Kansas is facing the threat of a $41 million penalty under a new federal cost-sharing system after it reported higher-than-acceptable errors in its SNAP (Supplemental Nutrition Assistance Program) payments.

In response, the state has begun taking significant steps to improve payment accuracy by overhauling training, technology, and operational systems. These efforts aim to ensure that SNAP benefits are administered correctly, thus avoiding penalties while maintaining support for vulnerable residents.

SNAP Payment Accuracy Update

| Key Fact | Detail |

|---|---|

| Projected penalty | $41 million per year starting FY 2028 |

| Federal error threshold | 6% payment error rate |

| Kansas’ recent error rate | About 9% |

| Primary cause | Administrative and eligibility calculation errors |

Understanding SNAP Payment Accuracy and Federal Oversight

SNAP payment accuracy refers to the percentage of cases in which the state either incorrectly determines eligibility or provides an incorrect benefit amount to the recipient. The USDA’s Food and Nutrition Service (FNS) monitors these accuracy rates through an annual Quality Control audit process.

The standard error rate threshold is set at 6%, meaning that states must maintain a 6% or lower error rate to avoid penalties. If error rates exceed this threshold, states like Kansas face financial repercussions.

Kansas has struggled with payment accuracy, often surpassing the 6% limit. In fiscal year 2025, Kansas reported a 9% error rate. While this is lower than previous years, it still places the state at risk of facing penalties if the trend continues.

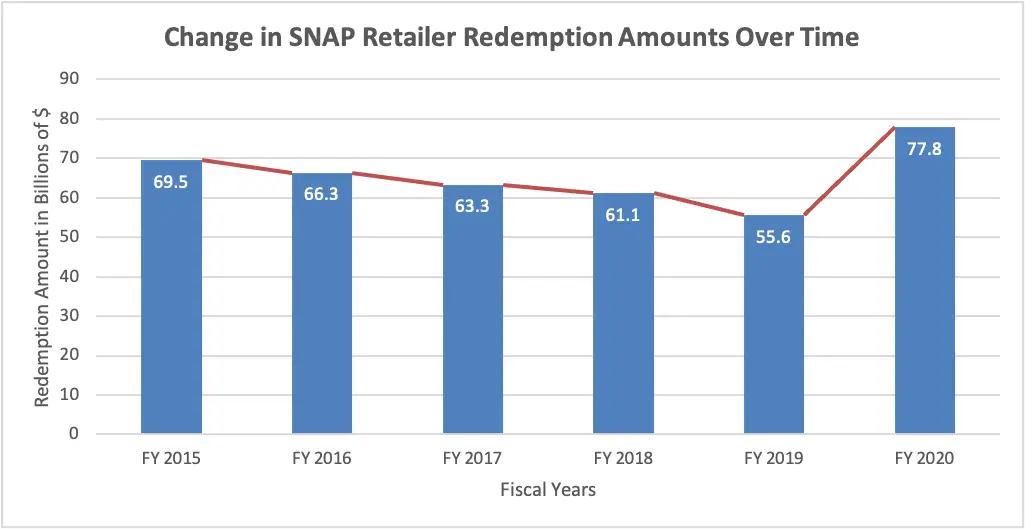

The USDA has long had quality control checks in place to ensure SNAP payments are delivered to eligible households in the correct amounts. However, as the program grows, so too does the complexity of managing its payment and eligibility systems.

Errors can occur due to misreported income, inconsistent documentation, or system flaws, and these errors can have direct financial consequences for both recipients and the state.

Kansas’ Current SNAP Error Rate and the Risk of a $41 Million Penalty

Kansas’ SNAP payment error rate has been a focal point for state and federal auditors. In 2025, Kansas was found to have an error rate above the 6% threshold, at 9%, leading to significant concern among lawmakers and advocates. According to federal guidelines, Kansas must reduce its error rate to below 6% by 2026 to avoid penalties.

Should Kansas fail to meet this target, it could be responsible for 10% of the federal SNAP benefit costs. The resulting annual penalty is projected to be about $41 million starting in 2028. This would place a heavy burden on state resources, as it would require Kansas to cover a portion of the benefits it currently receives from the federal government.

According to state reports, $41 million is a significant amount of funding that could strain other state programs, especially those targeting vulnerable populations.Causes of SNAP Payment Errors in Kansas

1. Administrative Complexity

SNAP eligibility and payment determination is a complex process that involves evaluating a range of factors, such as household income, living expenses, medical costs, and more. Any error in documenting these factors — such as missed income verification or incorrectly reported housing expenses — can lead to mistakes in payment amounts.

