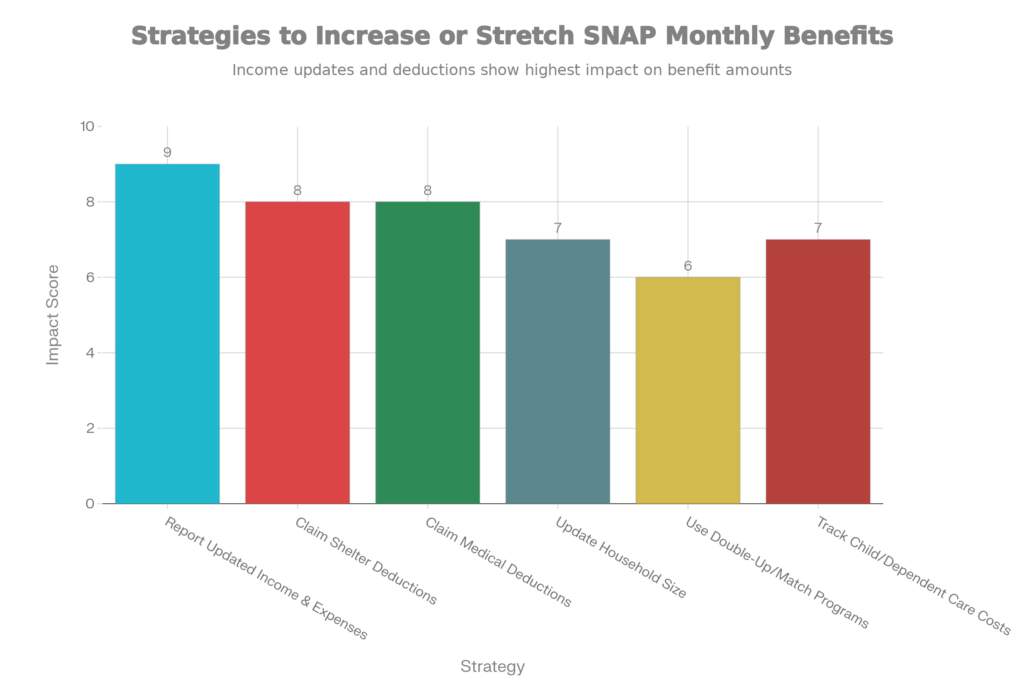

When people search for “SNAP Benefits: Simple Ways to Increase Your Monthly Deposit Amount,” they are usually not interested in policy language or complex formulas. They want clear, real‑world steps that can help them see a difference on their EBT balance. The core idea is simple: SNAP looks at your income, your household size, and your essential expenses. Whenever your real‑life situation changes, your benefits can change too up or down depending on what you report.

If your income drops, your rent goes up, or someone with medical expenses joins your household, your countable income can go down on paper. When that happens, your calculated benefit often goes up. The problem is that many households either do not know which changes matter or are afraid to report them. Learning how to handle these updates is one of the easiest ways to move your monthly SNAP deposit closer to the maximum you’re allowed.

SNAP Benefits

| Key Area | Practical Action You Can Take | How It Helps Your Monthly Deposit |

|---|---|---|

| Income And Expense Changes | Report drops in income and increases in rent, utilities, or child care as soon as they occur | Lowers your countable income and can raise your benefit based on the SNAP formula |

| SNAP Deductions | Make sure standard, shelter, medical, and dependent‑care deductions are all applied properly | Higher deductions reduce net income, which can mean a larger monthly benefit |

| Medical Expenses | List all allowed, unreimbursed medical costs for elderly or disabled household members | Medical deductions can move your benefits closer to the maximum for your household size |

| Household Size And Composition | Add new eligible household members who live with you and share food | Increases the benefit level your income is measured against |

| Bonus And Matching Programs | Use market match or “double up” programs to stretch your SNAP at certain stores or markets | Does not change the deposit amount, but effectively doubles spending power |

| Recertification And Case Reviews | Respond to all recertification notices and ask for a review if your situation changes | Keeps your case accurate so you are not stuck with outdated, lower benefits |

Why Your SNAP Amount May Be Lower Than It Should Be

SNAP benefits are calculated using a step‑by‑step formula. The agency starts with your gross income, subtracts several allowed deductions, and then compares your remaining “net” income to your household size. If your file does not show your full expenses or the correct number of people in your home, the formula will assume you can afford more out of pocket and give you less each month.

This is why two people with the same income can receive very different amounts: one may have higher documented rent, utilities, medical bills, or child‑care costs. If you have not updated your information in a while, or you rushed through your last recertification, there is a real chance that you are missing deductions and, as a result, missing money.

How Income Changes Can Increase Your Monthly Deposit

It is easy to think that contacting the SNAP office about income will only hurt you. In reality, there are many times when reporting income changes can help. If your hours were cut, you lost a job, your tips dropped, or you stopped receiving overtime, your actual earnings may be lower than what your case shows. When that happens, your countable income should go down and your benefits should generally go up.

