In 2026, freelancers and self-employed individuals face unique challenges when it comes to managing their tax responsibilities. The Internal Revenue Service (IRS) provides several tax relief options, which can offer crucial financial support.

Understanding these relief programs can help reduce liabilities, streamline payments, and ensure that workers in the gig economy or small businesses can thrive despite economic fluctuations.

Self-Employed and Freelancers

| Key Fact | Detail/Statistic |

|---|---|

| Self-Employment Tax Deduction | Self-employed individuals can deduct 50% of their self-employment tax. |

| Home Office Deduction | Eligible taxpayers may deduct a portion of their home expenses if they meet specific IRS criteria. |

| Qualified Business Income (QBI) Deduction | Allows freelancers to deduct up to 20% of their business income. |

| IRS Installment Payment Plans | Taxpayers can set up an installment plan to spread out their tax payments. |

| Offer in Compromise (OIC) | A program allowing settlement for less than the full amount owed, in certain financial hardship cases. |

Understanding IRS Tax Relief Options for Freelancers and Self-Employed Individuals

What Are Tax Relief Options for Self-Employed Workers?

For self-employed individuals and freelancers, the complexities of filing taxes can often feel overwhelming. Unlike traditional employees, who have taxes withheld by their employers, freelancers and self-employed workers are responsible for managing their own tax obligations.

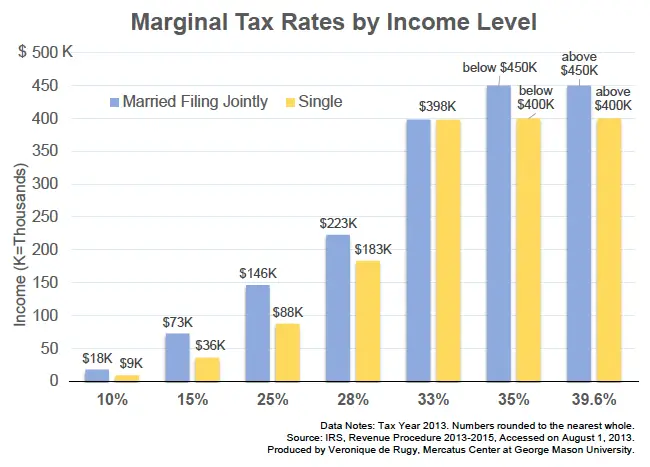

This includes paying both income tax and the self-employment (SE) tax, which covers Social Security and Medicare contributions. Tax relief for self-employed workers primarily comes in the form of deductions, credits, and flexible payment options.

These relief measures help reduce the tax burden and make compliance with IRS regulations more manageable.

Key Deductions and Credits Available to Freelancers and Self-Employed Workers

1. Self-Employment Tax Deduction

The self-employment tax rate for independent workers is 15.3%, which consists of 12.4% for Social Security and 2.9% for Medicare. Fortunately, self-employed individuals can deduct half of this tax when filing their income tax return. This deduction directly reduces taxable income, effectively lowering the amount you owe.

According to the IRS, this deduction applies only to the income tax portion of the SE tax, so while it does not reduce your self-employment tax, it can lower your overall tax burden significantly.

2. Home Office Deduction

The home office deduction is one of the most beneficial tax breaks available to freelancers. If you work from home and use a specific area exclusively for business activities, you may be eligible to deduct a portion of your home-related expenses. These expenses can include:

- Mortgage interest or rent

- Utilities (electricity, internet, phone)

- Property taxes and insurance

- Depreciation

The IRS offers two methods to calculate this deduction:

- The Simplified Option: A deduction of $5 per square foot for up to 300 square feet, for a maximum deduction of $1,500.

- The Regular Method: Involves calculating the exact percentage of your home used for business and applying that to your home expenses.

The eligibility for the home office deduction requires that the space must be used exclusively for business. Freelancers working from home must ensure that the area they claim is not used for personal purposes.

3. Qualified Business Income Deduction (QBI)

The QBI deduction allows self-employed individuals and freelancers to deduct up to 20% of their business income.

This deduction is available to those operating a sole proprietorship, partnership, or S-corporation, among other business structures. However, specific income limits apply, and the deduction is subject to other complex eligibility criteria.

