A new New Social Security Proposal initiative proposed in Washington would impose limits on annual cost-of-living adjustments for higher-benefit Social Security recipients, enforcing smaller benefits increases for top earners while preserving full inflation protection for most retirees as the programme struggles toward projected insolvency in the early 2030s.

New Social Security Proposal

| Key Fact | Detail |

|---|---|

| 2026 COLA | 2.8% increase to Social Security benefits |

| Proposed COLA cap | Target high-benefit recipients with restricted annual increases |

| Estimated savings | ~$115 billion over 10 years under cap scenario |

| Trust fund outlook | Social Security trust fund projected to be depleted around 2032–2035 |

How the New Social Security Proposal Reform Works

Background of the Proposal

The proposal comes from the Committee for a Responsible Federal Budget (CRFB), a fiscal-policy think tank. Their analysis suggests placing a limit on how much the annual cost-of-living adjustment (COLA) applies to beneficiaries with the largest monthly checks.

Under current rules, all Social Security benefits rise annually with inflation via the COLA formula, which uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). For 2026, the Social Security Administration (SSA) has set the COLA at 2.8%.

The reform would leave the base formula intact but apply a cap or scaling mechanism for those receiving higher-benefit amounts. For example, a retiree receiving $3,000 per month might see a COLA of $84 under a 2.8% rise, but with a cap, they might receive only $75. Lower-benefit recipients would receive the full $84.

Policy Rationale

The CRFB argues this approach increases program equity by asking more from those least dependent on Social Security while preserving full cost-of-living protection for those who rely on it most. According to their report: “These reforms can make Social Security more progressive without reducing base benefits for most retirees.”

Current COLA System and Why It Matters (KW2)

Mechanism of COLA

Social Security’s cost-of-living adjustment (COLA) is determined each October by comparing the CPI-W average for the third quarter of the current year to that of the third quarter of the prior year.

The resulting percentage is applied to benefits starting the following January. Since 2020, COLAs have ranged widely: 1.3% in 2021, 8.7% in 2023, 3.2% in 2024, and 2.8% for 2026.

Why It Is Central (KW3)

Because benefits compound annually, even small changes matter. The earlier a person retires and the higher their benefit, the more significant the long-term effect. The CRFB estimates that over 10 years, a modest cap could save $115 billion — equating to nearly 10% of the long-term funding gap.

How Inflation and Costs Affect Retirees

While COLA tracks inflation generally, retirees often face steeper increases in health care, housing and utilities than the CPI-W signal reflects. According to the Medicare Rights Center, older Americans’ actual inflation experience frequently exceeds general inflation measures.

Combined with rising Medicare Part B premiums (which for 2026 are rising about 10% to $202.90/month), many retirees see the net gain from COLA effectively reduced.

Solvency Challenges Driving the Discussion (KW4)

Trust Fund Projections

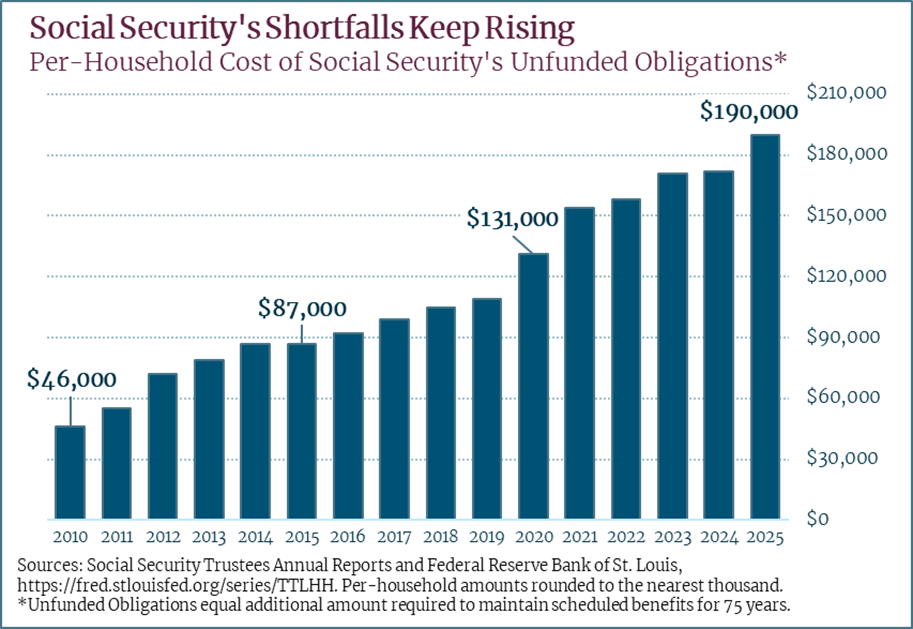

The 2025 Annual Report from the Social Security Trustees projects the Old-Age and Survivors Insurance (OASI) trust fund will be depleted in 2033, and the Disability Insurance (DI) trust fund may be depleted by 2036. At that point, incoming payroll taxes would cover only 75–80% of scheduled benefits.

