A new one-time $1,776 military payment will be issued to eligible U.S. service members in late 2025, according to Defense Department guidance. The payment, tied strictly to active-duty status, has prompted widespread questions about eligibility, exclusions, and timing—particularly among reservists, retirees, and service members transitioning between duty assignments.

Military Pay Update

| Category | Detail |

|---|---|

| Payment amount | $1,776 (one-time) |

| Eligible group | Qualifying active-duty service members |

| Ineligible groups | Retirees, veterans, most reservists |

| Tax treatment | Generally non-taxable |

| Payment method | Automatic direct deposit |

| Recurring? | No |

What Is the $1,776 Military Payment?

The $1,776 payment is a one-time supplemental compensation authorized under existing defense funding authorities for 2025. It is not a bonus tied to reenlistment, not a cost-of-living adjustment, and not a permanent increase to military pay tables.

Defense officials say the amount was chosen for symbolic reasons, referencing the year 1776, rather than as a reflection of service length, rank, or deployment status.

Administratively, the payment is treated as a special allowance, processed through standard military payroll systems. “This is recognition, not restructuring,” said a former Pentagon budget official familiar with personnel compensation programs.

Eligibility Criteria on Duty Status — Not Rank Alone

Active-Duty Service Members

The payment applies primarily to active-duty members of the U.S. Armed Forces serving on qualifying orders as of the eligibility cutoff date in late 2025.

This includes:

- Enlisted personnel across junior and mid-level ranks

- Commissioned officers up to a defined senior threshold

- Full-time active members of the Army, Navy, Air Force, Marine Corps, Space Force, and Coast Guard

Eligibility is automatic and determined by official duty status recorded in Defense Finance and Accounting Service (DFAS) systems.

Reserve and National Guard Members: A Narrow Path

Reserve and National Guard members qualify only if they meet specific conditions.

To be eligible, they must have been:

- Serving on federal active-duty orders, and

- On those orders for 30 or more consecutive days by the cutoff date

Routine drills, annual training, or inactive reserve status do not qualify. Defense officials stress that eligibility is binary—either the duty status qualifies, or it does not.

Who Does Not Qualify Military Pay — And Why

The following groups are explicitly excluded:

- Military retirees, regardless of years served

- Veterans no longer on active duty

- Reserve or Guard members without qualifying active orders

- Senior flag officers above the eligibility threshold

Officials say the exclusions are intentional and tied to the payment’s purpose: recognizing current active service obligations, not past service.

Why the Eligibility Cutoff Date Matters

The eligibility cutoff date is critical for determining who qualifies. Service members who:

- Separate from active duty before the cutoff

- Retire shortly before the cutoff

- Transition to inactive status

may not qualify, even if they served most of the year. Conversely, members activated shortly before the cutoff may qualify if they meet the minimum active-duty requirement.

“This is why timing matters,” said a military personnel policy analyst. “It’s not about fairness debates—it’s about administrative clarity.”

How the Military Payment Will Appear and Be Delivered

For most eligible service members, no action is required.

The payment will:

- Be directly deposited into existing military pay accounts

- Appear as a distinct line item on the Leave and Earnings Statement (LES)

- Be issued during a designated late-2025 pay cycle

Members undergoing Permanent Change of Station (PCS) moves, deployments, or unit transfers may experience slight delays.

Tax Treatment and Financial Considerations

In most cases, the $1,776 payment is classified as non-taxable, similar to certain allowances and special pays. However, individual circumstances can vary due to:

- Combat zone tax exclusions

- State tax rules

- Existing garnishments or allotments

Service members are advised to review LES entries carefully.