Tax Relief Programs: Payment Flexibility for Freelancers

In addition to deductions, the IRS provides several programs that help freelancers and self-employed individuals manage the financial impact of taxes more effectively.

4. Installment Payment Plans

For freelancers who owe taxes but cannot afford to pay in full, the IRS offers installment plans, which allow tax liabilities to be paid off in monthly installments. There are two primary options for these plans:

- Short-Term Payment Plans: These plans allow individuals to pay their taxes in full within 120 days. No setup fee is required, though interest and penalties will continue to accrue during the payment period.

- Long-Term Payment Plans: For those needing more time, this option spreads payments over a period of more than 120 days. There is typically a fee for setting up a long-term plan, depending on the length of the agreement.

These plans can be arranged online via the IRS website for amounts under $50,000, or by submitting Form 9465 for larger amounts.

5. Offer in Compromise (OIC)

For freelancers experiencing significant financial hardship, the IRS’s Offer in Compromise (OIC) program offers a way to settle tax debts for less than the full amount owed. The program is available to self-employed individuals who meet the IRS’s criteria for financial hardship, which typically involves proving an inability to pay the debt in full.

OIC eligibility requires a thorough financial analysis, including income, expenses, and asset evaluation. While the process can be time-consuming, it offers a valuable solution for those who qualify.

6. Penalty Relief and First-Time Abatement

For self-employed individuals who have failed to meet tax deadlines or make estimated tax payments, the IRS provides penalty relief under certain conditions. First-time penalty abatement allows freelancers to have penalties waived for their first missed deadline, provided they have a clean record of tax compliance.

This penalty relief is part of a broader effort by the IRS to make tax payment more flexible for self-employed individuals facing challenges due to unforeseen circumstances such as illness, natural disasters, or economic disruptions.

Additional Considerations: Minimize Tax Liabilities Moving Forward

While relief programs can provide immediate assistance, long-term tax planning is essential for freelancers who want to maintain a stable financial footing. There are several strategies to consider:

7. Electing S-Corporation Status

Many freelancers elect to form an S-corporation to reduce self-employment tax. An S-corporation allows freelancers to divide their income between salary and distributions.

Only the salary portion is subject to self-employment taxes, while distributions may be free from those taxes, thus lowering the overall tax burden.

8. Retirement Contributions

Freelancers can also reduce their taxable income by contributing to retirement plans such as a Solo 401(k) or SEP IRA. Contributions to these accounts are tax-deferred, meaning they reduce your taxable income for the year in which they are made. In addition to tax savings, retirement contributions help freelancers build their retirement savings.

9. Estimated Tax Payments

Freelancers are required to make quarterly estimated tax payments. While these payments are mandatory, they also offer an opportunity to avoid large year-end tax bills and penalties for underpayment.

Freelancers should estimate their tax obligations and make payments on time to stay compliant and avoid unnecessary interest charges.

10. Tax Planning for 2026 and Beyond

As the self-employed workforce continues to grow, so too does the need for effective tax planning. With possible tax reforms on the horizon, freelancers must stay informed about changes in tax laws. Collaborating with tax professionals who understand the nuances of self-employment taxes can help freelancers navigate evolving tax landscapes and ensure they don’t miss out on beneficial changes.

Related Links

Oklahoma SNAP Rule Change — When Junk Food Purchases Will Be Restricted

For self-employed individuals and freelancers, managing tax responsibilities can be a daunting task. However, the IRS offers numerous relief options designed to reduce tax burdens and provide flexibility for those struggling to meet their obligations.

From home office deductions to payment plans, the key to managing taxes as a freelancer is staying informed and taking full advantage of available resources. As the self-employed workforce continues to grow, it is essential to stay updated on new IRS rules, tax relief programs, and potential changes in tax legislation.

By understanding and utilizing the available tax relief options, freelancers can better navigate the complexities of their financial obligations and continue to thrive in the ever-evolving gig economy.

FAQs About IRS Tax Relief Options

Can I deduct my home office expenses?

Yes, self-employed individuals who use part of their home exclusively for business purposes can deduct related expenses, including rent, utilities, and insurance.

How can I lower my self-employment tax?

By contributing to retirement plans or electing S-corporation status, freelancers can potentially reduce their self-employment tax. Additionally, maximizing deductions for business expenses can lower your taxable income.