U.S. lawmakers have introduced legislation that would provide a temporary $200 increase to Social Security COLA payments beginning in early 2026. The proposal follows mounting criticism that the projected 2.8% cost-of-living adjustment—amounting to roughly $56 per month for the average retiree—fails to reflect rising living expenses faced by seniors across the United States.

New Push for Higher COLA

| Key Fact | Detail |

|---|---|

| Supplemental increase | $200 additional monthly payment for six months |

| 2026 COLA estimate | 2.8% increase (~$56 monthly) |

| Senior cost trends | Healthcare inflation nearly double CPI average |

Why Lawmakers Are Challenging the 2026 Social Security COLA

A Growing Divide Between COLA and Real Living Costs

The coalition behind the proposal—led by Sens. Elizabeth Warren, Chuck Schumer, Ron Wyden, and Kirsten Gillibrand—argues that the Social Security COLA has consistently failed to keep up with inflation pressures faced by older Americans. According to the Bureau of Labor Statistics, seniors spend a higher share of their income on medicine, rent, utilities, and food—categories that have seen above-average price increases since 2020.

“The current COLA formula does not reflect the economic reality seniors are living in,” Sen. Warren said during the bill’s announcement. “This proposal is designed to offer immediate relief as families struggle with persistent price increases.”

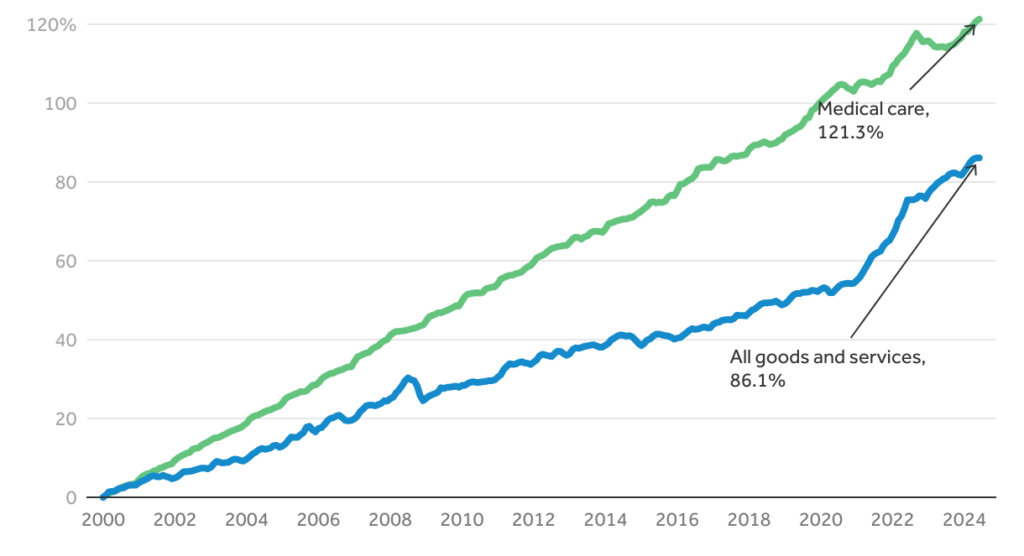

Economists note that seniors are particularly vulnerable to long-term inflation. Health care services have risen by more than 4% annually on average over the past decade—far higher than wage-earner inflation measured by the CPI-W, the index used to calculate COLA.

How COLA Works—and Why Critics Say It Needs Reform

The CPI-W Formula

The cost-of-living adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This method was adopted in the 1970s and has been criticized for failing to reflect the spending habits of seniors.

Limitations of CPI-W

- Underweights medical costs

- Underweights prescription drugs

- Underweights housing costs, especially rents and senior housing

- Overweights transportation and gasoline, categories less relevant to retirees

The Consumer Price Index for the Elderly (CPI-E), tracked since 1988, consistently shows higher inflation for people aged 62 and older. Advocacy groups, including the AARP, argue that CPI-E would better protect seniors’ purchasing power.

What the $200 Monthly Boost Would Mean for Beneficiaries

Who Would Qualify

The proposal extends the $200 monthly supplement to:

- Social Security retirees

- Social Security Disability Insurance (SSDI) recipients

- Supplemental Security Income (SSI) beneficiaries

- Veterans Affairs (VA) benefit recipients

- Railroad Retirement beneficiaries

If approved, payments would begin in January 2026 and continue for six months.

Why the Standard COLA Falls Short

Inflation and Essential Costs

A 2024 Urban Institute analysis found that seniors experienced a cumulative 20% inflation increase over the past five years—outpacing the general population. Rising healthcare costs, prescription drug prices, and rent hikes have played major roles.

“Seniors are extremely exposed to sustained medical inflation,” said Dr. Alicia Munnell, director of the Center for Retirement Research at Boston College. “A temporary boost will help, but long-term reform is necessary.”

