The Social Security Administration’s updated Full Retirement Age (FRA) framework is now fully in effect, reshaping how early retirees should think about claiming benefits at 62. Under the new New FRA Rule Takes Effect structure, individuals born in 1960 or later must wait until age 67 to receive full benefits.

Experts warn that filing early may sharply reduce monthly payments and shrink lifetime income, intensifying the impact of the long-standing claiming-age reduction formula.

New FRA Rule Takes Effect

| Key Fact | Detail |

|---|---|

| Earliest filing age | 62 |

| FRA for 1960+ | 67 |

| Early-claim reduction | Up to ~30% at age 62 |

| Earnings test applies until | The month FRA is reached |

Understanding the New FRA Rule Takes Effect Rule and the New FRA Structure

The Social Security system, built on a progressive earnings-based formula, has long allowed Americans to claim retirement benefits as early as age 62. However, the New FRA Rule Takes Effect rule—reinforced under the recently finalized FRA framework—means the consequences of claiming early are now more significant.

Individuals turning 62 today must wait until age 67 to receive full benefits, reflecting the latest stage of the FRA increase passed by Congress in the 1983 Amendments. Those born before 1938 had an FRA of 65; those born in the 1950s saw a gradual increase; and now, for all born in 1960 or later, full retirement age is formally 67.

The expanded FRA increases the gap between early filing and full eligibility, intensifying the reduction percentage for those who take benefits at 62.

How Early Filing Works — and Why 62 Carries the Largest Reduction

The Reduction Formula

SSA reduces benefits claimed early by:

- 5/9 of 1% per month for the first 36 months before FRA

- 5/12 of 1% per month beyond that

For someone whose FRA is 67, claiming at 62 is a full 60 months early, resulting in about 30% lower benefits permanently.

The Difference Over Time

A permanent reduction in monthly benefits compounds across decades of retirement. Even with cost-of-living adjustments (COLAs), beneficiaries who file early typically receive lower absolute dollar increases, because COLAs apply to a smaller base amount. Financial analysts compare this to interest compounding—except the effect works in reverse.

Breakeven Age: A Critical Planning Tool

A common way to evaluate early versus delayed claiming is to calculate the “breakeven age,” where the cumulative value of waiting surpasses the cumulative value of claiming early.

For many, the breakeven age falls around 78–82.

That means individuals expecting to live into their 80s often benefit more from waiting. Longevity trends—especially among college-educated Americans—continue to rise. For many, this supports delaying claiming unless income is urgently needed.

Working Before FRA: The Earnings Test

The earnings test affects any beneficiary who claims before FRA and continues working.

In 2025 terms:

- Workers under FRA lose $1 in benefits for every $2 earned above roughly $23,000.

- In the year they reach FRA, they lose $1 for every $3 earned above approximately $62,000.

These withheld benefits are recalculated at FRA, but the early-claim reduction still applies permanently.

Who Is Most Affected by Filing at 62?

Lower-Income Workers

Lower earners may experience a sharper relative impact because their Social Security benefit represents a larger share of retirement income.

Workers in physically demanding jobs

Those in manufacturing, construction or caregiving may be less able to work longer, making early filing a necessity despite long-term financial drawbacks.

Married Couples

For couples, early filing can reduce:

- Spousal benefits

- Survivor benefits

- Household retirement income stability

Coordinated planning becomes essential.

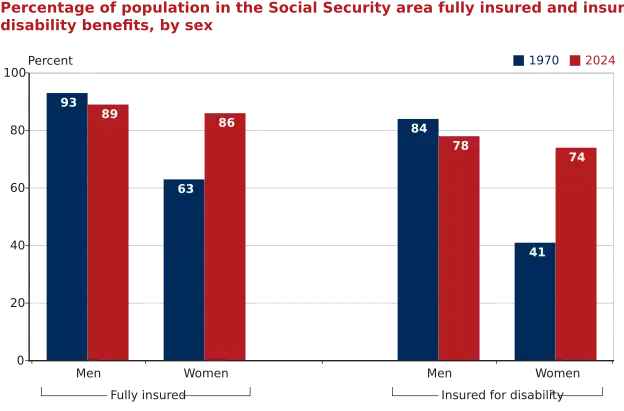

Women

Women live longer on average and therefore face greater longevity risk. Early reductions disproportionately harm long-term financial security for many female retirees.

