Canadian seniors receiving the Canada Pension Plan (CPP) and Old Age Security (OAS) benefits are set to receive their June 2025 payments, typically disbursed towards the end of the month. While some recipients may observe a combined direct check or deposit, it is crucial to understand that these are distinct federal programs with separate eligibility criteria and calculation methods. The exact amount an individual receives varies significantly based on factors such as contribution history, years of residency, and income levels.

Understanding the Two Pillars of Canadian Retirement Income

The Canadian retirement income system is primarily built upon two federal programs: the Canada Pension Plan (CPP) and the Old Age Security (OAS) program. While both provide financial support to seniors, their funding mechanisms, eligibility requirements, and benefit calculations differ.

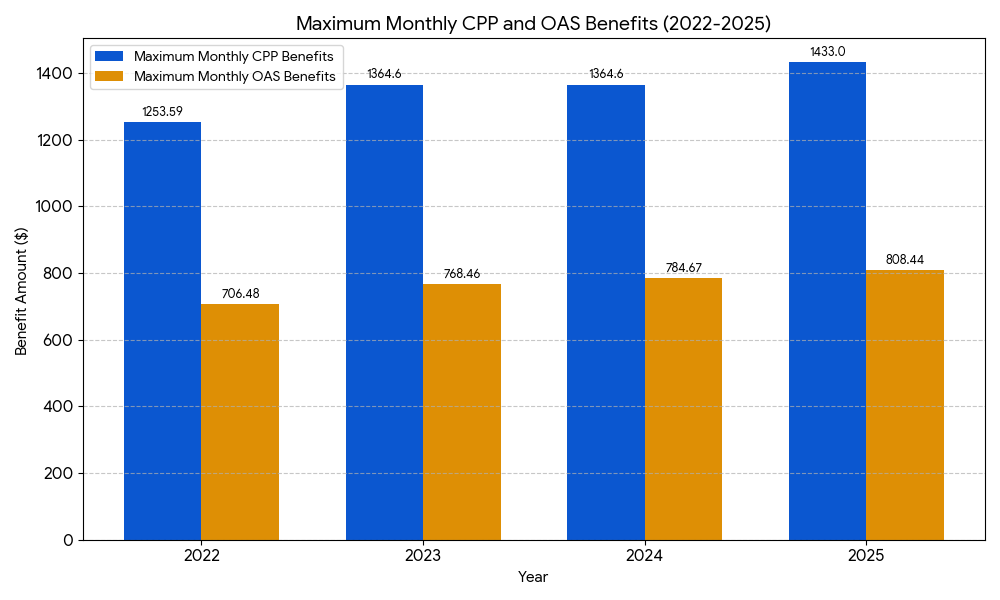

The Canada Pension Plan (CPP) is an earnings-related social insurance program. Contributions are mandatory for most employed and self-employed individuals in Canada between the ages of 18 and 65, with contributions tied to earnings up to a maximum annual pensionable amount. The benefit amount an individual receives from CPP is directly linked to their lifetime earnings and the number of years they contributed to the plan. Payments can begin as early as age 60, though deferring until age 65 or even 70 can result in a higher monthly amount. For 2025, the maximum monthly CPP payment for someone starting at age 65 is projected to be approximately $1,364.60, as per Service Canada data, though most individuals receive less than the maximum.

In contrast, the Old Age Security (OAS) program is a universal, non-contributory pension paid to eligible Canadians aged 65 and over. Eligibility for OAS is based primarily on age, legal status, and years of residency in Canada after age 18, rather than employment history or contributions. The full OAS pension is available to those who have resided in Canada for at least 40 years after age 18. A partial pension may be provided to those with at least 10 years of residency. OAS benefits are subject to a recovery tax, often referred to as the “OAS clawback,” if an individual’s net income exceeds a certain threshold. For the period of April to June 2025, the maximum monthly OAS payment for individuals aged 65-74 is $727.67, and for those aged 75 and over, it is $800.44, according to Service Canada.

How Payments are Determined and Adjusted

Both CPP and OAS payment amounts are subject to regular adjustments. CPP benefits are adjusted annually in January based on changes in the Consumer Price Index (CPI), ensuring they keep pace with the cost of living. The most recent adjustment for CPP benefits saw an increase of 2.7% for 2025, reflecting inflation data from the 12 months ending October 2024, as reported by The Motley Fool Canada.

OAS payment amounts are reviewed and potentially adjusted quarterly (in January, April, July, and October) to reflect changes in the CPI. This quarterly review helps ensure that OAS benefits maintain their purchasing power amidst fluctuating economic conditions. If the cost of living decreases, OAS payment rates will not decrease, protecting recipients from reductions.