Out-of-Pocket Medical Costs

According to a Kaiser Family Foundation study:

- The average Medicare recipient spends $6,600 annually out of pocket.

- Prescription drug prices rose more than 30% since 2018.

- Premium increases have outpaced COLA in 12 of the last 15 years.

Historical Context: How COLA Increases Have Changed Over Time

A Look Back at the Past 20 Years

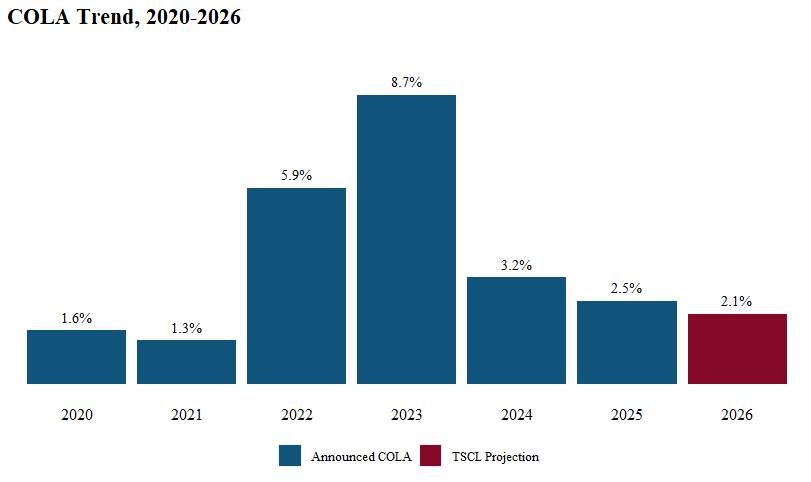

Over the last two decades, COLA increases have ranged from 0% to 8.7%, with dramatic variations tied to economic cycles.

- 2009, 2010, 2015: 0% COLA

- 2023: 8.7% COLA, the highest in 40 years

- 2024: 3.2% COLA

- 2025: 3.0% COLA

- Projected 2026: 2.8% COLA

Average COLA

Over 20 years, the average COLA is roughly 2.6%, lower than inflation experienced by seniors in key expenditure categories.

Previous Legislative Efforts

Past attempts to revise COLA include:

- CPI-E Act of 2017 — stalled

- Strengthening Social Security Act of 2021 — stalled

- Proposals for “minimum benefit thresholds” — no passage

The $200 temporary boost represents one of the largest proposed short-term increases in decades.

Demographic Impact: Who Stands to Benefit Most

Low-Income Seniors

About 40% of retirees rely on Social Security for at least half their income.

The boost would disproportionately assist:

- Seniors living on fixed incomes under $25,000 annually

- Elderly people living alone

- Disabled beneficiaries who have not seen wage-based benefit increases

- Veterans with service-connected disabilities

Women, Minorities, and Rural Seniors

Studies from the National Academy of Social Insurance find that women and racial minorities are more likely to rely heavily on Social Security due to wage gaps and caregiving-related career interruptions.

Rural seniors face:

- Higher transportation costs

- Fewer health care options

- Greater reliance on Social Security checks in lieu of employer pensions

Economic and Fiscal Considerations

Budget Impact

An early estimate from independent analysts suggests the proposal could cost $35–45 billion over six months. The exact figure will depend on beneficiary enrollment and administrative costs.

Republican lawmakers have raised concerns about adding short-term spending without long-term reforms.

“We need structural solutions, not temporary payments,” said Sen. John Thune in recent comments reported by major news outlets.

Does It Affect Social Security Solvency?

Economists emphasize that the temporary boost is funded separately and does not draw from Social Security trust funds.

However, long-term solvency remains a concern:

- The Social Security Trustees Report projects depletion of trust reserves by 2033 without reform.

- Future benefits could be reduced by up to 23% unless Congress intervenes.

How the U.S. Compares Globally

The U.S. is one of several Western nations that adjust retirement benefits for inflation, but:

- The U.K. uses a “triple lock” system—wages, inflation, or 2.5%, whichever is highest.

- Canada indexes benefits monthly, not annually.

- Germany ties pensions to wage growth, creating a more stable long-term model.

Some retirement experts argue the U.S. should consider monthly or quarterly indexing to respond more quickly to inflation volatility.

Public Reaction and Social Media Response

Public response has been mixed. Advocates welcome the proposal, while some analysts question whether temporary payments distract from broader reform needs.

AARP issued a statement calling the boost “a meaningful short-term relief measure,” but urged Congress to “modernize the COLA formula to better reflect seniors’ expenses.”

SNAP Update — Government Shutdown Creates Two Different Recipient Groups

What Comes Next in Congress

The proposal will move to committee review in early 2026, where lawmakers will debate cost, eligibility, and implementation timeline. Passage will depend on bipartisan negotiations in a divided Congress.

If inflation remains elevated, analysts say public pressure may increase support for the bill.