The Social Security 2025 Summary — Key Policy and Benefit Changes Announced by SSA details the most extensive set of updates to the program in more than a decade. The Social Security Administration (SSA) confirmed new benefit amounts, updated earnings limits, identity-verification reforms, and legislative shifts that will affect nearly every beneficiary.

These changes arrive as inflation, demographic pressures, and long-term funding concerns continue to shape federal policymaking.

Social Security 2025 Summary

| Key Update | Detail |

|---|---|

| COLA 2025 | Benefits rise by 2.5% |

| WEP/GPO elimination | Restores full benefits for public-sector retirees |

| Identity verification | Mandatory in-person verification for certain actions from March 2025 |

| Maximum taxable wages | Rising to $176,200 in 2025 |

| Disability reforms | Age-based qualification criteria under review |

What the Social Security 2025 Summary Means for Beneficiaries

The Social Security 2025 Summary — Key Policy and Benefit Changes Announced by SSA offers critical updates on monthly benefit amounts, enforcement rules, and long-term program expectations. The SSA released the summary to inform the public and prepare beneficiaries for administrative and financial changes taking effect across 2025 and early 2026.

The summary also reflects the SSA’s shift toward data-driven oversight, with several reforms aimed at strengthening system integrity and limiting fraud, particularly in online environments.

COLA 2025: What Retirees Should Expect (KW2: Social Security COLA 2025)

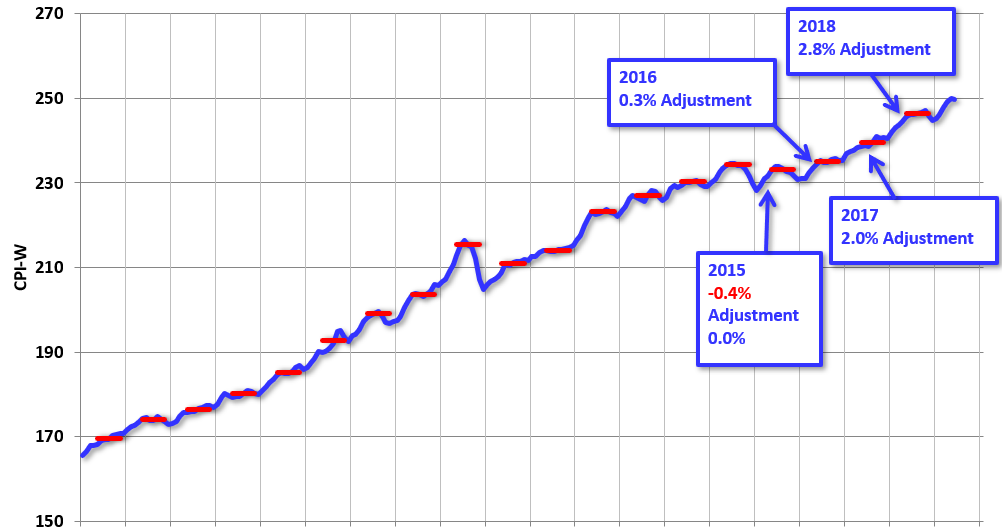

The Social Security COLA 2025 will raise benefits by 2.5%, ensuring recipients maintain purchasing power following several years of unusually high inflation.

Projected Payment Amounts

- Average retired worker: Increase of $48–$55 per month

- Average disabled worker: Increase of $35–$45 per month

- Average widow(er): Increase of $38–$50 per month

The Bureau of Labor Statistics’ CPI-W measurement remains the legal basis for calculating COLA. According to SSA officials, the CPI-W remains “the most consistent and impartial methodology” despite advocacy calls for an alternative index focused on older households.

Expert Perspective

Economist Dr. Linda Hoffman of the Urban Institute notes:

“A 2.5% COLA is modest compared to recent years but still critical. Retirees face rising healthcare costs that increase faster than general inflation, and COLA remains a vital tool to protect fixed-income households.”

Major SSA Policy Changes That Will Affect Millions (KW3: SSA policy changes)

Elimination of WEP and GPO: A Generational Shift

The Windfall Elimination Provision (WEP) and Government Pension Offset (GPO) have long been controversial. After Congress passed the Social Security Fairness Act, both provisions were formally removed.

Impact on Retired Public Workers

- 1.1 million workers receiving federal, state, or local pensions will see higher benefits

- Many will receive retroactive payments dating back up to one year

- Teachers, police officers, and firefighters benefit the most

The National Education Association praised the repeal, calling it “a restoration of decades of lost benefits for middle-class public servants.”

New Identity-Verification Requirements Take Effect in 2025

Amid rising cybersecurity threats, the SSA will require individuals who cannot pass online verification to verify their identity in person at a local office. This applies to:

- New benefit applicants

- Individuals changing bank accounts

- Beneficiaries moving to new addresses

- Anyone updating personal identifying information

While advocacy groups have raised concerns about accessibility for rural residents, the SSA states it is developing mobile field units and expanding appointment availability.

