The Social Security benefit you receive in retirement is influenced by several factors, primarily your lifetime earnings. To reach the maximum benefit, a person needs to consistently earn at or above a specific threshold for 35 years.

In 2026, the income required to qualify for the maximum Social Security benefit — approximately $5,251 per month — is far higher than the average worker earns annually. This article delves into the income requirements, calculations, and strategies for maximizing your Social Security benefit.

Maximum Social Security Benefit

| Key Fact | Detail/Statistic |

|---|---|

| Maximum Social Security Benefit | In 2026, the maximum monthly benefit at age 70 is approximately $5,251. |

| Income Threshold for 2026 | To maximize benefits, you need to earn at least $184,500 annually for 35 years. |

| Wage Base Limit for 2026 | Only earnings up to $184,500 count toward Social Security taxes. |

| Full Retirement Age (FRA) | The FRA for those born after 1960 is 67, but delaying benefits until age 70 maximizes the monthly benefit. |

Understanding the Social Security Benefit Formula

Social Security retirement benefits are calculated based on your average indexed monthly earnings (AIME), which reflects your lifetime earnings, adjusted for inflation. The Social Security Administration (SSA) takes the highest-earning 35 years of your career and uses them to determine your benefit amount.

However, reaching the maximum benefit is not straightforward. It requires both high earnings and strategic timing in claiming your benefits.

The Role of Earnings

To get the maximum benefit, it’s essential to earn up to or above the annual Social Security wage base limit, which, in 2026, is $184,500. If you earn exactly $184,500 or more each year for 35 years, you will meet the income requirement for maximizing your benefits.

However, any earnings above this threshold will not contribute to your Social Security benefit calculation, since the SSA only taxes earnings up to this limit.

To put it simply: if you earn more than $184,500 in a given year, only $184,500 of that income will count toward your Social Security benefits. Earnings beyond that are not considered for the calculation.

The 35-Year Rule

Your Social Security benefit calculation is based on your 35 highest-earning years. If you don’t work for 35 years or have lower-earning years, those years will be counted as zero when calculating your average.

This is important because any missing years or lower-earning years can drastically reduce your final benefit. To achieve the maximum benefit, you need to have 35 full years of high-income earnings.

The Maximum Social Security Benefit in 2026

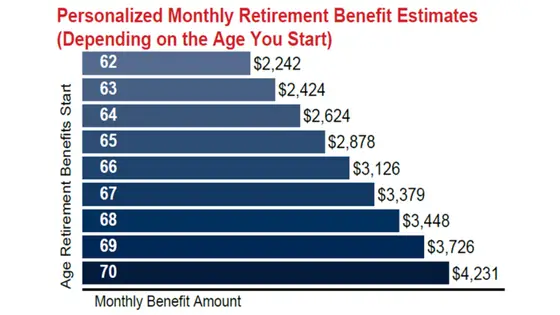

In 2026, the maximum Social Security retirement benefit you could receive at age 70 — assuming you meet all income and work requirements — is $5,251 per month (approximately $63,012 annually). This is the amount a person would receive if they earned at or above the wage base limit for 35 years and waited until age 70 to start collecting benefits.

However, if you claim your benefits at your full retirement age (FRA), which is 67 for those born after 1960, the maximum benefit is slightly lower: around $4,152 per month. If you claim earlier, at age 62, the amount will be substantially less (around $2,969 per month).

The key takeaway here is that the timing of your claim significantly impacts the amount you will receive. Delaying until age 70 increases your monthly benefit by about 8% per year over your FRA amount.

How Much Must You Earn to Qualify for the Maximum Benefit?

The annual earnings threshold that allows you to qualify for the maximum benefit is $184,500 for 2026. This figure represents the wage base limit for Social Security payroll taxes. In order to ensure that you are contributing the maximum possible amount to your Social Security benefits, you must earn this amount or more each year for 35 years.

Real-World Examples:

- Example 1: Meeting the Income Requirement: A worker who earns exactly $184,500 every year for 35 years will qualify for the maximum benefit at age 70, assuming other conditions (like claiming at 70) are met.

