A lot of people are hearing about a bigger 2026 check and asking the same thing: what does Receiving $1850 From Social Security actually mean for real life budgeting, and how much of it will you really keep. If you’re close to that number already, receiving $1850 From Social Security can feel like a simple headline, but the final deposit depends on deductions, timing, and a few 2026 rule changes. The big driver is the 2026 cost of living adjustment, and it’s the reason so many estimates keep circling back to the $1,850 range. If your benefit is near $1,800 today or you’re already at $1,850, the 2026 bump changes your gross amount first, then Medicare premiums and any withholding decide what you see in your account.

If you’re trying to map out 2026 finances, Receiving $1850 From Social Security is a useful “middle of the road” reference point because it’s close to where many retirees land after the 2.8% COLA is applied. This guide walks through what pushes a benefit toward $1,850, what pulls it down after deductions, and how it compares with both average and maximum checks. It also covers how working can affect monthly cash flow if you claim before full retirement age, plus a few simple planning moves that make your check go further. Then, there’s a quick FAQ section for common questions.

Receiving $1850 From Social Security

| Overview Item | What It Means For 2026 |

|---|---|

| 2026 COLA | Benefits rise by 2.8% starting with January 2026 payments. |

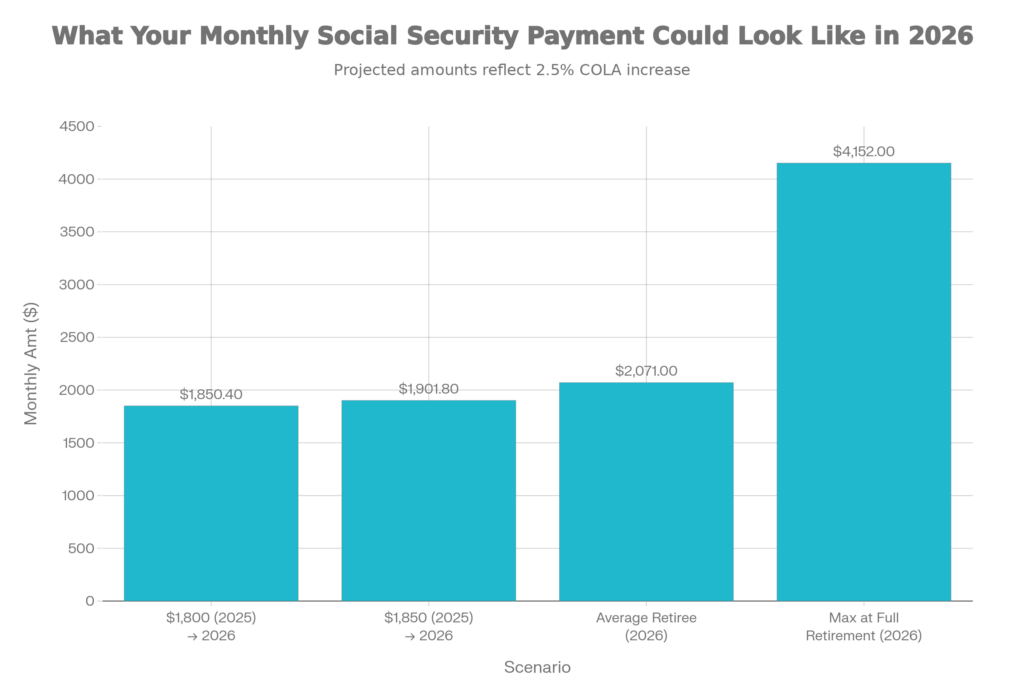

| $1,800 example | $1,800 in 2025 becomes about $1,850.40 in 2026 after the 2.8% increase. |

| If you’re already at $1850 | $1,850 becomes about $1,901.80 after a 2.8% increase. |

| Average retiree check | Around $2,071 per month in 2026 for the average retired worker. |

| Maximum benefit at full retirement age | Around $4,152 per month for new retirees claiming at full retirement age. |

| Taxable wage base | Rises to $184,500 in 2026. |

| Earnings limit (under full retirement age) | $24,480 per year, with $1 withheld for every $2 above the limit. |

| Earnings limit (year you reach full retirement age) | $65,160 per year, with $1 withheld for every $3 above the limit. |

| SSI timing note | Higher SSI amounts can show up at the end of December ahead of January Social Security payments. |

How The 2026 COLA Shapes An $1850 Benefit

- The cleanest way to understand a 2026 check is to start with the COLA math. A 2.8% cost of living adjustment means Social Security takes your current gross benefit and multiplies it by 1.028. That is why a lot of examples start with $1,800: when you apply 2.8%, you land at about $1,850.40, which looks like “$1,850” in everyday talk.

- Now, here’s the part people miss: the COLA raises the benefit amount first, but it does not guarantee your take home deposit rises by the same percentage. If other costs rise at the same time, especially healthcare premiums, the increase can feel smaller. So when you see a headline about Receiving $1850 From Social Security, treat it as a gross number first, then work down to your net deposit.

- A helpful way to use this is planning. If you’re still in 2025 and your check is about $1,800, you can budget for roughly $50 more per month gross in 2026. If you’re already near $1,850, you can budget for roughly $52 more per month gross to land near $1,901.80. Even before deductions, that’s enough to cover a few recurring expenses, but it probably won’t erase the pressure from bigger bills.