Expert Commentary: Why FRA Policy Matters More Than Ever

Dr. Alicia Munnell, Center for Retirement Research

“When the FRA increases, the penalty for claiming early rises. The decision to file at 62 becomes far more consequential for younger cohorts.”

Mark Duggan, Stanford Institute for Economic Policy Research

“Social Security replacement rates are falling as FRA rises. The higher full-retirement threshold essentially reduces lifetime benefits unless individuals delay.”

SSA Spokesperson (recent briefing)

“The ability to claim early remains unchanged, but individuals should review their benefit estimates carefully. The difference between filing at 62 and claiming at FRA or age 70 can be substantial.”

Historical Context: Why FRA Rose to 67

The FRA increase from 65 to 67 was enacted in 1983 to reinforce Social Security’s long-term solvency amid demographic shifts.

Key motivations included:

- Longer life expectancy

- Lower birth rates

- A rapidly aging population

- Pressure on trust-fund reserves

Raising FRA effectively trims benefits without cutting the program outright.

Behavioral-Economics Angle: Why People Still Claim at 62

Studies show many Americans file early due to:

- Loss aversion (“I paid into it; I want it now”)

- Misunderstanding how reductions work

- Lack of savings

- Concern about program solvency

- Fear of dying before receiving benefits

- Misinformation about yearly COLAs

Yet behavioral economists emphasize that waiting is one of the simplest ways to increase guaranteed lifetime income.

Policy Debate: What the Future May Hold

Several reform proposals circulating in Congress include:

- Increasing the minimum benefit

- Changing COLA calculations to CPI-E

- Lifting or eliminating the payroll tax cap

- Introducing “longevity insurance” enhancements

- Revisiting the FRA increase

None have passed, but the growing gap between rich and poor retirees is drawing bipartisan urgency.

Case Study: Two Claiming Paths

Case 1: Filing at 62

Maria, FRA: 67

Benefit at FRA: $2,000

Benefit at 62: ~$1,400

Lifetime benefit (age 62–87): $420,000 (approx.)

Case 2: Filing at 67

Lifetime benefit (age 67–87): $480,000 (approx.)

Maria gains ~$60,000 over her lifetime simply by waiting—before accounting for higher COLA-adjusted increases.

Related Links

$2,000 Tariff Checks: Treasury Outlines the Key Requirement for Approval

Social Security Payment for Nov 19, 2025: Here’s the Average and Maximum Amount You Could Receive

What Retirees Should Do Now

- Check individual benefit projections at SSA.gov.

- Model benefits at 62, FRA and 70 using official calculators.

- Factor in health, family longevity and lifestyle needs.

- Consider delaying if working or if savings can bridge the gap.

- Coordinate with a spouse to optimize household benefits.

- Consult a certified financial planner for complex cases.

As the new FRA structure becomes standard for younger cohorts, the financial stakes around early claiming grow sharper. Policymakers continue examining long-term reforms, but for now, experts stress the importance of informed decision-making as Americans navigate one of the most consequential financial choices of retirement.

FAQ About New FRA Rule

1. Does everyone lose 30% if they claim at 62?

Only those with an FRA of 67. Reductions vary by birth year.

2. Do COLAs reduce the early-claim penalty over time?

No. COLAs apply, but they are applied to a permanently lower base.

3. Is claiming early ever smart?

Yes. Serious health issues, limited savings or shorter life expectancy can justify early filing.

4. What about claiming and continuing to work?

The earnings test may temporarily reduce payments, but not permanently.

5. Should both spouses file at 62?

Rarely. Coordinated claiming usually yields better lifetime outcomes.