The Maximum Social Security Benefit 2026 will rise to an estimated $5,181 per month for retirees who meet strict lifetime earnings and age requirements, according to projections from the Social Security Administration. The figure highlights how decades of high income, consistent payroll contributions, and delayed retirement combine to produce the system’s highest possible monthly benefit.

Understanding the Maximum Social Security Benefit 2026

The Maximum Social Security Benefit 2026 represents the upper limit of what the U.S. retirement system can pay to an individual worker under current law. It is not a typical benefit level and is reached by only a small fraction of retirees.

Social Security was designed as a progressive program, replacing a higher share of earnings for lower- and middle-income workers. While higher earners receive larger dollar benefits, the formula intentionally limits how much income replacement they receive relative to their wages.

As a result, the maximum benefit functions as a ceiling rather than a target for most workers. According to the Social Security Administration, fewer than 10 percent of retirees come close to the top benefit level in any given year.

Social Security Benefit 2026

| Key Fact | Detail |

|---|---|

| Maximum monthly benefit at age 70 (2026) | $5,181 |

| Maximum benefit at full retirement age (67) | About $4,150 |

| Earliest claiming age | 62 (with permanent reductions) |

| Earnings years counted | Highest 35 years |

| Projected taxable wage cap (2026) | About $184,500 |

The Exact Salary Needed to Reach the Maximum Benefit

Reaching the Maximum Social Security Benefit 2026 requires earning at or above the Social Security taxable maximum for most or all of a worker’s top 35 earning years.

The taxable maximum is the highest amount of annual wages subject to the Social Security payroll tax. For 2026, analysts expect this cap to rise to approximately $184,500, reflecting national wage growth.

Earnings above that level do not increase Social Security benefits. A worker earning $300,000 in a year receives the same Social Security credit as someone earning $184,500.

To reach the maximum benefit, a worker must consistently hit the taxable maximum for decades, not just a few peak years late in their career.

How Social Security Calculates Benefits

Social Security benefits are calculated in several steps, beginning with Average Indexed Monthly Earnings (AIME). The SSA adjusts a worker’s earnings history for changes in national wages, then averages the highest 35 years of indexed earnings.

That average is run through a progressive formula with three “bend points,” which replace:

- A high percentage of lower earnings

- A moderate percentage of middle earnings

- A much smaller percentage of earnings near the taxable maximum

This structure ensures that benefits rise with income but at a diminishing rate.

“The benefit formula reflects a balance between fairness and social insurance,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “High earners pay more into the system, but the formula limits how much of that income is replaced.”

Why Claiming Age Is Critical

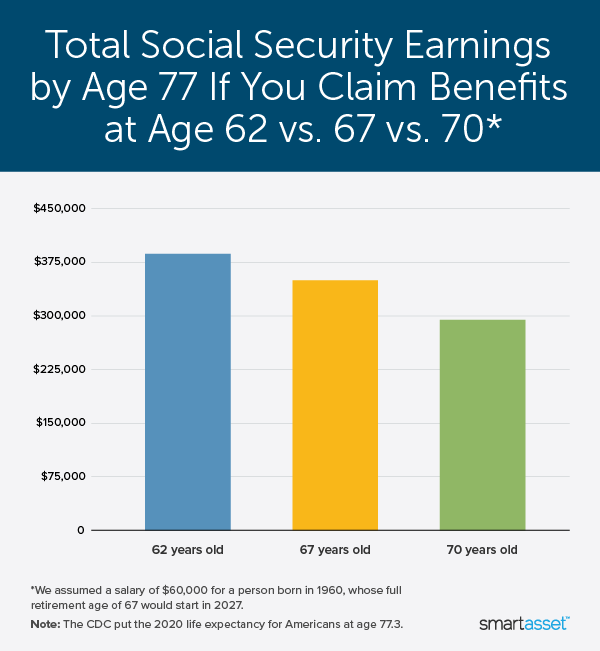

Even with a maximum earnings record, the age at which benefits are claimed dramatically affects monthly payments.

Workers can claim as early as age 62, but doing so permanently reduces benefits by up to 30 percent. Full retirement age is currently 67 for most future retirees.

Those who delay benefits beyond full retirement age earn delayed retirement credits, which increase benefits by roughly 8 percent per year until age 70. No additional credits accrue after that age.

It is this delay that pushes the maximum benefit to $5,181 in 2026. Claiming earlier produces a substantially smaller payment, even for top earners.

A Hypothetical Example

Consider a worker who earns at or above the taxable maximum for 35 consecutive years and retires in 2026.

- If the worker claims at 62, their benefit would be capped at roughly $3,000 per month.

- Claiming at full retirement age raises the benefit to just over $4,100.

- Waiting until 70 produces the full $5,181 maximum benefit.

Over a 20-year retirement, the difference between claiming at 62 and 70 could exceed $500,000 in total benefits, depending on longevity.

Who Typically Reaches the Maximum

Workers who reach the maximum benefit often share several characteristics:

- Long careers with minimal gaps in employment

- Earnings consistently at or above the taxable maximum

- Access to employer-sponsored retirement plans that allow them to delay Social Security

These workers are commonly found in fields such as medicine, law, senior management, engineering, and finance.

However, high income alone does not guarantee the maximum benefit. Missing years, career breaks, or late entry into high-paying roles can significantly reduce the final calculation.

The Role of Inflation and Cost-of-Living Adjustments

Once benefits begin, they are adjusted annually through cost-of-living adjustments (COLAs) tied to inflation. These increases help preserve purchasing power but do not change a worker’s base benefit calculation.

The projected $5,181 maximum reflects both long-term wage growth and expected COLAs. Actual figures will be finalized later in 2025, once inflation and wage data are confirmed.

Broader Policy Context

The rising Maximum Social Security Benefit 2026 comes amid ongoing debate about the program’s long-term finances. According to the Social Security Trustees, the trust fund could face a shortfall in the mid-2030s without legislative action.

Some policymakers argue that raising or eliminating the taxable maximum could strengthen Social Security’s finances. Others warn that such changes could alter the program’s balance between contributions and benefits.

Supporters of the current structure note that high earners already contribute significantly more in absolute dollars, even though their benefits replace a smaller share of income.

Public Perception and Misconceptions

Public understanding of Social Security benefits is often incomplete. Surveys by the Pew Research Center show many Americans overestimate how much Social Security will replace their income.

The $5,181 figure, while eye-catching, can create unrealistic expectations for workers whose earnings histories fall below the taxable maximum.

Financial planners consistently stress that Social Security should be viewed as a foundation, not a full retirement income plan.

IRS Fresh Start Program 2026 Update: New Eligibility Rules and Monthly Payment Limits

What Workers Can Do Now

Experts recommend that workers regularly review their Social Security earnings records to ensure accuracy. Errors can reduce benefits if left uncorrected.

Workers approaching retirement age may also benefit from personalized claiming analyses, which consider health, life expectancy, and other income sources.

“Claiming strategy is one of the most important retirement decisions people make,” said Kathleen Romig, a senior policy analyst specializing in Social Security. “The difference between good and poor timing can last a lifetime.”

What Comes Next

The Social Security Administration will release official 2026 benefit figures later in 2025. Until then, the $5,181 figure remains a projection, though one grounded in current law and wage trends.

Any future changes to Social Security, including benefit formulas or taxable wage limits, would require congressional action.

For now, the Maximum Social Security Benefit 2026 stands as a clear illustration of how income history, longevity, and policy design intersect within the nation’s retirement system.