Moreover, changes in a family’s situation, such as employment status or the addition of a new household member, need to be promptly updated. Failure to account for these changes within required timeframes leads to either overpayments or underpayments.

2. Staffing and Training Gaps

Kansas has faced challenges with a high turnover rate among caseworkers responsible for determining eligibility. As of 2025, some workers reported taking up to a year to fully understand all the nuances of SNAP rules. Inadequate training and inconsistent staffing levels have exacerbated the issue, making the error rate even more difficult to control.

Kansas’ Strategy to Improve SNAP Payment Accuracy

The state has recognized the importance of addressing these issues, not only to avoid financial penalties but to ensure that benefits reach those who need them most. The Kansas Department for Children and Families (DCF) has outlined several reforms to tackle SNAP payment accuracy.

Centralized Case Review System

Kansas is shifting towards a centralized system for reviewing SNAP eligibility and payments. By consolidating the review process, the state aims to reduce inconsistency and improve standardization across the state.

Centralized teams of experts will conduct case reviews, ensuring that eligibility decisions are made uniformly and according to the same standards. This move is designed to streamline procedures and ensure that errors, particularly those in complex cases, are caught and corrected earlier.

Technology Improvements

Technology plays a crucial role in reducing SNAP payment errors. Kansas is investing in new eligibility management software to automate calculations, flag errors in real time, and ensure that benefit amounts are calculated accurately.

By updating legacy systems and integrating modern technologies, Kansas hopes to reduce the manual work involved in reviewing cases and minimize human error.

Enhanced Staff Training

The Kansas DCF has also launched intensive retraining programs for caseworkers, focusing on the most frequent sources of error, such as income verification, proper deductions, and timely reporting of household changes.

The new training emphasizes the importance of following state and federal guidelines, improving the consistency and reliability of eligibility determinations.

Comparing Kansas with Other States

Kansas is not alone in facing challenges with SNAP payment accuracy. Other states have also struggled to meet federal error rate standards. However, Kansas’ 9% error rate is higher than many other states that have managed to keep their error rates closer to the 6% benchmark.

For example, states like California and New York have employed innovative systems to streamline eligibility determinations and reduce mistakes.

Kansas officials are looking to these states for examples of best practices in training, technology, and case management systems. By adopting successful strategies from other states, Kansas hopes to achieve compliance with federal standards without compromising on service delivery.

The Impact of SNAP Payment Errors on Food Security

The errors in SNAP payments have serious consequences for families relying on food assistance. Overpayments could mean that a household receives more than they are eligible for, resulting in future benefit reductions or debt collections.

Underpayments, on the other hand, leave families without enough assistance to meet their food needs, exacerbating food insecurity. Local food banks and charitable organizations have reported seeing a higher demand for emergency food assistance due to SNAP payment issues.

Many families turn to these services when their benefits fall short or when eligibility errors delay payments. Harvesters — a food bank in Kansas City — has been actively engaged in supporting families impacted by SNAP inaccuracies.

Broader Implications for Kansas and Other States

Kansas’ SNAP payment accuracy challenges are a reminder of the broader struggles states face in balancing administrative efficiency with the complexity of serving vulnerable populations. While Kansas has made progress, it’s clear that broader systemic changes are needed to address errors and ensure that the program functions smoothly.

The penalties imposed by the federal government represent a significant financial burden for any state. The $41 million penalty is only one part of a larger issue facing SNAP programs nationwide, as many states are being held to higher standards of accountability.

These penalties can impact food security in unintended ways, potentially forcing states to make difficult choices between maintaining program benefits or allocating resources to avoid penalties.

As Kansas works toward reducing its error rate, its success or failure will likely influence future reforms to SNAP and could serve as a model for other states facing similar challenges.

Related Links

SNAP Benefits 2026 Changes – New Orders That Could Affect Future Payments

Pet Owner Settlement Deadline – Last Weeks to Claim Up to $100,000 in Payouts

Kansas’ efforts to improve SNAP payment accuracy are essential not only to avoid a significant penalty but to maintain the integrity of a program that serves as a lifeline for many families. With $41 million on the line, the state is focused on implementing reforms that reduce errors and streamline operations. As these changes take shape, they may have ripple effects on SNAP administration across the country.

In the coming years, Kansas will continue to monitor its progress, with the goal of achieving compliance before the 2028 deadline. The state’s response will be closely watched by policymakers and other states that face similar challenges in maintaining SNAP’s accuracy and fairness.