living adjustment.

January SSI Payment

| Key Fact | Detail |

|---|---|

| January SSI payment date | December 31, 2025 |

| Reason for shift | January 1 federal holiday |

| 2026 maximum federal SSI | $994 (individual) |

| Extra payment? | No—January benefit paid early |

Why the January SSI Payment Comes Early in 2026

The reason the January SSI payment comes early in 2026 is procedural and longstanding. Under federal payment rules, Supplemental Security Income benefits are scheduled for the first day of each month. When that date falls on a weekend or a federal holiday, payments are issued on the preceding business day.

In 2026, January 1 is New Year’s Day, a federally observed holiday. Banks and federal offices are closed, prompting the SSA to release January SSI benefits on Wednesday, December 31, 2025. The policy is designed to prevent payment delays rather than to alter benefit amounts.

This approach is not unique to 2026. Similar shifts occur multiple times each year and are published in advance on SSA calendars.

What Supplemental Security Income Is—and Who It Serves

Supplemental Security Income (SSI) is a means-tested federal assistance program. Unlike Social Security retirement or disability insurance, SSI is not based on work history or payroll taxes. The program provides monthly cash support to individuals who meet strict financial limits and who are:

- Age 65 or older

- Blind

- Living with a qualifying disability

According to the SSA, SSI exists to help recipients meet essential living needs—food, shelter, and clothing—when other income is limited or unavailable.

What Changes With the Early January 2026 Payment

The 2026 Cost-of-Living Adjustment (COLA)

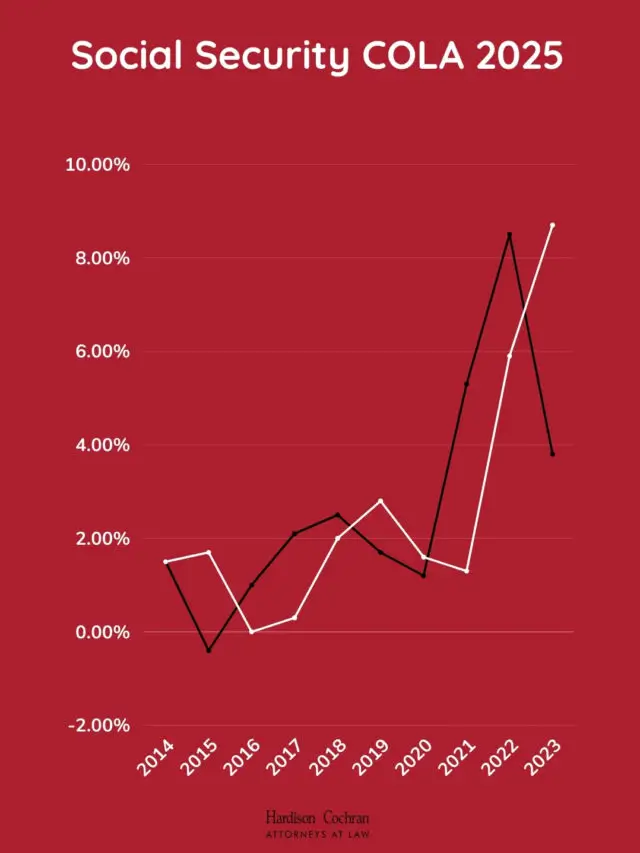

The December 31 deposit is also the first SSI payment to reflect the 2026 cost-of-living adjustment. COLA increases are calculated annually using inflation data and applied automatically.

For 2026, the maximum federal SSI benefit for individuals rises to $994 per month. Couples who both qualify are eligible for a higher combined amount. Actual payments vary based on income, household composition, and state supplementation.

Why Some Recipients See Two Payments in December

Because January’s benefit is paid on December 31, many SSI recipients will see two deposits in December:

- December 1: Regular December SSI payment

- December 31: January 2026 SSI payment (issued early)

This does not represent extra money. The December 31 deposit replaces the January payment, meaning no SSI payment will be issued in January.

