The second wave of February Social Security checks is set to arrive soon, as payments continue to be disbursed in a carefully planned schedule. For millions of U.S. retirees and beneficiaries, understanding when their payments are due and what to expect from these disbursements can help with financial planning.

This article explores when you can expect your next payment, why the payments are staggered, and how to ensure you receive your benefits on time.

Second Wave of February Social Security

| Key Fact | Detail/Statistic |

|---|---|

| First Wave | Payments made on Feb. 3 and Feb. 11, based on birth dates. |

| Second Wave | Payments for Feb. 18 and Feb. 25 based on birth dates. |

| SSI Early Payment | SSI recipients received early payments on Jan. 30. |

| COLA Adjustment | A 2.8% cost-of-living adjustment (COLA) applied in 2026. |

Understanding the February Payment Cycle

The Social Security Administration (SSA) follows a structured payment schedule to distribute benefits to millions of U.S. beneficiaries each month. Payments are made to retirees, disability recipients (SSDI), and survivors on different days depending on factors like the beneficiary’s birth date and the type of benefits received.

For February 2026, the payment cycle includes two main groups: those paid at the beginning and mid-month and those paid later in the month. Understanding these groups and when payments are issued ensures that beneficiaries can better manage their finances and avoid confusion.

The First Wave of Payments (Feb. 3–11)

The first group of Social Security beneficiaries has already received payments. These individuals typically include:

- Beneficiaries who began receiving Social Security before May 1997.

- Those with birthdays between the 1st and 10th of any month.

These payments arrived between February 3 and February 11, with checks being directly deposited into bank accounts or issued to recipients using Direct Express cards. Payment amounts for these beneficiaries reflect the 2.8% Cost of Living Adjustment (COLA) that was applied to Social Security payments in 2026.

The Second Wave (Feb. 18–25)

The second wave of payments will go to individuals with birthdays later in the month:

- February 18, 2026: For beneficiaries born between the 11th and 20th of the month.

- February 25, 2026: For beneficiaries born between the 21st and 31st of the month.

These payments will follow the same process as the first wave, with deposits made directly into the beneficiary’s bank account or through Direct Express cards. If you belong to one of these groups, you can expect your Social Security payment to arrive on these dates.

What About Supplemental Security Income (SSI)?

Supplemental Security Income (SSI) is a needs-based program designed for people with limited income who are either disabled or elderly. Unlike regular Social Security payments, SSI payments are made on the 1st of every month. If the 1st falls on a weekend or holiday, the payment is made on the preceding business day.

For February 2026, since February 1st fell on a Sunday, SSI payments were issued early on January 30. This early payment covered February’s SSI benefits, and recipients will not receive another payment in February. This early payment system ensures that those dependent on SSI do not face delays due to weekend holidays.

