As 2026 kicks off, millions of Americans receiving Social Security benefits are looking forward to a 2.8% increase in their monthly checks. This Cost-of-Living Adjustment (COLA) means that if you’re currently receiving $1,850 per month, your monthly check could rise by approximately $52 to a total of $1,902.

However, various factors, such as rising Medicare premiums and potential tax deductions, could affect how much of this increase you actually take home. Understanding how much your monthly payment could increase in 2026 and what factors might affect that increase is crucial for budgeting and financial planning in the year ahead.

Social Security $1,850 Check: How Much Can Your Monthly Payment Increase?

In 2026, Social Security benefits will see a 2.8% COLA increase. For someone receiving around $1,850 a month in benefits, this means they’ll see an increase of about $52 per month. The new monthly payment will be approximately $1,902, depending on the exact amount you currently receive.

While this might seem like a decent increase, it’s important to consider that Medicare premiums and taxes will affect the net gain. In 2026, the Medicare Part B premium is expected to rise to $202.90 per month from the previous year’s $185, which will reduce the impact of the COLA increase for many recipients.

For example:

- Current Social Security benefit: $1,850

- 2.8% COLA increase: $52

- New benefit before deductions: $1,902

However, after the Medicare Part B premium increase:

- Medicare Part B increase: $17.90

- Net increase in monthly check: Around $34.10 after the premium deduction.

This scenario highlights that while COLA increases offer helpful adjustments, higher premiums and other deductions can reduce the real gain beneficiaries see.

How COLA Affects Different Social Security Recipients

The COLA adjustment applies to all types of Social Security benefits, including retirement, disability, and survivor benefits. However, the impact of the COLA increase may vary depending on the type of benefit you receive.

1. Retirement Benefits

For retirees, the COLA adjustment is intended to help offset the impact of inflation. If you’re receiving $1,850 per month in retirement benefits, you’ll see an increase of about $52 per month. This is particularly beneficial for seniors living on a fixed income, helping them keep pace with increasing living costs.

2. Disability Benefits (SSDI)

Those receiving Disability Insurance benefits under SSDI will also benefit from the 2.8% COLA increase. For a $1,850 monthly SSDI benefit, the increase will be $52, boosting the total monthly payment to $1,902. However, similar to retirees, SSDI recipients will also face the Medicare Part B premium increase.

3. Survivor Benefits

Survivors of deceased workers, including widows, widowers, and children, will also receive the 2.8% COLA. The exact amount of the increase will depend on the base benefit of the deceased worker’s record. For example, a widow receiving $1,850 per month could see an additional $52 per month after the COLA adjustment.

4. Supplemental Security Income (SSI)

The SSI program, which assists low-income individuals, will see its maximum monthly benefit rise to $994 for individuals and $1,491 for couples. The COLA adjustment ensures that SSI recipients can keep up with the rising costs of living.

