New Rules Set to Determine SNAP Benefit Approval and Continuation in 2026 essentially describes a full reset of how states decide who qualifies and who stays on the program. Instead of relying heavily on self‑reported information, agencies are leaning more on wage records, tax data, and cross‑checks with other benefit systems to confirm what you put on your application. That means there is less room for error and less tolerance for missing pay stubs, unclear rent details, or unreported changes.

At the same time, many current recipients are being pushed through a fresh look at their cases as their recertification dates arrive in 2026. This is where the new rules really take hold benefit amounts may change, work rules may suddenly apply, and some households will find they no longer meet the updated guidelines. The goal of the overhaul, from the official perspective, is to tighten program integrity. For recipients, the practical goal is simpler: stay informed, stay organized, and stay ahead of deadlines.

SNAP Benefits in 2026

| Point | What It Means In 2026 | Who It Affects | Why It Matters |

|---|---|---|---|

| Program Status | SNAP is funded and operating for the full FY 2026 year. | All SNAP households | Benefits are expected to continue without shutdown‑style interruptions. |

| Income & COLA Updates | New income limits, deductions, and maximum allotments effective from Oct. 1, 2025. | New and current beneficiaries | More people may qualify, but benefit growth is now tied closely to inflation. |

| Work Requirements | Expanded work standards and ABAWD rules, with higher age coverage. | Many adults up to around age 65, unless exempt | More adults must prove work, training, or volunteering hours to keep full benefits. |

| Recertification Timing | New rules apply immediately to new cases and at recertification for existing cases. | Existing SNAP households | The impact shows up at different times, depending on your renewal date. |

| Funding Reserves | Large funding allocation plus reserve capacity for the program. | All states and territories | Helps keep benefits flowing even amid national budget tensions. |

FY 2026 SNAP Benefits: At-A-Glance

For 2026, the foundation of the program is relatively stable. A full year of funding has been approved, and there are backup reserves built in so that benefits can continue even if broader budget debates drag on. That stability matters for households that remember the stress of temporary funding fights and last‑minute extensions. It means that, as long as you remain eligible under the new rules, you should be able to count on your monthly allotment arriving on time.

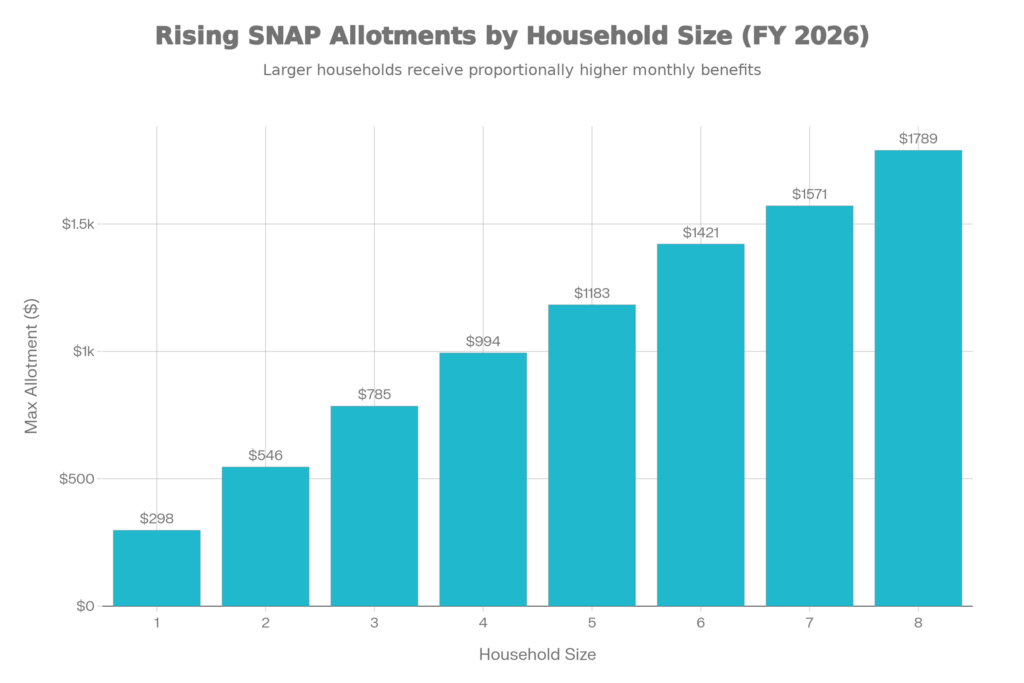

On the benefits side, the FY 2026 cost‑of‑living update has nudged maximum allotments and income thresholds upward. Households with high housing or utility costs may see some modest benefit gains because standard deductions and shelter caps have also moved. At the same time, future increases are now more closely capped to inflation, which means that big emergency boosts like those seen during the pandemic era are no longer the norm. In short, benefits are slightly higher, but much more predictable and controlled.

What SNAP Funding Has Been Secured

- A crucial part of New Rules Set to Determine SNAP Benefit Approval and Continuation in 2026 is the funding security behind it. The program has a clear budget for the fiscal year, which covers core benefits and administrative costs for states and territories. For recipients, that translates into fewer fears about the program suddenly running dry or being paused midyear due to political gridlock.