Administrative Modernization Efforts

The 2025 Summary outlines technology upgrades including:

- Expansion of My Social Security online services

- Faster processing timelines for SSDI medical reviews

- Pilot testing of digital benefit notices

- Improved multilingual resources

An SSA spokesperson stated:

“We must adapt to serve a more digital-first population while protecting vulnerable groups who need in-person support.”

Updates to Retirement Benefits for Current and Future Claimants (KW4: retirement benefit updates)

Earnings Limits Increasing in 2025 and 2026

Working beneficiaries under full retirement age (FRA) will see higher earnings limits, enabling them to work more without risking a reduction in benefits.

2025 Limits

- Under FRA: Higher limit before $1 in benefits withheld for every $2 earned

- FRA year: Higher threshold before $1 withheld for every $3 earned

Federal analysts report that nearly 3 million retirees engage in part-time work, enhancing the importance of this update.

Maximum Taxable Earnings Threshold Rising

The maximum amount of earnings subject to Social Security taxes will increase:

- 2025: $176,200

- 2026: Approximately $184,500

This adjusts with national wage growth and ensures that higher-income earners contribute more to the trust fund.

Disability Program Evaluation Underway

The SSA is examining age-related disability standards used in SSDI determinations. These rules currently allow “grid pathways” for older workers with limited education to qualify more easily.

Possible changes include:

- Adjusted age thresholds

- Revised vocational guidelines

- Updated definitions of physical exertion categories

No final changes have been enacted, but updates are expected later in 2025.

Long-Term Financial Outlook of Social Security

The SSA’s 2025 summary continues to warn of projected trust fund shortfalls. Without congressional action, the combined OASDI trust funds could become insolvent in the mid-2030s.

What Would Insolvency Mean?

- Benefits would not disappear, but automatic cuts of up to 20–25% may occur

- The size of the workforce and future wage growth will heavily influence projections

- Immigration levels also impact long-term solvency

The Congressional Research Service highlights that increasing payroll tax revenue and adjusting benefit formulas are the two most effective approaches to stabilizing the trust fund.

Historical Context: How 2025 Changes Compare to Past Reforms

To help recipients understand the significance of these updates, analysts compare them to earlier reforms:

| Year | Key Reform | Impact |

|---|---|---|

| 1983 | Social Security Amendments | Increased retirement age; introduced taxation of benefits |

| 1994 | Disability reforms | Updated eligibility screening and review processes |

| 2015 | Bipartisan Budget Act | Closed claiming loopholes affecting spousal benefits |

| 2025 | WEP/GPO elimination + identity requirements | Largest increase in program fairness since 1983 |

Policy researchers argue that the 2025 updates reflect a broader national shift toward strengthening middle-class retirement stability.

State-Level Impacts: Why Some States Are Affected More Than Others

Although Social Security is a federal program, state-level effects vary:

States with Large Public-Sector Workforces

Texas, California, Ohio, Illinois, and Massachusetts benefit heavily from the WEP/GPO repeal.

States with Older Populations

Florida, South Carolina, West Virginia, and Maine will feel COLA effects more acutely due to higher retiree concentrations.

Rural States

Montana, Wyoming, and Mississippi may see greater challenges with in-person identity verification due to distance from SSA offices. These differences underscore the importance of regional planning and outreach.

How the Changes Affect Key Beneficiary Groups

Retirees

- Higher monthly payments from COLA

- Greater clarity in benefit estimates

- Potential for increased future benefits based on earnings trends

Disabled Workers

- COLA adjustments improve monthly budgets

- Online system modernization may ease document submission

- Eligibility reforms may alter future approvals

Related Links

November 2025 Social Security Payments — SSA Confirms Early Deposit Dates: Check Details

SSI November Update — Will Payments Be Delayed During the Shutdown?

Public-Sector Employees

- Major benefit increases due to WEP/GPO removal

- Retroactive payments offer significant financial relief

Younger Workers

- Higher payroll tax thresholds

- More robust digital service options

- Early access to clearer earnings documentation

The Social Security 2025 Summary — Key Policy and Benefit Changes Announced by SSA underscores an agency in transition, balancing modernization with fairness and long-term sustainability. The coming year will test how effectively these reforms improve service delivery and financial security for millions of Americans.

FAQ About Social Security 2025

Q1: When will the new COLA increase take effect?

January 2025.

Q2: Who benefits most from the WEP/GPO repeal?

Public-sector retirees with pensions earned from non–Social Security-covered employment.

Q3: Do all beneficiaries need in-person identity verification?

Only if online verification fails.

Q4: How high will benefits rise in 2025?

On average, between $35 and $55 per month.

Q5: Is Social Security running out of money?

Not immediately; however, trust funds face depletion in the mid-2030s without policy intervention.