As December 2025 approaches, there will be no new federal stimulus checks issued to Americans. The IRS has confirmed that no further relief payments are planned. However, the proposal for a tariff-based dividend—where tariff revenue would be used to fund direct payments to U.S. citizens—remains under discussion.

While the idea has captured attention, its future remains uncertain as it faces legal, fiscal, and political hurdles.

No Federal Stimulus This December

| Key Fact | Status / Detail |

|---|---|

| Federal Stimulus Payments – December 2025 | None scheduled. No new stimulus checks are authorized by Congress or the IRS. |

| Last Pandemic Relief Payment | Final disbursements for Recovery Rebate Credit ended January 2025. |

| Tariff-Based Dividend Proposal | Proposed by Trump, aiming for up to US$2,000 per qualified individual, but legislation not yet passed. |

| Legislative Status | No bill passed as of December 2025. Payments not confirmed for 2025. |

| Expected Timing of Tariff-Based Payments | Tentatively mid‑ to late‑2026. |

| Fiscal Concerns | Some experts raise concerns about tariff revenue being insufficient to fund large‑scale payments. |

The Absence of Federal Stimulus Payments in December 2025

No New Federal Payments Authorized

In December 2025, there will be no new federal stimulus checks issued to U.S. citizens. The IRS has confirmed that the Recovery Rebate Credit program—which provided multiple rounds of direct financial assistance to Americans during the COVID‑19 pandemic—officially ended by January 2025. No new legislation has been introduced since then to authorize further rounds of relief payments.

Unlike previous years when the government issued multiple rounds of relief checks, no new plans or bills have been brought before Congress to implement additional economic aid at the federal level.

The Pandemic Relief Package and Its Aftermath

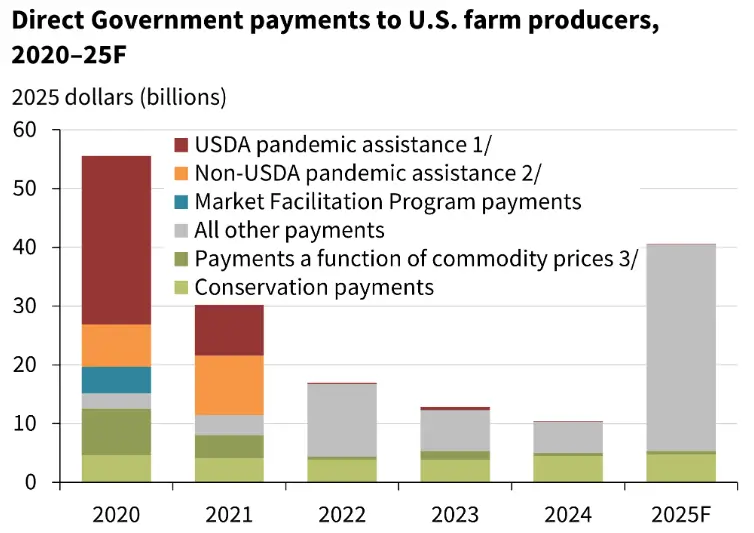

The last major round of federal payments came as part of pandemic relief efforts, authorized under the CARES Act in 2020, followed by additional packages in 2021 and 2022. These payments played a crucial role in supporting millions of American households during the height of COVID‑19, helping people cover expenses such as housing, utilities, and medical bills.

However, with the ongoing economic recovery post-pandemic, the political will for further stimulus payments has waned. Proposals to distribute more payments to households have stalled in Congress, reflecting the broader debate on how to allocate public funds amid concerns about inflation and the federal deficit.

Confusion Over “Stimulus” Payments

Despite the IRS confirming there will be no new federal stimulus payments, rumors and misinformation continue to circulate online. Some websites have incorrectly labeled regular IRS tax refunds or state-level relief programs as new federal stimulus checks. As a result, many Americans are mistakenly anticipating additional federal funds.

The IRS and tax professionals have urged taxpayers to verify any unexpected deposits carefully, especially during this holiday season, to avoid falling for misinformation or scams.

The Tariff-Based Payment Proposal: A New Idea for Economic Relief

What Is the Tariff-Based Dividend?

