A new legislative proposal in the U.S. Senate would temporarily add $200 per month to federal benefit checks during the first half of 2026, offering short-term inflation relief to millions relying on Social Security, Supplemental Security Income (SSI), veterans’ benefits, and Railroad Retirement payments.

The Proposed Bill Would Add $200 Monthly is designed as an emergency supplement amid rising living costs and concerns over benefit adequacy.

Proposed Bill Would Add $200 Monthly to Social Security Benefits

| Key Fact | Detail / Statistic |

|---|---|

| Name of bill | Social Security Emergency Inflation Relief Act (S. 3078) |

| Proposed amount | $200 monthly supplement for January–June 2026 |

| Benefit programs covered | Social Security, SSI, veterans’ benefits, Railroad Retirement |

| COLA interaction | Separately, 2026 COLA = 2.8% |

| Legislative status | Introduced; pending review in Senate Finance Committee |

Understanding the Proposed Bill Would Add $200 Monthly Proposal

Purpose and Scope

The Proposed Bill Would Add $200 Monthly seeks to offer targeted financial support to Americans whose incomes are tied to federal benefits. The proposal responds to what lawmakers describe as persistent strain among older adults and people with disabilities who face rising medical, housing, and food expenses.

The temporary nature of the boost distinguishes the bill from broader Social Security reform packages. Rather than recalculating the benefit formula or changing the retirement age, S. 3078 acts as a six-month emergency measure intended to ease immediate cost pressures.

Eligibility Criteria to Add $200 Monthly to Social Security Benefits

Programs Covered

The bill would apply to individuals receiving:

- Social Security (retirement, disability, survivors)

- Supplemental Security Income (SSI)

- Veterans Affairs disability compensation or pension

- Railroad Retirement benefits

This coverage reflects a broad interpretation of federal benefit programs tied to fixed incomes.

Residency Requirements

Recipients must be lawful U.S. residents or live in qualifying U.S. territories during the payment window. Standard program residency rules apply.

No Double Payments

If a person receives more than one eligible benefit—such as both VA disability and Social Security—they would still receive only one $200 monthly supplement.

KW2, KW3, KW4 Payment Mechanics and Timeline

Payment Method

The $200 supplement would be delivered using the same system beneficiaries already rely on:

- Direct deposit (majority of recipients)

- Direct Express debit card

- Paper checks (limited cases)

Government agencies state that reusing existing systems would minimize administrative cost and delay.

Payment Schedule

Payments would follow standard monthly distribution dates:

- Social Security: second, third, or fourth Wednesday depending on birth date

- SSI: first of the month

- VA benefits: typically the first business day of the month

Implementation Window

The anticipated timeline is:

- January 2026 → June 2026

- Total potential supplement: $1,200.

Why the Increase Is Being Proposed

Inflation and Economic Pressures

The U.S. has experienced persistent price increases in key sectors disproportionately affecting seniors:

- Prescription drugs

- Medicare premiums

- Long-term care

- Rents

- Utilities

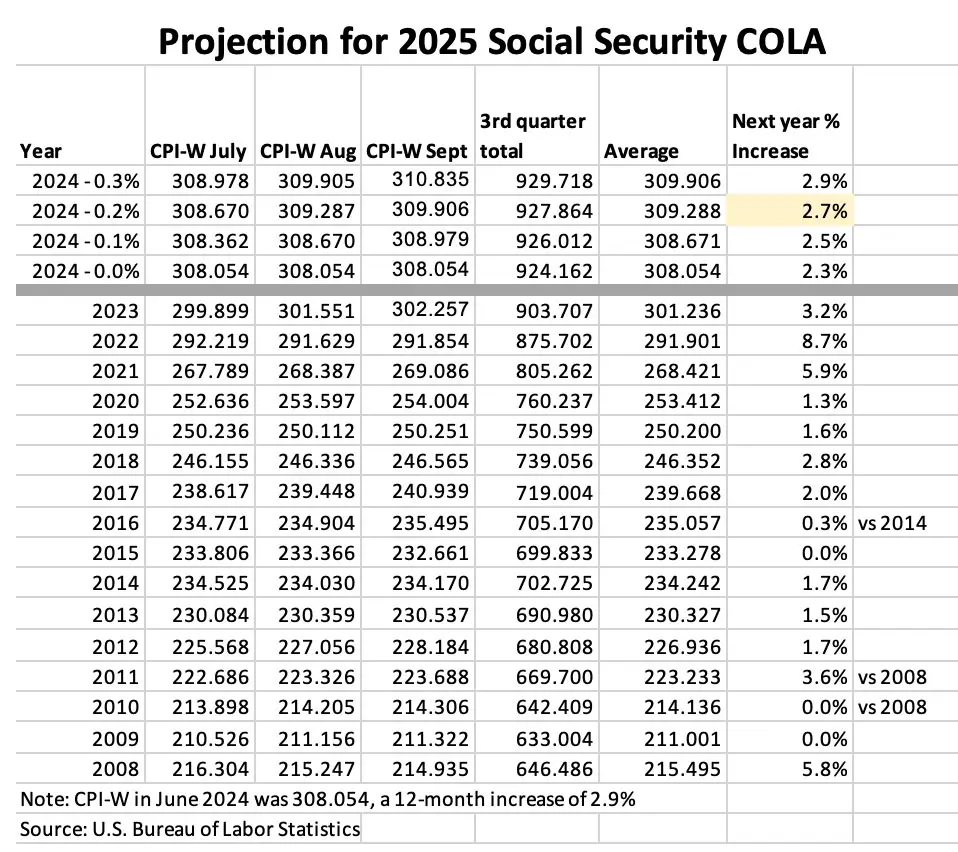

Social Security’s 2.8% COLA for 2026 raises the average payment by about $56. Analysts say this is modest compared to increased annual out-of-pocket medical costs.