The same principle applies when your expenses rise faster than your income. For example, if your rent increases or your utility bills jump, but your pay stays the same or even falls, your budget is clearly tighter. When you report those higher costs, the program can recognize that your net income is lower than before. That means your SNAP calculation may move you closer to the maximum benefit for your family size.

The Bottom Line For Beneficiaries Right Now

Food prices remain high and many households are struggling to stretch their benefits through the entire month. That makes it even more important to keep your case aligned with your real situation. Think of your SNAP case like a financial snapshot: the more accurate the picture, the fairer your benefits are likely to be. If the state is using an old snapshot, you may be judged on income you no longer earn or on expenses that no longer reflect reality.

Take a moment to ask yourself a few questions: Has your rent gone up? Are you paying more for child care? Did anyone lose hours at work? Has a senior or disabled family member moved in with you? If the answer to any of these is yes, you may have a strong reason to request a case review or report a change that could increase your monthly deposit.

Practical Steps To Increase Your Monthly SNAP Deposit

Here are clear, simple ways to put SNAP Benefits: Simple Ways To Increase Your Monthly Deposit Amount into practice in your own life:

- Report all housing costs. Make sure your case includes your full rent or mortgage, any lot fees, property taxes (if you pay them), and separate charges for heating, cooling, electric, water, or basic phone. These costs affect your shelter deduction.

- Keep proof of your utility situation. If you pay for heat or air conditioning, that can qualify you for a higher standard utility allowance in many places, which can increase your shelter deduction and lower your net income in the formula.

- Document medical expenses for seniors and disabled members. If someone in your home is over 60 or has a disability, keep receipts and statements for things like prescriptions, co‑pays, insurance premiums, dental or vision costs, and travel to medical appointments. Those out‑of‑pocket costs may be deductible.

- Track child‑care and dependent‑care costs. If you pay for child care or care for an adult who cannot care for themselves so you can work, look for work, or attend training, those costs can often be deducted.

- Make sure everyone in your SNAP household is listed. Anyone who lives with you, shares food, and meets the eligibility rules should be counted, because a larger household size means a higher maximum benefit level.

- Respond quickly to any mail from the SNAP office. If you miss a recertification deadline or a request for more information, your benefits can drop or stop. Answering quickly protects your deposit and keeps your case active.

- Ask for an explanation if your amount seems too low. You have the right to know how your benefit was calculated. If something does not look right, you can ask your worker to walk you through the numbers or request a fair hearing.

Using these steps is not gaming the system. It is making sure the system sees the full reality of your situation so you can receive what the rules already say you should receive.

Stretching Your SNAP Beyond The Deposit Amount

Even after you have done everything possible to increase your monthly deposit, it still has to last all month. That is where smart shopping strategies and local incentive programs come in. Many areas now offer “double up” or market match programs that give you extra dollars to spend on fresh fruits and vegetables when you use your EBT card at certain farmers markets or grocery stores.

On top of that, you can stretch your benefits by planning meals around sales, buying store brands instead of national brands, and focusing on budget‑friendly staples like rice, beans, lentils, oats, eggs, seasonal produce, and frozen vegetables. Combining coupons, loyalty‑card discounts, and approved cash‑back apps can help reduce how much of your deposit you spend on each trip, leaving more for the rest of the month.

Staying Organized And Working With Your Caseworker

One of the best long‑term strategies for getting the most out of SNAP is staying organized. Keep a simple folder or envelope at home for rent receipts, utility bills, pay stubs, medical receipts, and child‑care invoices. When the agency asks for verification, you will already have most of what they need. That makes the process easier and reduces the risk of a wrong calculation based on missing documents.

It also helps to treat your caseworker as a partner rather than an enemy. If something in your life changes, let them know and ask how it might affect your SNAP benefits. If you are not sure whether a cost can, be deducted, you can ask directly. You might discover that an expense you always considered “just part of life” is actually something the rules allow you to count, which can increase your monthly deposit amount.

FAQs on SNAP Benefits

1. Can I really increase my monthly SNAP deposit just by updating information?

Yes. When you report lower income or higher eligible expenses like rent, utilities, medical bills, or childcare the SNAP formula can lower your countable income and, in many cases, raise your monthly benefit.

2. How often should I review my SNAP case?

At a minimum, review it at every recertification. But it is smart to look over your situation whenever there is a major change in income, household size, or key expenses.

3. Do the same strategies work in every state?

The basic rules and concepts are federal, so the strategies are similar everywhere. However, dollar amounts like income limits, maximum benefit levels, and some allowances can vary by state or region.

4. Are there legal ways to get more food without changing my official SNAP amount?

Yes. Programs that double your SNAP dollars for produce, farmers‑market incentives, coupons, store rewards, and careful meal planning can all increase how much food you get from the same deposit.