Why Reform Is Being Urged

Without action, automatic across-the-board benefit cuts of 20% or more could occur. Analysts warn that delaying reform increases the risk of abrupt cuts later. “The challenge is real,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “The longer we wait, the harsher the choices become.”

How a COLA Cap Helps

By targeting COLA growth for higher-benefit recipients, the proposal generates savings while retaining inflation-protection for lower-benefit recipients. According to the CRFB modelling, a cap at the 75th-percentile benefit level would postpone full trust-fund depletion by about two years.

How the New Social Security Proposal Could Play Out

Case Study 1: Mary Henderson, Middle-Income Retiree

Mary retired at age 67 in 2024 with a monthly benefit of $1,500. At a 2.8% COLA in 2026, her monthly benefit would increase by $42 to $1,542. Under the proposed cap, because her benefit is below the 75th percentile, she would still receive the full increase. Her focus likely remains managing medical and living costs.

Case Study 2: James Delgado, High-Benefit Retiree

James retired at age 65 with a monthly benefit of $3,000. Under a 2.8% COLA he would expect a $84 increase to $3,084. But if a cap is implemented at the 75th percentile, his increase could be cut by 10% (e.g., $75 instead of $84). That reflects the policy’s intent: reduce growth for those with above-median benefits while preserving full increases for others.

Taxation and State-Level Effects

Because Social Security benefits may be taxed up to 85% at the federal level—depending on combined income—and some states tax benefits or exclude them from income, a slower benefit increase means less exposure to higher tax brackets and potentially less state tax burden. But it also means planning for smaller net income growth over retirement.

International Comparisons and Indexing Approaches

Other developed countries handle pension indexation differently. For example, in Canada the Old Age Security benefit is adjusted quarterly using the Consumer Price Index, but many private pensions use wage-growth indexing rather than inflation alone.

In Germany, statutory pensions are indexed based on wage growth and contribution ratios. These models highlight alternative approaches to inflation protection beyond the U.S. COLA system.

Some economists argue that switching to a hybrid index—blending wage growth and inflation—could reduce pressure on programme finances while still protecting older adults from cost-burden shifts. The New Social Security Proposal proposal draws on this context by focusing only on high-benefit recipients rather than altering the index for everyone.

Political and Legislative Landscape

Current Status of the Proposal

At present, the New Social Security Proposal proposal remains conceptual. It is part of a broader menu of policy options published by the CRFB and has not been introduced as formal legislation. The idea is gaining attention within budget-reform circles but has yet to gain committed bipartisan support in Congress.

Political Risks and Considerations

Any change to COLA must navigate several political risks:

- Generational equity concerns: Retirees may view any reduction as a breach of the Social Security entitlement promise.

- Benefit complexity: Introducing a cap differentiates benefit growth by income tier, complicating public understanding and administration.

- Election timing: With a presidential and congressional election cycle ahead, major reforms face greater scrutiny and resistance.

Potential Timeline

Even if Congress were to adopt a cap, experts say an effective date before 2028 is unlikely due to the lead time needed for legislative drafting and administration. Some analysts forecast that if adopted, changes would apply only to new beneficiaries or have phased-in effects.

What Beneficiaries Should Do Now

- Monitor congressional activity: Watch for Social Security reform bills and public hearings that include the primary-keyword concept.

- Check your benefit level: Know where your monthly benefit falls relative to the proposed threshold (e.g., 75th percentile) so you can assess exposure.

- Assess your income mix: Since private savings and pensions can offset slower benefit growth, higher-income retirees may adjust portfolios accordingly.

- Budget for slower growth: Even without a cap, consider scenarios in which benefit growth is constrained and plan accordingly—for example by increasing savings or reducing spending.

- Engage advocacy and consult advisors: Senior-advocacy organisations and financial advisors can help interpret reform proposals and their potential impact on income, taxes and estate planning.

Related Links

Social Security Payment for Nov 19, 2025: Here’s the Average and Maximum Amount You Could Receive

$2,000 Tariff Checks: Treasury Outlines the Key Requirement for Approval

Timeline of Past COLAs and Reform Talks

| Year | COLA | Notes |

|---|---|---|

| 2021 | 1.3% | Pandemic-era inflation dip |

| 2023 | 8.7% | Post-COVID inflation spike |

| 2024 | 3.2% | Receding inflation trend |

| 2026 | 2.8% | Latest announced increase by SSA |

| 2032–2035 | — | Projected trust fund depletion window, driving reform urgency |

This timeline underlines how inflation, demographics and policy converge to build pressure for reform. The New Social Security Proposal proposal is the latest iteration of efforts to reconcile benefit adequacy with fiscal sustainability.

The debate over a COLA cap underscores a core challenge facing Social Security today: balancing the goal of full inflation protection for all retirees with the imperative of long-term financial sustainability. The New Social Security Proposal proposal targets higher-benefit recipients and signals a narrow, targeted reform path rather than broad benefit cuts.

Whether this approach gains traction will depend on political will, public acceptance and competing reform priorities in Congress. However, for beneficiaries and near-retirees, the message is clear: stay informed, understand your benefit level, plan for slower growth and monitor developments closely.