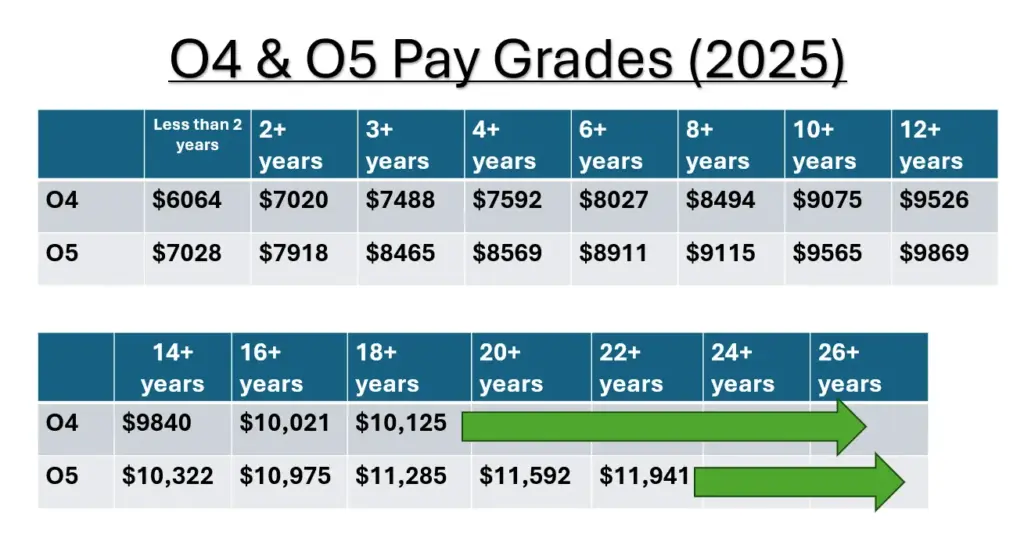

Rank-Band Impact: Why the Payment Is Flat

Unlike many military pays that scale by rank, this payment is flat—the same amount for all eligible recipients. Defense analysts say this approach avoids complexity but has mixed morale effects.

“A flat payment benefits junior enlisted proportionally more,” said a defense compensation researcher. “That may be intentional.”

Funding Authority and Legal Basis

The payment is funded through existing defense appropriations, not a standalone act of Congress. Officials say the Pentagon has discretion to allocate limited supplemental payments under personnel support provisions, provided they remain within budget caps. No new long-term funding obligations are created.

Historical Context: Not Without Precedent

The U.S. military has issued one-time payments before, often during:

- Periods of elevated operational tempo

- Force restructuring

- Recruitment and retention stress

In nearly all cases, the payments were temporary and non-recurring. “This fits a familiar pattern,” said a military historian. “Recognition payments appear during transition periods.”

Addressing Misinformation

Online claims suggesting that:

- All veterans qualify

- The payment will recur annually

- The payment increases retirement benefits

are incorrect.

Defense officials emphasize that the $1,776 payment is:

- One-time

- Status-based

- Non-precedential

What to Do if the Military Payment Is Missing

Service members who believe they qualify but do not receive the payment should:

- Review their LES carefully

- Confirm duty status on the cutoff date

- Verify direct deposit information

- Contact unit finance or personnel offices

Most issues can be resolved administratively.

Broader Impact on Military Families

For many military families, the payment may help offset:

- Holiday travel costs

- Housing expenses

- Debt repayment

Economists say the limited scope of the payment means it will not affect broader economic conditions.

Related Links

Pennsylvania Reopens Refund Window for Renters and Homeowners — How to Apply?

Texas SNAP Update: December Deposits Continue With Benefits Up to $1,789

Looking Ahead

Defense officials say there are no current plans to repeat the $1,776 payment in 2026. Future compensation discussions are expected to focus on base pay, housing allowances, and targeted bonuses for critical skills.

For now, the payment stands as a symbolic, one-time acknowledgment of active service, rather than a shift in military compensation policy.

FAQs About Military Pay Update

Is the $1,776 payment automatic?

Yes, for most eligible active-duty members.

Does this affect retirement pay?

No.

Can reservists qualify?

Only under specific active-duty conditions.

Will there be another payment next year?

There are no announced plans.