This person will have 35 years of maximum earnings, contributing the highest possible amount to their Social Security benefit calculation. - Example 2: Missing Years of High Earnings

If someone earns below $184,500 for some of their working years, those lower earnings will be factored into the benefit calculation, reducing their AIME and ultimately their monthly benefit.

Even a few years of significantly lower earnings could prevent them from qualifying for the maximum benefit.

Earnings Above the Wage Base Limit: What Happens?

It’s important to note that while $184,500 is the annual cap for the purpose of calculating Social Security benefits, you may still be able to earn more in other ways. For example, income from investments, self-employment, or side businesses is not capped by the wage base limit.

However, only earned income (wages or salary from work) counts toward Social Security tax and benefits. For instance, if you earn $200,000 in a year, only $184,500 will be factored into your benefit calculation. The remaining $15,500 does not increase your Social Security benefit.

The Impact of Inflation on Social Security Benefits

Social Security benefits are indexed for inflation, which means they automatically adjust each year based on the Consumer Price Index (CPI) to maintain purchasing power. This Cost-of-Living Adjustment (COLA) ensures that beneficiaries don’t lose purchasing power due to inflation.

For example, in 2026, Social Security beneficiaries will see a 2.8% increase in their benefits due to inflation. This adjustment helps to keep Social Security payments in line with rising living costs, which is especially important in times of high inflation. However, the COLA might not always keep pace with actual price increases, especially during periods of high inflation.

Social Security for Self-Employed Individuals

Self-employed individuals face unique challenges when trying to maximize their Social Security benefits. Unlike salaried workers, self-employed individuals pay both the employee and employer portions of Social Security taxes, which is 12.4% of their net earnings, up to the wage base limit.

Self-employed individuals also face different reporting requirements. To maximize their Social Security benefits, they must ensure they report all their income accurately and consistently pay into the system. Since self-employment income is often less predictable, planning becomes crucial.

Taxation of Social Security Benefits

While Social Security benefits are not taxed at the federal level for everyone, high earners may find their benefits subject to income taxes. If your combined income (which includes your adjusted gross income, nontaxable interest, and half of your Social Security benefits) exceeds a certain threshold, up to 85% of your Social Security benefits may be taxable.

For example, for individuals earning over $34,000 annually, and for married couples earning over $44,000, a portion of their Social Security benefits may be taxed.

The Importance of Early Planning for Social Security

Maximizing your Social Security benefit starts with careful financial planning. Understanding how Social Security works and how your lifetime earnings will be used in calculating your benefits can help you make better decisions about when to claim, how much you need to save, and whether you need to supplement your Social Security income with other retirement savings.

Starting to plan early for retirement, even in your 20s or 30s, can have a significant impact on your future financial well-being. Saving for retirement, understanding tax implications, and evaluating when to begin claiming Social Security can all contribute to a more secure retirement.

Related Links

DoorDash Adds New Grocery Options for SNAP Households

Rising Health Costs May Take a Bigger Share of Social Security in Retirement

The path to the maximum Social Security benefit is challenging but achievable for a select few who consistently earn above the taxable wage base limit for 35 years and delay claiming until age 70.

For most workers, however, the Social Security benefit they receive will be much lower than the maximum amount. To maximize your benefits, it’s essential to aim for high lifetime earnings, work for at least 35 years, and delay your claim until age 70 if possible.

By understanding the income thresholds, timing rules, and calculation methods, you can better plan for a future that includes a reliable Social Security benefit, while also considering additional retirement savings to secure your financial well-being.

FAQs About Maximum Social Security Benefit

What is the maximum Social Security benefit for 2026?

The maximum monthly benefit at age 70 is $5,251.

How much do I need to earn to qualify for the maximum Social Security benefit?

You need to earn at least $184,500 per year for 35 years to qualify for the maximum benefit.

When should I start claiming my Social Security benefits to maximize my monthly payout?

To maximize your Social Security benefit, you should wait until age 70 to start claiming.