For June 2025, the payments for both programs will adhere to the updated rates for the April-June quarter for OAS, and the annual adjustment for CPP. Service Canada typically disburses these payments on the 26th of each month, unless it falls on a weekend or holiday, in which case the payment is made on the last business day prior. Therefore, the June 2025 CPP/OAS payments are scheduled for June 26, 2025.13

Description: A clear bar chart or line graph visually depicting the maximum monthly payment amounts for CPP (at age 65) and OAS (for ages 65-74 and 75+) over the past few years, highlighting the incremental increases. Data sourced from Service Canada official figures.]

The “Combined” $1612 Scenario: A Closer Look

The notion of a “combined” $1612 payment is likely a hypothetical or generalized example, representing a sum that an individual might receive if they qualify for both CPP and OAS, potentially along with other income-tested benefits like the Guaranteed Income Supplement (GIS). It is critical for recipients to understand that this is not a fixed, universal payment amount.

For instance, an individual turning 65 in June 2025 could theoretically receive the maximum OAS payment of $727.67. If this same individual also qualifies for a CPP retirement pension, the amount would be based on their contribution history. To reach a total of $1612, the CPP portion would need to be approximately $884.33 ($1612 – $727.67). This level of CPP payment would depend on a robust history of maximum or near-maximum contributions over many years.

Furthermore, some low-income OAS recipients may be eligible for the Guaranteed Income Supplement (GIS), a non-taxable monthly payment designed to provide additional financial support. The amount of GIS depends on marital status and net annual income. For example, a single, widowed, or divorced individual with an income below $22,056 (for 2025) could receive up to $1,086.88 in GIS, as per Service Canada. Combining these various benefits can lead to varying total amounts for different individuals.

How to Determine Your Exact Amount

To ascertain the exact amount of your CPP and OAS payments for June 2025, individuals should:

- Access their My Service Canada Account: This online portal provides detailed information on CPP contributions, estimated benefits, and payment schedules for both CPP and OAS.16

- Review Direct Deposit Statements: For those receiving payments via direct deposit, bank statements will indicate the precise amounts deposited.

- Contact Service Canada: For personalized information or if issues arise, individuals can contact Service Canada directly. Their toll-free number for general inquiries regarding CPP and OAS is 1-800-277-9914 (in Canada and the United States).

It is important to note that the figures discussed represent maximum potential payments. The majority of recipients receive amounts below the maximum due to varying contribution histories for CPP and residency durations or income levels for OAS. Changes in an individual’s financial situation, such as a significant increase in income, can also affect OAS benefits due to the recovery tax.

Looking Ahead: CPP Enhancement

Beyond the regular inflation adjustments, the Canada Pension Plan is undergoing a multi-year enhancement program. This enhancement aims to gradually increase the income replacement rate from 25% to 33.33% of average earnings on which contributions were made. This will result in higher CPP benefits for future retirees and those currently contributing to the plan, particularly higher-income earners. The full effect of these enhancements will be realized over several decades, with benefits gradually increasing for those who contribute under the enhanced CPP framework.

The June 2025 CPP and OAS payments reflect the ongoing commitment of the Canadian government to provide essential financial support to its senior population. While the specific figure of “$1612” may be an illustrative example, understanding the individual components of CPP and OAS, their calculation methods, and payment schedules is key for recipients to manage their retirement finances effectively.

FAQs

1. What are the main sources of income for Canadian seniors?

The main sources typically include government benefits like the Canada Pension Plan (CPP) and Old Age Security (OAS), private pensions (from former employers), and income from investments (e.g., RRSPs, TFSAs, non-registered accounts).

2. What is the Canada Pension Plan (CPP)?

The CPP is a contributory social insurance program that provides partial replacement of earnings in retirement, disability, or upon death. It is funded by contributions from employees, employers, and self-employed individuals.

3. Who is eligible for CPP retirement benefits?

To qualify for CPP retirement benefits, you must be at least 60 years old and have made at least one valid contribution to the CPP.

4. How is the amount of my CPP benefit determined?

The amount of your CPP retirement pension depends on several factors, including your earnings during your working years, the amount and number of years you contributed to CPP, and the age at which you start receiving your pension. Generally, contributing more and for longer periods leads to higher benefits.

5. When can I start receiving CPP benefits?

The standard age to start receiving CPP is 65. However, you can begin as early as age 60 with a permanent reduction (0.6% per month, up to 36% at age 60) or defer it as late as age 70 for a permanent increase (0.7% per month, up to 42% at age 70).

6. What is Old Age Security (OAS)?

OAS is a monthly, taxable social security payment available to most Canadians aged 65 or older who meet the residency requirements. Unlike CPP, you do not need to have worked or contributed to a specific plan to be eligible for OAS. It is funded through general tax revenues.