The Social Security Administration (SSA) will increase retirement benefits by 2.8 % in 2026, providing the average retiree with roughly $56 more per month. However, for many seniors, a substantial rise in health-care costs — particularly the standard premium for Medicare Part B — could offset much or all of that gain.

Retirees Welcome $56 COLA Boost

| Key Fact | Detail / Statistic |

|---|---|

| COLA increase | 2.8 % for 2026 benefits, affecting ~71 million Americans. |

| Average boost | From about $2,015 to approximately $2,071 per month for retired workers, ~$56 more. |

| Medicare Part B premium rise | Standard monthly premium will be $202.90, up $17.90 from $185.00. |

| Net effect risk | Premium hike may consume one-third of the COLA gain for many beneficiaries. |

What the COLA Increase Means for Retirees

How the Adjustment Works

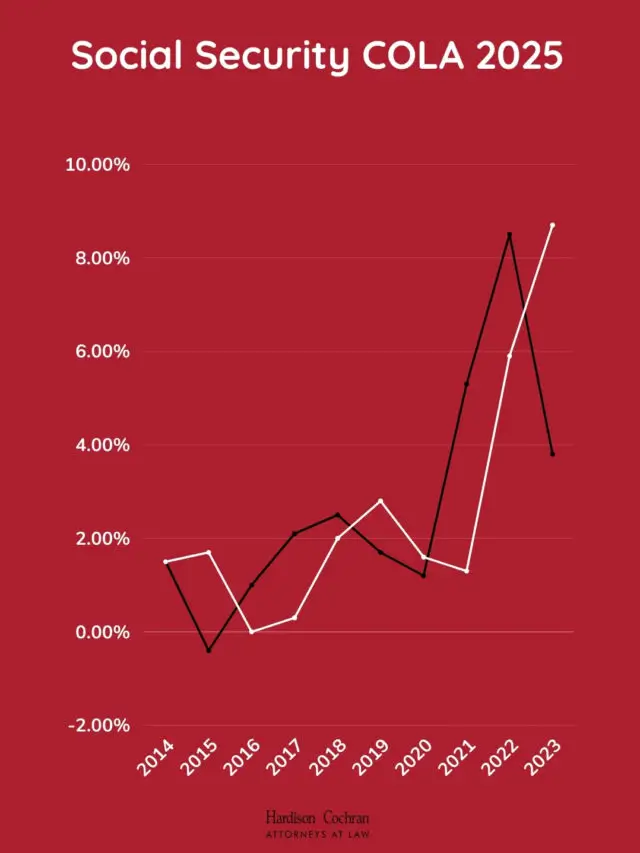

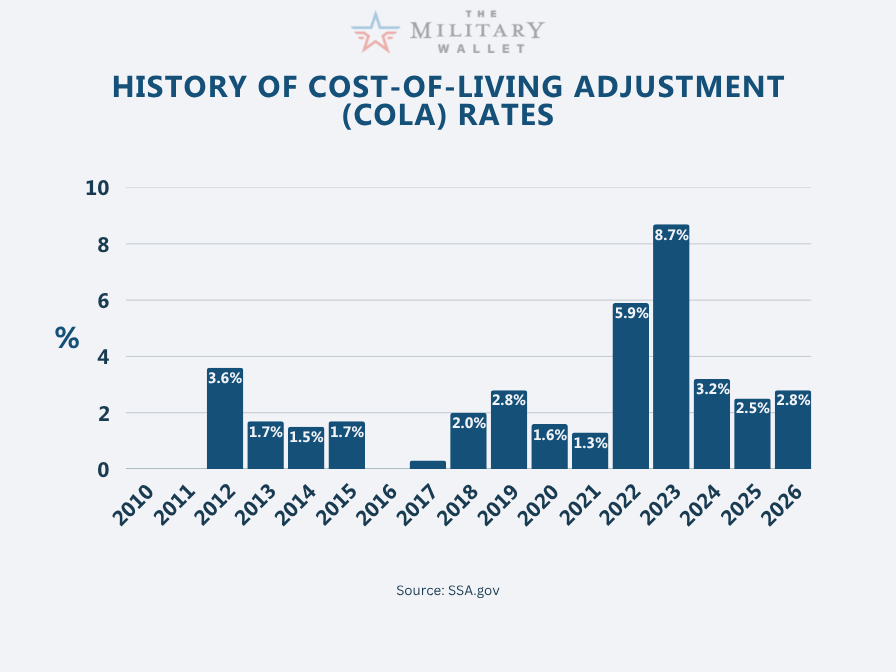

The cost-of-living adjustment (COLA) for the Social Security program is calculated by comparing the average of the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the third quarter of the current year with the third quarter of the prior year.

For 2026, the SSA announced the COLA will be 2.8 %. Beginning January 2026, most beneficiaries will see the higher benefit; those receiving Supplemental Security Income (SSI) receive the raise starting December 31, 2025.

What Retirees Will Receive

Under the new formula, the average retired worker’s benefit moves from about $2,015 to approximately $2,071 per month. For an aged couple both receiving benefits, monthly payments would rise from about $3,120 to $3,208.

SSA Commissioner Frank J. Bisignano described the COLA as “a vital part of how Social Security delivers on its mission.”