In the absence of traditional stimulus payments, a new proposal has emerged that suggests using tariff revenue—taxes on imports—to fund direct payments to U.S. citizens. This idea, championed by former President Donald Trump, is referred to as a tariff-dividend or tariff rebate.

The concept is simple: since tariffs increase the cost of goods, especially imported products, the government could use some of the tariff revenue to offset these costs for consumers by returning it in the form of a US$2,000 check to eligible Americans.

The plan has been touted as a way to relieve middle- and lower-income Americans, many of whom are grappling with the economic consequences of rising inflation. Trump has suggested that each qualified individual could receive up to US$2,000, and the payments would be distributed on a recurring basis.

What Are the Legal and Legislative Challenges For New Tariff-Based Payments?

Although the tariff-dividend proposal has generated significant interest, it faces major legal and legislative hurdles. For the program to become a reality, Congress must pass a bill that authorizes the use of tariff revenue for direct payments. As of now, no such legislation has been proposed or voted on.

Furthermore, the U.S. Department of the Treasury and the IRS have made no official moves toward preparing for the disbursement of these payments. There are also concerns that the federal tariff revenue might not be sufficient to fund widespread payments, as current tariffs do not generate the massive amounts needed to cover millions of payments.

When Could the New Tariff-Based Payments Happen?

Trump has suggested that the payments may not arrive until mid- to late-2026, indicating that any potential disbursements are still years away. This timeline makes it clear that no tariff-based payments will be issued in December 2025.

Challenges to the Feasibility of the Tariff-Dividend Proposal

Revenue vs. Payments: The Math Doesn’t Add Up

One of the key concerns with the tariff-dividend proposal is the revenue disparity. While tariffs contribute significant funds to the federal treasury, they do not generate nearly enough money to cover the cost of providing US$2,000 checks to every qualified American.

The U.S. government relies more heavily on income taxes than tariffs to fund its budget. As such, experts have raised doubts about the sustainability of such a payment plan.

Moreover, the projected cost of distributing these payments could be far greater than current tariff collections, leading to fiscal challenges. Some estimates suggest that funding these payments could further exacerbate the federal deficit.

Political and Economic Resistance

Even within Trump’s own party, there is mixed support for the tariff-dividend idea. Some conservative lawmakers argue that the revenue from tariffs should be used for debt reduction or infrastructure investment, rather than direct payments to citizens. They also caution that such payments could stoke inflationary pressures by increasing demand in an already tight economy.

In addition, any such payment program would require congressional approval, which is unlikely given the current fiscal constraints and the need for bipartisan support.

Alternatives to Federal Stimulus Payments

Other Forms of Relief

While a new round of federal stimulus payments is off the table for December, Americans still have access to other forms of government assistance. Programs such as the Child Tax Credit, food assistance (SNAP), unemployment benefits, and state-level relief programs continue to provide support for millions of families.

These programs aim to address the ongoing economic challenges faced by low- and middle-income Americans. Several states have also enacted their own stimulus or relief measures, such as one-time checks, tax rebates, and eviction moratoriums. These local-level programs can provide vital aid, particularly in areas where federal relief has been insufficient.

Related Links

New York December 2025 Social Security Calendar — When Each Group Gets Paid

Social Security Sends Up to $4,018 on December 10 — Check If You Can Qualify

What You Can Expect This December

No Stimulus Checks, But Some State-Level Aid Available

As the holiday season arrives, Americans should not expect a federal stimulus check from the IRS. The federal government has not authorized any additional stimulus payments, and the tariff-dividend proposal is still in its early stages, with no immediate plans for implementation.

If you are eligible for a state-level relief program, be sure to check your state’s website or consult with local authorities for further details on available assistance.

The Road Ahead

As of December 2025, no immediate federal relief payments are forthcoming. While the idea of a tariff-based dividend has sparked debate, it remains uncertain whether the proposal will make it past the legislative and fiscal challenges it faces.

For now, many Americans will continue to rely on existing forms of government assistance, while keeping an eye on potential future relief initiatives in 2026. For those hoping for an immediate financial boost, patience will be required as political discussions continue to evolve.