In January 2026, millions of Social Security beneficiaries will receive a 2.8% cost-of-living adjustment (COLA) to their monthly checks, which will provide some relief against inflation. However, for many retirees, this automatic increase is not enough to cover the full rise in living costs.

Fortunately, there are strategic moves individuals can make to increase their monthly benefits well beyond the standard COLA adjustment.

Whether you are already retired or planning for the future, there are key actions that can enhance your Social Security benefits — ensuring that you receive the highest possible monthly amount. This article delves into three practical moves to help you maximize your benefits before and during retirement.

Social Security Benefit Boost 2026

| Key Fact | Detail |

|---|---|

| 2026 COLA Adjustment | Beneficiaries will see a 2.8% increase in Social Security benefits in 2026. |

| Claiming Strategy | Delaying benefits until age 70 can increase monthly payments by up to 8% per year. |

| Earnings History | The amount you paid into Social Security during your working years affects your benefit. |

| Survivor Benefits | Spouses and survivors can claim up to 50% of the higher earner’s benefit in certain situations. |

The Social Security COLA and Its Impact

The 2.8% cost-of-living adjustment (COLA) to Social Security benefits in 2026 will result in a modest increase in benefits for nearly 71 million Americans. For the average retiree, this means an increase of approximately $56 per month, bringing the average monthly benefit to about $2,040.

While this increase helps offset inflation and rising costs, it may not be enough for many seniors, especially given rising healthcare costs, taxes, and general cost of living.The Social Security system continues to be a primary source of income for retirees, but strategic planning can significantly improve what you receive.

The COLA boost is important, but there are ways to maximize your monthly check even further. In this article, we explore three practical moves to increase your Social Security benefits beyond the automatic COLA adjustment.

1. Delay Your Social Security Claim to Maximize Your Monthly Benefit

How Delaying Benefits Can Increase Your Check

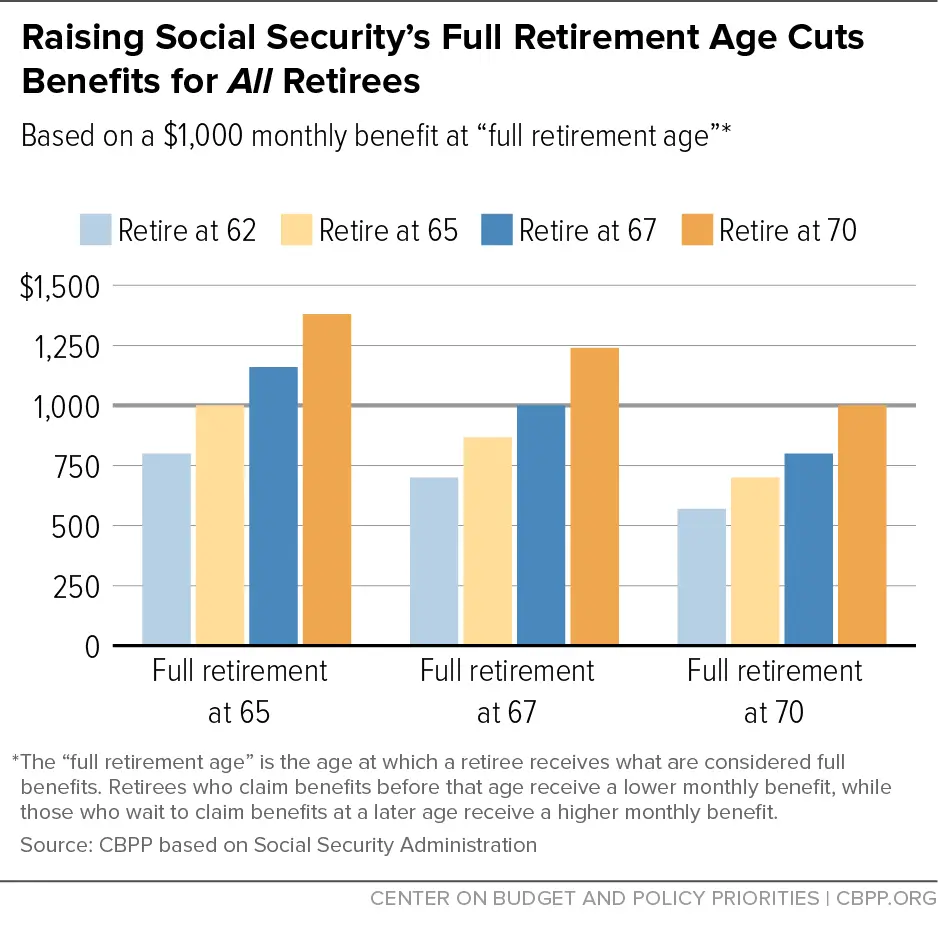

One of the most effective ways to increase your Social Security benefits is by delaying your claim. Many people begin claiming benefits as early as age 62, but waiting until full retirement age (FRA) or even age 70 can significantly raise the amount you receive each month.

- Full Retirement Age (FRA): For individuals born between 1943 and 1954, FRA is 66 years old. If you start claiming benefits at FRA, you will receive your full monthly benefit.

- Delaying Benefits Beyond FRA: For each year you delay claiming benefits past FRA, up to age 70, you earn delayed retirement credits. These credits increase your monthly benefits by about 8% per year.