Why the Increase May Still Feel Modest

Inflation and Cost Pressures

Although 2.8 % is the formal increase, many retirees may find their personal cost-burden rising faster. The nonprofit AARP found that 77 % of older adults believe a ~3 % raise will not keep up with their real costs.

Separate data show that while overall inflation rose ~3 %, sectors such as medical care (4 %), electricity (5 %) and piped gas (11.7 %) climbed more steeply. This mismatch between the general cost-index and individuals’ actual spending means the increase may not fully restore purchasing power.

Healthcare Costs as a Key Erosion Risk

One of the most significant offsets to the increase is the rise in Medicare Part B premiums. In 2026 the standard monthly premium will increase by $17.90 to $202.90. Because many Medicare beneficiaries have the Part B premium deducted automatically from their Social Security check, that hike effectively reduces the net benefit increase.

Analysts estimate the premium rise might consume about one-third of the $56 monthly increase. For higher earners, income-related premium adjustments (IRMAA) will apply, with some paying up to $689.90 monthly in 2026.

Hence the “expensive misstep” referenced is underestimating how health-care premium and cost increases can erode the apparent benefit increase.

The Bigger Picture — Retirement Income and Costs

Other System-Wide Changes

In 2026, several additional policy changes will affect current and future retirees.

- The taxable maximum for Social Security payroll tax rises to $184,500 from $176,100 in 2025.

- The full retirement age (FRA) is gradually increasing: for those born in 1960 or later it will reach age 67.

- The earnings test thresholds are being adjusted. For beneficiaries under full retirement age, earnings up to $24,480 will not trigger benefit reductions. For those reaching FRA in 2026, the threshold rises to $65,160.

Solvency & Longer-Term Considerations

The SSA’s 2025 Trustees Report projects the combined Old-Age, Survivors, and Disability Insurance (OASDI) trust funds may not sustain full benefit payment beyond the early 2030s.

While the 2026 COLA helps maintain value short-term, it does nothing to forestall the broader structural challenges: rising longevity, slower wage growth, and shifting demographics. According to Committee for a Responsible Federal Budget, the increase remains “modest at best, given the pace of underlying health and housing cost inflation.”

What Retirees Can Do to Maximize Their Benefit

Review Your Budget, Especially Healthcare Costs

Given that the nominal benefit is rising by ~$56 a month, it’s essential to examine how much of that remains after mandatory deductions and cost increases.

Key steps:

- Confirm whether you pay the standard or higher income-related Medicare Part B premium.

- Check the Part B deductible, which will rise to $283 in 2026 (up from $257).

- Review other health-care costs: prescription drugs, Medicare Advantage or Medigap premiums, long-term care insurance, and out-of-pocket expenses. These may be rising faster than general inflation.

- Factor in non-health cost inflation: housing, utilities, and maintenance typically increase at different rates and can erode retirement budgets.

Confirm Your SSA Record and Benefit Notice

Retirees and soon-to-be claimants should log into their “my Social Security” account to review their earnings history and draft benefit notice. Errors in earnings records can permanently reduce benefit amounts.

SSA typically sends the annual benefit notice in late November; those who don’t receive one should follow up.

Consider Income Diversification and Cost-Control

Since benefit increases and COLA may not fully offset rising living costs, a prudent strategy includes:

- Exploring additional income sources (part-time work, consulting, rental income) while being mindful of earnings-test rules if already receiving benefits early.

- Identifying and trimming discretionary spending (travel, membership services, dining out) to create a buffer for unexpected costs.

- Reviewing housing options – downsizing, relocating to lower-cost areas, or refinancing property to reduce maintenance burdens.

- Annual review of Medicare Advantage or Medigap plans during open enrollment to ensure best fit and cost control.

Related Links

Retirees Get New Deadline: Government Sets Late-November Date to Check Updated COLA Notices

New Push for Higher COLA: Lawmakers Introduce $200 Monthly Boost After $56 Increase Criticized

Why This Matters

For tens of millions of Americans who rely on Social Security as their primary or sole source of income, even a modest boost of $56 a month can be meaningful. At an average benefit level of about $2,000 a month, the increase represents a 2.8 % lift.

Yet, in a context of steeply rising health-care costs, housing and utility inflation, and the automatic deduction of premiums, the net improvement in quality of life may be far smaller. Especially for lower-income retirees, even small shifts in mandatory costs can have outsized impacts.

This dynamic underscores why transparent planning and proactive budgeting are essential in retirement — what appears to be a raise may feel like maintenance once added deductions and cost-increases are applied.

The 2.8 % COLA for 2026 is a welcomed adjustment for the roughly 71 million Americans who receive Social Security or SSI benefits. Beginning January, most retirees will see an additional ~$56 per month. But the weighted reality is more nuanced. Rising costs — chief among them the Medicare Part B premium increase to $202.90 in 2026 — threaten to absorb a significant portion of that gain.

Retirees who rely solely on the benefit increase without accounting for these cost pressures risk seeing little real improvement. As the year advances, careful budgeting, diligent review of health-plan options, and conservative planning will be critical to ensure the COLA truly strengthens retirement income rather than simply preserves it.