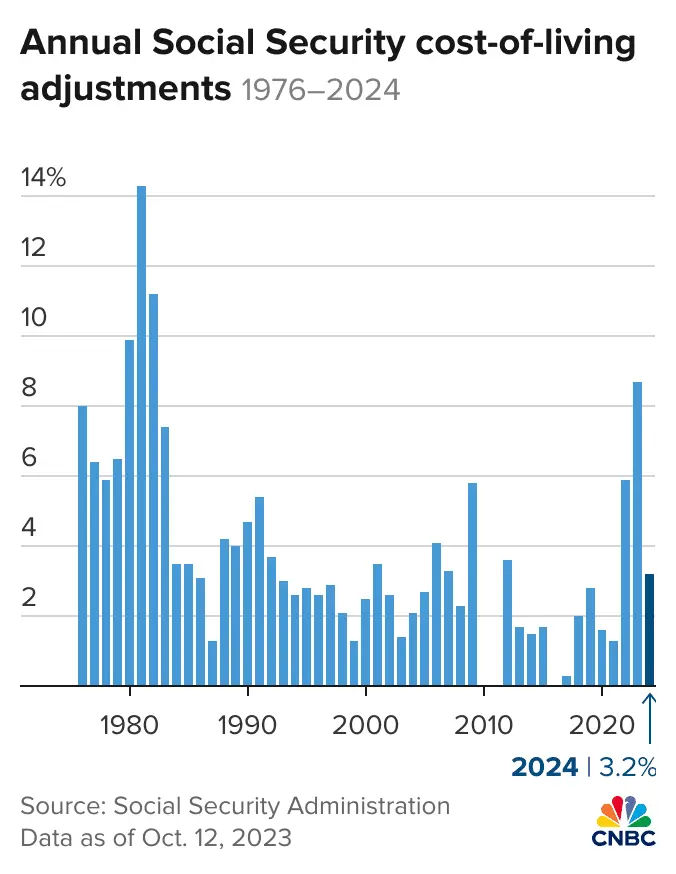

Impact of the 2.8% COLA Adjustment

Social Security benefits in 2026 have been adjusted for inflation, with a 2.8% cost-of-living adjustment (COLA). This increase is intended to help beneficiaries keep up with rising living costs, particularly for essentials such as healthcare, food, and housing.

Here’s how the COLA affects benefits:

- Retirement benefits for the average U.S. worker increased to $2,074.53 per month for 2026, reflecting the COLA.

- Social Security Disability Insurance (SSDI) recipients saw similar increases, averaging around $1,633.48 monthly.

- Survivor benefits also received the COLA, bringing the average monthly payout to about $1,622.33.

- SSI recipients saw a smaller increase due to the nature of the program, but it still helps cover the rising costs of basic living expenses.

While the COLA increase provides some relief, rising inflation, particularly in healthcare costs, continues to challenge many Social Security recipients, especially those who rely on fixed incomes.

Other Special Considerations for Social Security Payments

Who Else Receives Social Security Payments?

While most Social Security recipients are retirees or individuals with disabilities, spouses and dependent children may also receive benefits. Spouses who have reached the required age can claim benefits based on their partner’s earnings. These payments are also staggered according to the birth date system.

- Spouses and ex-spouses are eligible for benefits based on their partner’s work history, but they must meet certain criteria, such as being at least 62 years old or having been married for 10 years.

- Children under 18 or those with disabilities may also be eligible to receive a portion of a parent’s Social Security benefits.

How Direct Deposit Affects Payment Timing

For most recipients, payments are made through direct deposit into a U.S. bank account or Direct Express card. Direct deposit ensures that payments arrive promptly, minimizing the risk of delayed mail. If you’ve recently moved or changed banks, it is essential to update your account details with the Social Security Administration (SSA) to avoid delays.

Special cases like recipients in foreign countries may receive payments using different arrangements, including foreign banks that participate in international direct deposit.

Tax Implications for Social Security Benefits

While Social Security benefits are typically not subject to state income tax in most states, they may be subject to federal income tax. If your total combined income exceeds certain thresholds, up to 85% of your benefits may be taxable.

The IRS calculates combined income as your adjusted gross income, nontaxable interest, and half of your Social Security benefits. If your income exceeds the following levels, a portion of your Social Security benefits will be taxable:

- Single filers: Combined income over $34,000

- Married couples: Combined income over $44,000

Taxable benefits are included in your total gross income when filing your annual tax return. It’s important to plan accordingly for potential tax obligations, especially for beneficiaries who rely heavily on Social Security as their primary income source.

Related Links

IRS $1,776 Tax-Free Payment — Who Qualifies and Expected Payment Timing

Oklahoma SNAP Rule Change — When Junk Food Purchases Will Be Restricted

Potential Changes to the Social Security Payment System

As the baby boomer generation continues to retire and the Social Security Trust Fund faces pressure, there may be future changes to how benefits are paid or adjusted. While no specific legislative changes are expected in 2026, ongoing debates about funding and benefit levels could lead to reforms in the coming years.

One area of focus is the long-term sustainability of the Social Security system, particularly in light of the aging population. If you’re nearing retirement or planning for the future, it’s wise to stay informed about potential reforms and how they could affect your benefits.

FAQs About Second Wave of February Social Security

1. Why was my SSI payment issued early in January 2026?

Since February 1st was a Sunday, SSI payments for February were issued early on January 30, ensuring no delays for beneficiaries.

2. Can I receive Social Security benefits if I move abroad?

Yes, U.S. citizens can continue receiving Social Security benefits abroad, as long as they live in an eligible country. Payments are not sent to certain countries like Cuba and North Korea.

3. When do I receive my Social Security check in February 2026?

If your birthday falls between the 11th and 20th, you will receive your payment on February 18. If your birthday is between the 21st and 31st, your payment will arrive on February 25.