Social Security checks don’t look the same everywhere, and that surprises a lot of people. The reason is simple: the “average” benefit in each state reflects the work histories and earnings levels of the people who spent decades paying into the system there. When you look up Social Security average payments by state, you’re really looking for context. Is my check roughly in line with others around me, or am I way above or below the norm? At the same time, it’s important to keep expectations realistic. Your payment is still built around your own lifetime earnings record and the age you claimed benefits. State averages are a benchmark, not a promise. Still, Social Security average payments by state can be incredibly useful for planning retirement cash flow, comparing relocation options, and spotting how wide the gap is between high-benefit and low-benefit regions.

When people talk about Social Security average payments by state, they usually mean the average monthly retirement benefit paid to retired workers in each state (not SSI and not disability-only figures). These averages can differ by a few hundred dollars a month from state to state, which adds up fast over a year. The newest commonly referenced state-by-state numbers are based on SSA statistical tables for retired workers and reflect average monthly benefits by location. If your check is lower than your state’s average, it does not automatically mean you did anything wrong. It typically means one of these are true.

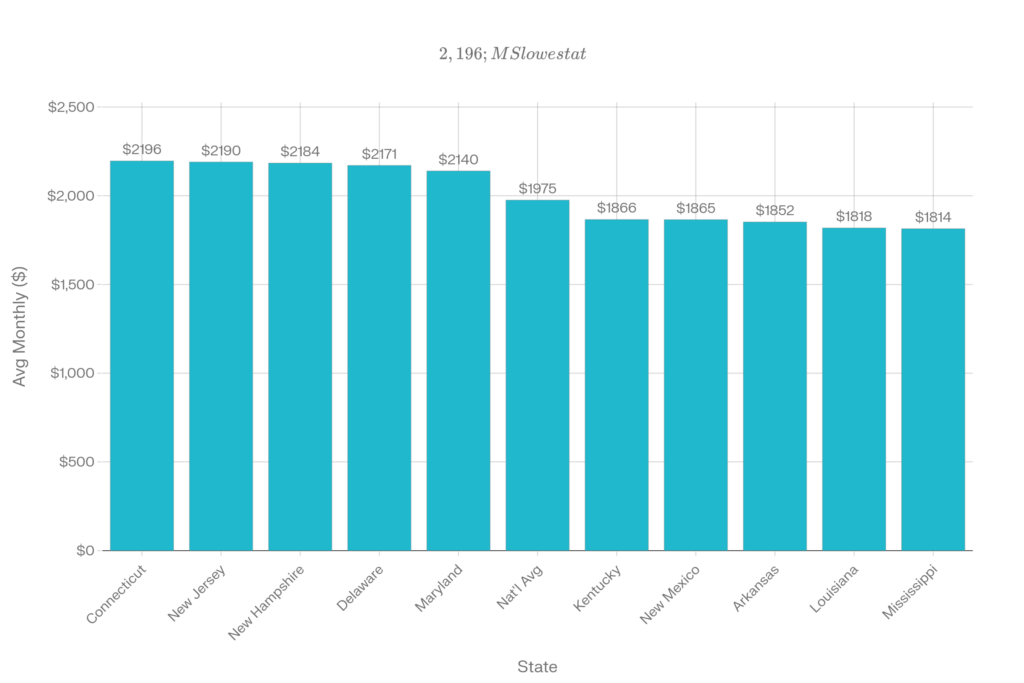

Social Security Average Payments by State

| Category | Benchmark (Monthly) | Notes |

|---|---|---|

| National average (retired workers) | $1,975.34 | A practical baseline for quick comparison. |

| Highest average state | Connecticut: $2,196.15 | Highest statewide average among retired workers. |

| Other high-average states | New Jersey: $2,190.05 | Consistently near the top. |

| New Hampshire: $2,183.82 | Another top-tier average. | |

| Delaware: $2,170.63 | Strongly above national average. | |

| Maryland: $2,139.54 | Rounds out the top group. | |

| Lowest average state | Mississippi: $1,814.24 | Lowest statewide average among retired workers. |