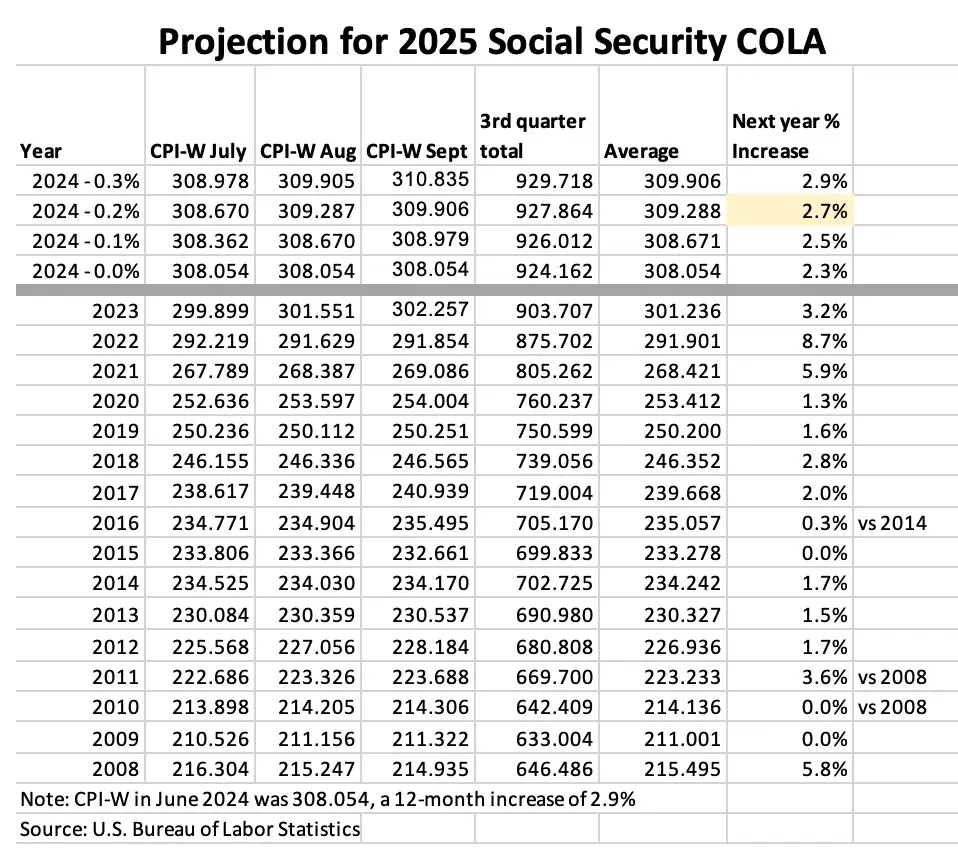

How the COLA Increase Compares to Previous Years

The 2.8% COLA increase for 2026 represents a moderate increase compared to recent years. To put this in perspective:

- 2025 COLA was 1.6%

- 2024 COLA was 1.3%

- 2023 COLA was 5.9% (a historically high increase due to rising inflation during the pandemic).

While 2.8% is a reasonable increase, it may not completely cover inflation in some areas, particularly healthcare and housing costs. Many beneficiaries still struggle with the cost of Medicare premiums and rising prescription drug costs, which can outpace the COLA increase.

Budget with Social Security in 2026

As the $1,850 check increases in 2026, it’s important for Social Security beneficiaries to budget carefully, especially given the rising costs of living and potential higher premiums. Here are a few budgeting tips:

- Track Your Income and Expenses: Knowing how much you bring in after deductions (such as Medicare premiums) will help you plan better.

- Prioritize Necessary Expenses: If your fixed income is limited, prioritize essential expenses like food, healthcare, and housing.

- Set Aside COLA Increases: Consider putting your COLA increase into savings to cover future expenses or emergencies.

- Review Benefits and Medicare: Make sure your Medicare plan still fits your needs and that you’re aware of any changes to your Social Security benefits.

Important Deadlines and Dates for 2026 Social Security $1,850 Check

Knowing important Social Security dates and deadlines is crucial in 2026:

- January 2026 payments: Recipients will begin receiving their first COLA-adjusted payments starting in January. Payments will be made on the 2nd, 14th, 21st, and 28th.

- Medicare Part B open enrollment: Be aware of Medicare enrollment deadlines to avoid higher premiums.

- Tax filing deadlines: Social Security recipients may need to adjust their tax filings based on Social Security benefits received.

Related Links

FDA Food Recall Alert – Why Frozen Shrimp Was Removed From Stores and What Shoppers Should Check

Social Security Benefits Abroad – How Retirees Can Receive Payments Outside the United States

The Impact of COLA on Family Members and Dependents

In addition to individual beneficiaries, COLA increases can have an impact on spouses, children, or other dependents who rely on family members’ benefits. If you are a spouse of someone receiving Social Security, your monthly benefit could also be affected by the 2.8% COLA increase.

For children or dependent survivors, the amount they receive from a parent’s Social Security benefit will also increase, ensuring that families can keep up with inflation in the coming year.

How COLA Will Affect Your Social Security Benefits in 2026

The 2.8% COLA increase for 2026 will provide much-needed relief for Social Security beneficiaries, including those receiving $1,850 per month. However, Medicare premiums and other deductions should be carefully considered, as they can offset some of the benefits.

By planning carefully, setting up direct deposit, and managing budget expectations, recipients can ensure that the COLA increase makes a meaningful difference in their finances.

As always, staying informed about Social Security changes, COLA updates, and important deadlines is crucial to maximizing the benefit of your Social Security checks in 2026.