CPI-W vs CPI-E Debate

The current COLA formula uses the CPI-W, criticized for underestimating senior living costs. Advocates argue CPI-E—a measure tailored to older adults—would produce more accurate COLAs over time. Supporters of S. 3078 view the $200 supplement as partial remediation while long-term reform is debated.

Legislative Landscape and Political Dynamics

The bill is sponsored by Senator Elizabeth Warren, with cosponsors including Senate Majority Leader Chuck Schumer and Senator Ron Wyden, chair of the Senate Finance Committee.

Supporters’ Arguments

Supporters say the increase would:

- Protect seniors and disabled Americans from price shocks

- Supplement inadequate COLAs

- Provide meaningful relief without long-term structural changes

Senator Warren said the measure would “offset higher prices” for seniors and families “living on modest, fixed incomes.”

Opponents’ Concerns

Critics cite:

- Fiscal cost

- Impact on federal deficits

- Potential expectations for future supplemental increases

- Short-term design lacking long-term reform

Some Republicans argue for broader Social Security restructuring rather than temporary supplements.

Economic Analysis and Expert Commentary

Insights from Economists

Dr. Michael Sanderson of the Wharton School notes that temporary relief “can bridge vulnerable households through high-cost periods,” but warns that short-term payments do not address “the deeper actuarial challenges facing Social Security.”

Advocates’ Perspective

The Senior Citizens League estimates that 73% of older Americans rely on Social Security for more than half their income, increasing the urgency of supplemental support.

Administrative Feasibility and Implementation Challenges

Even when legislation is approved, agencies must:

- Update payment systems

- Verify eligibility across overlapping programs

- Coordinate inter-agency data

- Ensure accuracy for millions of beneficiaries

Past temporary payment programs—such as 2009 stimulus checks and 2020–2021 pandemic relief payments—demonstrated that logistical challenges can delay distribution.

Who Stands to Benefit the Most?

Retirees

COLA increases cover inflation broadly, but retirees with high medical spending would see outsized benefit from additional cash support.

Disabled Workers

Disabled individuals often have fixed, limited incomes and higher medical costs, making additional predictable monthly income particularly impactful.

Low-Income SSI Recipients

For SSI beneficiaries, $200 may equal 15–20% of total monthly income.

Veterans

Veterans with service-connected disabilities, especially those with fixed ratings, may experience rising medical and living expenses that outpace current benefits.

Scenario-Based Breakdowns

Scenario 1: Average Retiree

- Current: $2,000/month

- COLA 2026: +$56

- Proposed supplement: +$200

- Total during relief period: $2,256/month

Scenario 2: SSI Beneficiary

- Current: ~$943/month (individual)

- Proposed supplement: +$200

- Total: $1,143/month

Scenario 3: Disabled Veteran

- Current VA disability: varies by rating

- New payment: additional $200 only

- Cannot combine multiple $200 payments

Historical Context: Past Federal Relief Measures

U.S. lawmakers have occasionally provided supplemental payments to benefit recipients:

- 2009: One-time $250 payment to Social Security and VA beneficiaries during the Great Recession

- 2020–2021: Stimulus payments that included retirees and disabled adults

- 2023–2024: Enhanced SNAP and housing support for fixed-income Americans

These measures inform expectations for modern relief proposals.

Related Links

Social Security Increase for 2026 — Steps to Make Sure You Get the Updated Payment

Deadline Today — Octapharma Data Breach Claims Worth Up to $5,000 Close Shortly

International Comparison

Many OECD nations—including Canada, the U.K., and Germany—use inflation-adjusted pension formulas. Some countries provided temporary cost-of-living supplements during recent inflation spikes, similar in intent to the Proposed Bill Would Add $200 Monthly.

What Beneficiaries Should Do Now

- Follow updates from SSA, VA, and Railroad Retirement Board

- Ensure bank details are current

- Review My Social Security online account

- Be wary of scams promising early payments

- Do not adjust long-term financial plans until legislation is confirmed

The proposed $200 monthly increase offers short-term relief for millions facing rising costs, but its future depends on negotiations in a politically divided Congress. As lawmakers debate benefit adequacy, long-term solvency, and fiscal priorities, the next several months will determine whether the Proposed Bill Would Add $200 Monthly becomes law or simply signals broader momentum for Social Security reform.

FAQ About Add $200 Monthly to Social Security Benefits

Is the $200 increase guaranteed?

No. It requires full congressional approval and presidential signature.

Will it affect SNAP, Medicaid, or housing assistance?

The bill intends to make the payment not count as income, limiting eligibility disruptions.

Does this change COLA?

No. It is in addition to the 2.8% COLA for 2026.

Will taxes apply?

The proposal designates the $200 as tax-free, though final IRS guidance would confirm this.

Do beneficiaries need to apply?

No application would be required; payments would be automatic.