Historical Context: How Often Early SSI Payments Occur

Early SSI payments are a recurring feature of the program. Whenever the first of the month falls on a weekend or federal holiday, the payment moves earlier. In a typical year, this happens two to four times, depending on the calendar.

Advocacy organizations note that confusion tends to spike around year-end, when holiday spending and heating costs increase. As a result, the January shift often draws more attention than similar adjustments later in the year.

Payment Methods Matter: Direct Deposit vs. Paper Checks

Most SSI recipients receive benefits via direct deposit or a government-issued debit card. These electronic payments typically post on the scheduled business day.

Recipients who still receive paper checks may experience additional delays due to mail processing, especially around holidays. The SSA continues to encourage electronic delivery to reduce the risk of late or lost payments.

Who Is Eligible for the January SSI Payment

Eligibility for the early January payment is identical to eligibility for any SSI benefit.

Financial Limits

- Limited monthly income

- Countable resources generally capped at $2,000 for individuals and $3,000 for couples

Certain assets, including a primary residence and one vehicle, are usually excluded.

Age, Disability, or Blindness

Applicants must be 65 or older, legally blind, or disabled under SSA definitions, meaning the condition significantly limits daily activities and is expected to last at least one year or result in death.

Citizenship and Residency

Recipients must be U.S. citizens or meet specific non-citizen criteria and reside in the United States or qualifying territories.

Who Is Not Affected by the Early Payment

The January SSI schedule applies only to SSI. It does not affect:

- Social Security retirement beneficiaries

- Social Security Disability Insurance (SSDI) recipients

- Survivor or spousal benefit recipients

Those programs follow different schedules, often tied to birth dates, and do not pay on the first of the month.

State Supplements and Regional Differences

Some states provide state-funded SSI supplements to reflect local living costs. These payments vary widely by location and may be administered by the SSA or by state agencies.

As a result, two recipients with identical federal benefits can receive different total monthly amounts depending on where they live.

Tax Treatment and Reporting Responsibilities

In most cases, SSI benefits are not taxable, because they are needs-based assistance rather than earned income. This differs from Social Security retirement benefits, which may be partially taxable.

Recipients must still report changes in income, living arrangements, or marital status to the SSA. Failure to do so can result in overpayments, which the agency may later seek to recover.

Appeals, Overpayments, and Administrative Safeguards

If a recipient believes a payment amount is incorrect, the SSA provides a formal appeals process. Beneficiaries can request reconsideration, submit evidence, and, if necessary, seek a hearing.

Overpayments can occur when income or living situations change. Advocates stress that prompt reporting is the most effective way to avoid repayment demands later.

Fraud and Scam Warnings

Payment-date changes often attract scams. Fraudsters may claim recipients are owed “bonus” or “special” checks and request personal information. The SSA warns that it does not call, text, or email beneficiaries to demand immediate action or payment. Suspected scams should be reported promptly.

Guidance for Caregivers and Representative Payees

Many SSI recipients rely on representative payees—often family members or caregivers—to manage benefits. The early January payment requires careful budgeting to ensure funds last through January. The SSA advises payees to treat the December 31 deposit strictly as January income.

Broader Policy Context: Is SSI Adequate?

The early January payment arrives amid ongoing debate over SSI adequacy. While COLA increases help offset inflation, advocates argue that housing, healthcare, and utility costs continue to outpace benefit growth.

No immediate reforms are scheduled, but the issue remains under review by policymakers and researchers.

Related Links

Alaska Confirms Expanded SNAP Use in Rural Areas, Including Hunting and Fishing – Check Details

$1,776 Military Payments Explained: What’s Authorized and Who May Be Eligible

What Comes Next

Calendar-driven shifts will continue whenever holidays affect payment dates. The SSA publishes annual schedules to help beneficiaries plan. For recipients, awareness—and careful budgeting—remains the best protection against disruption.

FAQs About January SSI Payment

Is the early January SSI payment an extra check?

No. It is the regular January benefit paid early.

Will there be an SSI payment in January 2026?

No. January’s payment is issued on December 31, 2025.

Does this affect retirement benefits?

No. Social Security retirement and SSDI follow separate schedules.