What Receiving $1850 From Social Security Looks Like After Deductions

This is where expectations get real. Many retirees have Medicare Part B premiums deducted directly from their Social Security checks. When Part B premiums rise, your deposit can increase less than you expected even though your official benefit did go up. That’s why two people can have the same gross benefit but different net deposits.

Here are the most common reasons your $1,850 gross isn’t the number that hits your bank account:

- Medicare Part B premium deductions, which come out before you get paid.

- Medicare Part D or Medicare Advantage premiums, if you have them deducted from your check.

- Federal tax withholding, if you choose to have taxes withheld from Social Security.

- Past due obligations that can be withheld in certain cases, depending on your situation.

So, what should you do with this? Start treating your Social Security amount like a paycheck with “automatic deductions.” If you’re building a monthly plan around Receiving $1850 From Social Security, the smarter number is the deposit you actually receive, not the gross benefit shown in a general estimate. Pull up two or three months of bank deposits and use that as your baseline, then adjust for the COLA. Also, keep an eye on timing. If you change Medicare plans or choose tax withholding, the next month’s deposit can change. People often think Social Security made a mistake, when it’s just a different deduction hitting the same benefit.

How $1850 Compares With Other 2026 Social Security Checks

- The $1,850 mark is meaningful because it sits slightly below the projected 2026 average retired worker benefit of around $2,071. That doesn’t mean you’re “low,” it just means you’re not at the average point of the distribution.

- At the top end, the system allows much higher checks, but those checks generally come from a specific recipe: many years of high earnings and, often, claiming at a later age. In 2026, a commonly cited maximum benefit at full retirement age is around $4,152 per month, which is more than double the $1,850 benchmark.

- This comparison matters for one big reason: it’s a reminder that Social Security is partly about your lifetime earnings record and partly about when you claim. If you’re at $1,850, you’re seeing what a broad swath of retirees see: a stable base income, but not necessarily enough to cover everything alone.

- In practical terms, Receiving $1850 From Social Security often works best as the foundation of a retirement plan, with the rest coming from savings, part time income, family support, or a pension, depending on your situation.

Work, Earnings Limits, And An $1850 Check In 2026

Working while collecting benefits can be smart, but it can also confuse people when checks change. If you claim Social Security before full retirement age and your earnings go above a set limit, Social Security may withhold part of your benefits temporarily.

For 2026, two numbers matter most:

- If you are under full retirement age all year, the earnings limit is $24,480, and Social Security withholds $1 in benefits for every $2 earned above that limit.

- In the year you reach full retirement age, the earnings limit is $65,160, and Social Security withholds $1 in benefits for every $3 earned above that limit.

This doesn’t mean the money disappears forever. It means monthly cash flow can get messy. If you’re counting on Receiving $1850 From Social Security every month like clockwork, a strong work year can trigger withholding, which can create gaps in deposits. The best move is to plan ahead: treat your Social Security deposit as variable during the year if you expect to cross the earnings limit. Also, if you’re near full retirement age, timing matters. Some people choose to shift work hours, move bonus timing, or reduce overtime just to keep benefits smooth. Others are fine with temporary withholding because they value the extra earned income more.

Retirement Planning 2026: Why Boosting Social Security Benefits Is Becoming Harder

Key Planning Tips If You’re Around The $1850 Mark

If the goal is making your money feel less tight in 2026, the biggest wins often come from small, boring moves that compound.

- First, separate the “must pay” bills from the “nice to have” spending. If you’re building a plan around Receiving $1850 From Social Security, start by covering housing, utilities, groceries, transportation, and healthcare. Then decide what’s left for subscriptions, travel, gifts, and eating out. This one step turns anxiety into clarity.

- Second, treat the COLA increase as targeted money. Instead of letting it disappear into random spending, assign it a job. For many people, the best “job” is one of these: higher grocery costs, a rising premium, medication, or an emergency fund buffer.

- Third, review withholding and deductions once a year. A lot of retirees never look at what’s being deducted until something changes. If your deposit seems off, check whether a premium or withholding changed rather than assuming your benefit got cut.

- Fourth, know where you stand compared to the average. If you’re below the average benefit level, it’s not automatically a problem, but it’s a signal to keep a closer eye on discretionary spending and healthcare costs.

- Finally, if you have flexibility, consider ways to lower fixed costs. Even a small reduction in fixed monthly bills can feel bigger than a COLA raise. Lower fixed costs make Receiving $1850 From Social Security feel like a stronger paycheck without needing a bigger benefit.

FAQs on Receiving $1850 From Social Security

Will everyone’s Social Security check rise by the same amount in 2026?

The percentage increase is the same for most people because the COLA is a percentage, but the dollar increase depends on your starting benefit.

If I’m receiving $1,800 now, will I really be receiving $1,850 in 2026?

With a 2.8% increase, $1,800 becomes about $1,850.40, so yes, that’s the basic math behind the $1,850 benchmark.

If I’m already at $1,850, what happens in 2026?

A 2.8% increase takes $1,850 to about $1,901.80 gross, before Medicare premiums or any withholding.

Can working change my monthly deposit if I’m receiving benefits early?

Yes. If you claim before full retirement age and earn above the 2026 earnings limit, benefits can be temporarily withheld, which can make monthly deposits uneven.