| Other low-average states | Louisiana: $1,818.40 | Very close to the bottom. |

| Arkansas: $1,852.07 | Below national average. | |

| New Mexico: $1,865.12 | Below national average. | |

| Kentucky: $1,865.76 | Below national average. | |

| Largest retired-worker populations | California: 5,120,435 | High count due to population size. |

| Florida: 4,063,202 | Major retiree destination. | |

| Texas: 3,546,829 | Large and growing retiree base. | |

| New York: 2,908,411 | Big beneficiary population. | |

| Pennsylvania: 2,255,780 | One of the largest retiree populations. |

Connecticut Wins For Biggest Check, But Not By Much

Connecticut sits at the top for average retired-worker benefit, and it’s a useful reminder that highest doesn’t mean wildly higher. The top states tend to cluster within a fairly tight range, and several states follow closely behind.

What’s driving the top end? In general, higher average wages over a working lifetime lead to higher Social Security benefits. In many high-average states, residents may have had higher earnings across more years, which shows up in the final benefit calculation.

A smart way to use this information is not to obsess over the top number, but to ask:

- If my benefit is below my state average, is it because I claimed early?

- If my benefit is above my state average, am I budgeting as if that will last easily through inflation and healthcare costs?

Remember: even in a top state, a higher average check doesn’t automatically mean retirement is easier. Cost of living, housing, and taxes can still squeeze budgets.

Largest Number of Social Security Checks Come as No Surprise

When you look at where the most retirement checks are going out, the list is dominated by the largest states. This is mostly a population story. These high-count states matter for a different reason: they often shape national conversations about retirement. They also tend to have huge variation inside the state. For example, a statewide average might not reflect the reality in a high-cost metro area versus a rural county.

If you’re reading this for planning purposes, here’s the practical takeaway:

- Use the statewide average as a “starting point.”

- Then compare your own budget to local reality (housing, utilities, transportation, healthcare, and taxes).

- Finally, decide whether your benefit is “enough” based on expenses, not just comparisons.

Northeast and Mid-Atlantic Are Home to the Highest Average Benefits

A clear regional pattern shows up: the Northeast and Mid-Atlantic tend to have higher average retirement benefits. This is usually connected to lifetime earnings patterns areas with higher average wages tend to produce higher average Social Security benefits. Social Security average payments by state are averages. Within any high-average state, many retirees receive less than the average and some receive much more. Median figures can sometimes give a better typical retiree signal than the average because medians are less influenced by very high earners.

If you’re trying to interpret the difference between your check and the statewide benchmark, ask:

- Did I spend many years earning at or near the taxable maximum?

- Did I have long stretches of part-time work or time out of the workforce?

- Did I claim at 62, at full retirement age, or later?

Each of these can move your benefit meaningfully.

SNAP Food Restrictions by State – Where Soda and Snack Purchases Are Being Limited

Smallest Benefit Checks on Average

On the lower end, several Southern states show the smallest average benefits. The difference between the highest and lowest state averages is not minor it can be hundreds per month, which can mean thousands per year.

Social Security average payments by state is such a popular comparison topic. A gap of $300–$400 per month can change:

- Whether you can cover rent without dipping into savings

- How much room you have for healthcare premiums and out-of-pocket costs

- Whether you can realistically maintain a car, travel, or help family financially

If you live in a lower-average state and your check is also below your state average, don’t panic. Instead, focus on controllables:

- Tighten your retirement spending plan.

- Review whether you can reduce big fixed costs (housing and debt).

- Consider whether part-time work is feasible and worthwhile.

- Make sure you’re claiming all benefits you qualify for (including spousal or survivor benefits when applicable).

FAQs on Social Security Average Payments by State

How Often Do Social Security Average Payments by State Change

Typically, the averages shift year to year as cost-of-living adjustments occur, new retirees enter the system, and claiming patterns change.

Are Social Security Average Payments By State Based On Retirees Only

The figures discussed here refer to retired-worker benefits. Social Security also pays disability benefits and survivors benefits, and those programs have different average payment levels.

If I Move to a Higher Paying State Will My Social Security Check Increase

No. Your Social Security benefit is based on your earnings record and claiming age, not on the state where you live after retirement.

How Can I Tell If My Benefit Is Correct

The fastest way is to compare your payment and earnings record details inside your Social Security account and confirm that your earnings history looks accurate.