Federal officials are reviewing enforcement efforts within the Supplemental Nutrition Assistance Program as SNAP Fraud Enforcement Under Review fraud becomes a focal point of political debate, despite limited consensus on its scale.

The review comes amid renewed scrutiny from the U.S. Department of Agriculture (USDA), while researchers and anti-hunger advocates warn that overstating abuse risks undermining access to food assistance for millions of eligible households.

Why SNAP Fraud Is Back in the Spotlight

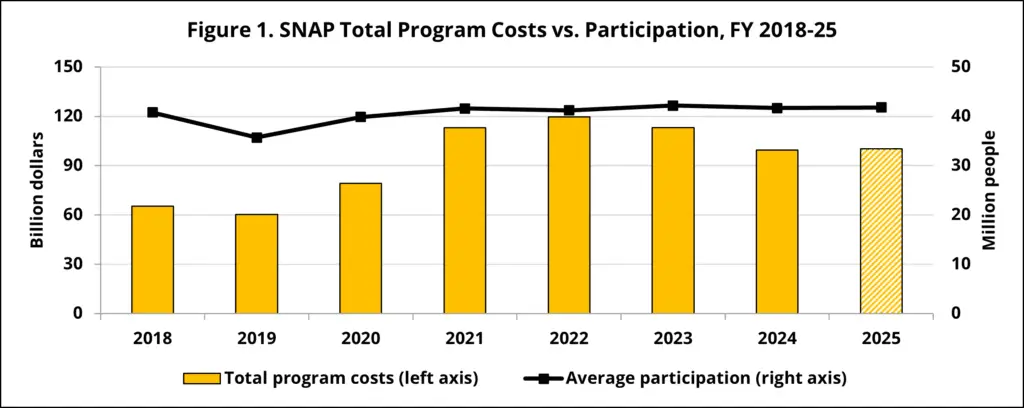

The Supplemental Nutrition Assistance Program provides food assistance to more than 40 million Americans and distributes over $110 billion annually. While SNAP has historically maintained one of the lowest fraud rates among federal benefit programs, it has long been subject to political scrutiny.

The current review reflects a broader push by federal officials to emphasize program integrity, particularly as SNAP costs rose during the pandemic and remained elevated amid persistent food inflation. USDA leadership has framed enforcement as essential to preserving public confidence and ensuring benefits reach intended recipients.

Critics, however, argue that fraud narratives often intensify during periods of political polarization, regardless of whether underlying data shows a meaningful change in abuse rates.

Distinguishing Fraud, Theft, and Error

A core challenge in the debate is definitional clarity. SNAP misuse is often described broadly as “fraud,” but federal oversight agencies distinguish among several categories.

Fraud involves intentional deception, such as misrepresenting income or trafficking benefits for cash.

Benefit theft occurs when criminals steal benefits directly from recipients’ accounts, typically through card skimming or electronic hacking. Administrative error includes unintentional mistakes by state agencies or recipients, such as misreported income or documentation gaps.

Policy analysts caution that public discussions frequently conflate these categories, inflating perceptions of criminal misuse and obscuring where enforcement resources are most effective.

What Federal Data Shows—and Its Limits

The most comprehensive USDA analysis of SNAP fraud covered 2015–2017 and estimated that roughly 1.6 percent of benefits were stolen from recipient accounts, largely through electronic theft. That figure does not represent total fraud and does not include administrative errors.

Since then, USDA has acknowledged limitations in nationwide fraud measurement. While some officials have suggested losses may reach several billion dollars annually, those estimates are not derived from audited national totals.

By comparison, the Government Accountability Office (GAO) has repeatedly found that SNAP improper payment rates—mostly errors rather than fraud—remain relatively low compared with other federal programs. GAO reports have also emphasized that data gaps make it difficult to isolate intentional fraud with precision.

How SNAP Fraud Compares to Overall Program Spending

Even at the higher end of unofficial estimates, fraud represents a small share of total SNAP spending. With annual outlays exceeding $110 billion, a hypothetical $5–10 billion in losses would still constitute a fraction of total program costs.

Anti-hunger advocates argue that focusing disproportionately on fraud risks diverting attention from larger policy questions, such as benefit adequacy, rising food prices, and access disparities in rural and urban communities.

Supporters of tougher enforcement counter that even modest losses undermine trust and justify preventative measures.

Federal and State Enforcement Capacity

SNAP is federally funded but administered by states, leading to significant variation in enforcement capacity. Some states maintain dedicated fraud investigation units with advanced data analytics, while others rely on smaller teams with limited resources.

USDA’s Food and Nutrition Service coordinates enforcement through retailer audits, transaction monitoring, and referrals to law enforcement. Retailer fraud cases—though less common—often involve larger dollar amounts and can result in permanent disqualification from SNAP.

States have also requested greater federal support for investigations, citing staffing shortages and increasingly sophisticated criminal tactics.

EBT Technology and Vulnerabilities

One area of broad agreement is the need for stronger Electronic Benefit Transfer (EBT) security. Many states still rely on magnetic-stripe cards, which are more susceptible to skimming than chip-enabled or contactless systems.

USDA has encouraged states to modernize EBT technology, but upgrades are costly and complex. In the meantime, benefit theft continues to affect recipients, many of whom lose access to food assistance for weeks before stolen benefits are replaced.

Advocates stress that enforcement strategies must prioritize protecting recipients from theft, not just policing misuse.

Retailers at the Center of Enforcement

Retailers play a critical role in fraud prevention and detection. They must comply with strict transaction rules, maintain detailed records, and train employees to identify suspicious activity.

Small retailers, particularly convenience stores in low-income neighborhoods, often face higher compliance burdens relative to their size. Industry groups have urged USDA to balance enforcement with clearer guidance to avoid accidental violations.

Retailer associations generally support fraud prevention but warn against policies that increase operational complexity without addressing underlying vulnerabilities.

International Comparisons

Compared with similar programs abroad, SNAP operates with relatively few food restrictions and a strong emphasis on access. Some European countries rely on unrestricted cash benefits, while others subsidize specific healthy foods rather than restricting purchases.

International policy experts note that the U.S. approach—combining electronic benefits with targeted enforcement—is relatively efficient, though not immune to abuse.

These comparisons suggest that fraud prevention alone cannot address nutrition or poverty outcomes without complementary policy tools.

Related Links

Tax Changes for 2026: Why Refunds May Be Larger and Filing Will Look Different

SNAP Updates: New Restrictions and Benefit Rules Taking Effect This Month

Legal Safeguards and Due Process

Enforcement actions carry significant consequences, including benefit termination, repayment demands, and potential criminal charges. Federal law requires states to provide notice, hearings, and appeal rights to recipients accused of fraud.

Legal advocates emphasize that due process protections are essential to prevent wrongful penalties, particularly given the complexity of eligibility rules.

Courts have periodically reviewed SNAP enforcement actions, reinforcing the need for clear standards and evidence-based investigations.

What Comes Next

USDA officials say the current review will inform future guidance on enforcement priorities, data transparency, and technology investments. Congress is also weighing proposals related to EBT security, audits, and funding for fraud prevention.

For now, SNAP fraud remains a contested issue shaped as much by political narratives as by empirical data. How policymakers balance enforcement, access, and modernization will influence the program’s credibility and effectiveness in the years ahead.