- However, this stability comes with expectations. States are being encouraged to modernize their systems so they can quickly adjust benefit levels if conditions change later, and to handle the increased administrative workload that comes with stricter eligibility checks and more complex work rules. That can mean more online portals, automated checks, and automated notices tools that speed up processing but also leave less room for informal corrections after the fact.

How The FY 2026 Rules Affect Eligibility And Approvals

- From the start of the FY 2026 cycle, all new applications have been assessed using the updated income limits, expense deductions, and maximum benefit amounts. That means if you applied after October 1, 2025, you are already inside the new framework, even if your approval notice landed toward the end of the year. Asset rules, household composition rules, and immigration status rules remain part of the core eligibility picture, with some categories receiving closer review than before.

- For existing recipients, the changes arrive in stages. Your case will be reviewed under the new rules at your next scheduled recertification date. When that comes up, the agency can adjust your benefits up or down, place new work conditions on your case, or even close your case if you no longer meet the standard. Because recertification cycles differ by state and by household type, neighbors and relatives may see changes at different times. That staggered rollout is confusing, but it is exactly how New Rules Set to Determine SNAP Benefit Approval and Continuation in 2026 is being applied in practice.

Work Requirements, ABAWDs And Time Limits In 2026

- One of the biggest pressure points is work requirements. Recent law and guidance have expanded the group of adults considered subject to “able‑bodied adult without dependents” (ABAWD) standards, and in many places, the upper age limit has moved higher. If you fall in that bracket and do not qualify for an exemption, you are expected to meet a monthly minimum of work, training, or qualified volunteer hours to keep getting benefits beyond a short period.

- If those conditions are not met and not documented your SNAP support can be cut off after a limited number of months within a three‑year window. This is where the rules become unforgiving. Hours from gig jobs, part‑time work, or an approved training course can count, but you must keep records and send them in on time. If you believe you qualify for an exemption because of disability, caregiving responsibilities, homelessness, or other factors, you should gather proof and talk to your caseworker early rather than waiting for a warning notice.

When States Will Apply New Rules To Existing Cases

A common source of confusion is the timing of when households feel the impact of New Rules Set to Determine SNAP Benefit Approval and Continuation in 2026. There is no single day when every household in the country flips to the new standard. Instead, agencies use the FY 2026 rules right away for new applicants, then phase them in for existing beneficiaries at their normal recertification dates.

In some states, there may also be targeted review campaigns focused on groups hit hardest by the updated work requirements or income rules. That can mean earlier letters for people whose profiles show they are likely to be affected. Because of this variety, it is especially important to open every piece of mail or online message you receive from the benefits office. Your personal timeline is defined not by a national announcement, but by your own case schedule.

Practical Steps Beneficiaries Should Take Now

- With so much riding on documentation and deadlines, there are a few simple habits that can help you navigate New Rules Set to Determine SNAP Benefit Approval and Continuation in 2026. First, create a dedicated folder physical or digital for your pay stubs, rent and utility receipts, child‑care costs, and any medical or disability documentation. Having these ready when your renewal packet arrives can shorten processing time and reduce the risk of an avoidable cutoff.

- Second, make sure your contact information is always current with your local office. If you move, change your phone number, or switch email addresses, update the agency right away so that important letters do not go to the wrong place. Third, if you are subject to work requirements, talk directly with your caseworker about which activities qualify, how many hours you need, and how to report them. Many states offer SNAP Employment and Training programs that can help you meet the rules while building skills that may improve your income in the long term.

Trump’s $2,000 Payment Idea: Check Eligibility Criteria and Payment Details

How These Changes Affect Different Groups

- The impact of the 2026 rules is not the same for everyone. Single adults without children who fall into the ABAWD category face the most immediate pressure, since they are directly tied to work standards and time limits. For them, missing work hours or failing to report properly can quickly lead to a loss of benefits. Low‑wage workers with irregular schedules, seasonal jobs, or gig work need to be especially careful about tracking their hours and pay.

- Families with children may be less exposed to the strictest work requirements, but they are still affected by income and deduction changes. A small raise in pay, a change in child‑care costs, or a shift in rent can change their monthly SNAP amount. Older adults and people with disabilities may be eligible for exemptions, but that protection depends on documentation without clear paperwork, they can be misclassified. In every one of these situations, the central lesson of New Rules Set to Determine SNAP Benefit Approval and Continuation in 2026 is the same clear information and timely action are your best allies.

FAQs on SNAP Benefits in 2026

Will everyone on SNAP have to reapply under the 2026 rules?

Almost every ongoing case will be re‑evaluated under the 2026 standards, but not all at once. New applicants are already under the new rules, while current recipients see the changes when their normal recertification date arrives.

Are SNAP benefits going up or down in 2026?

On paper, benefits are going up slightly because of cost‑of‑living adjustments, and income limits are a bit higher too.

How do the new work rules affect older adults?

Work requirements now apply to a wider age range, which can include some adults in their early 60s who previously would have been exempt.

What should I do if my SNAP benefits suddenly stop in 2026?

Check the most recent notice from your caseworker to see whether the issue is missing paperwork, income changes, or work requirements.