Example: If your monthly benefit at FRA (age 66) is $2,000, waiting until age 70 could raise that to $2,640, an increase of $640 per month.

Why Delaying Works for You

Delaying your benefits works particularly well for those in good health who expect to live longer into retirement. By waiting to claim Social Security, you not only increase your monthly check, but you also ensure that your benefits will be more financially stable as you grow older.

This is especially valuable for those who may have fewer other sources of retirement income. However, delaying is not the best option for everyone. If you need immediate income, claiming earlier may be necessary, but keep in mind that early claims result in a permanent reduction in monthly benefits.

2. Ensure Your Earnings Record is Correct

The Importance of Accurate Earnings Records

Your Social Security benefit is calculated based on your highest 35 years of earnings, adjusted for inflation. If your earnings record is incomplete or inaccurate, you could end up with a lower monthly benefit.

The Social Security Administration (SSA) uses this history to calculate your average indexed monthly earnings (AIME), which determines your primary insurance amount (PIA) — your base benefit amount. Errors in your earnings record can result in a significant reduction in benefits over your lifetime, which is why it’s essential to ensure that your record is correct.

What You Can Do to Fix It

- Review Your Earnings Record Regularly: You can check your earnings history by creating a my Social Security account on the SSA website. Make it a habit to check your record at least once a year.

- Correct Any Discrepancies: If you notice that any of your earnings years are missing or incorrect, you can contact the SSA to have the record updated. Keep in mind that it can take time for corrections to be processed.

- File a Formal Request for Review: If you find significant errors, you can file a formal request with the SSA to review your earnings history. This process might take several months, so the sooner you act, the better.

Ensuring that your earnings record is accurate can have a long-lasting impact on the amount you receive from Social Security.

3. Optimize Your Earnings Before Retirement

Why Your Pre-Retirement Income Matters

The more you earn over your lifetime, the higher your Social Security benefits will be. Your benefit calculation is based on your highest 35 years of earnings, so earning more money in the years leading up to retirement can help boost your monthly check.

Even if you’re nearing retirement, it’s still possible to replace lower-earning years with higher-earning years to improve your overall earnings record.

Ways to Increase Your Earnings Before Retirement

- Work Longer: If you’ve worked for fewer than 35 years, you can increase your Social Security benefit by staying in the workforce longer and replacing lower-earning years with higher-earning years.

- Increase Your Earnings: Try to earn more money during the final years of your working career by pursuing promotions, changing jobs for better compensation, or taking on side work.

- Maximize Social Security Taxes: Keep in mind that Social Security taxes apply to income up to the annual taxable maximum. In 2026, the taxable maximum is expected to be around $160,200. Earning more within this limit can raise your benefit calculation.

Retirement Earnings Test

If you plan to continue working while collecting Social Security before reaching FRA, be aware of the retirement earnings test. If you earn above the set limits, your benefits will be reduced until you reach FRA. However, once you reach FRA, this test no longer applies, and you can earn as much as you want without reducing your benefits.

Additional Considerations for Maximizing Benefits

Coordinating Benefits with Your Spouse

Married couples can potentially receive more Social Security benefits by coordinating their claiming strategies. For example, a lower-earning spouse may be eligible for up to 50% of the higher-earning spouse’s benefit. In some cases, it may make sense for one spouse to delay claiming benefits so that the surviving spouse can receive a higher benefit after the other’s death.

Survivor Benefits

If your spouse passes away, you may be eligible for survivor benefits. As a widow or widower, you can choose to receive the higher of your own benefit or your deceased spouse’s benefit. Understanding how survivor benefits work can help you plan more effectively for the future.

Looking Ahead: The Future of Social Security

While the COLA adjustment will help beneficiaries in the short term, Social Security faces significant long-term challenges. According to the 2025 Social Security Trustees Report, the Social Security Trust Fund may be depleted by 2034, meaning that beneficiaries could face cuts unless Congress takes action.

Planning for the Future

Given the uncertainty around Social Security’s long-term viability, it is essential to plan ahead. Relying solely on Social Security may not be enough for a comfortable retirement. Supplementing your benefits with personal savings, investments, or employer-sponsored retirement plans is essential for financial security.

Related Links

California Social Security Payments January 2026 – Exact Dates and Who Gets Paid First

Social Security Benefits Strategy – 3 Smart Steps to Increase Your Monthly Retirement Check

Maximize Your Social Security Benefits

While the 2.8% COLA increase will certainly help, there are practical steps you can take to ensure you’re getting the most out of your Social Security benefits. Delaying your claim, ensuring your earnings record is accurate, and optimizing your earnings before retirement are three proven ways to boost your monthly check.

By planning ahead and utilizing these strategies, you can maximize your Social Security benefits and secure a more stable financial future.

FAQs About Social Security Benefit Boost 2026

Q1: How much will the COLA increase my Social Security check in 2026?

A1: The COLA increase for 2026 is 2.8%, which translates to an average increase of about $56 per month.

Q2: Can I increase my Social Security check if I’m already retired?

A2: While you can’t increase your benefit through delayed claims if you’re already retired, you can still correct errors in your earnings record to ensure you’re receiving the correct benefit amount.

Q3: Should I delay claiming Social Security benefits?

A3: If you’re in good health and can afford to wait, delaying until age 70 can increase your monthly benefit by 8% per year compared to claiming at full retirement age.