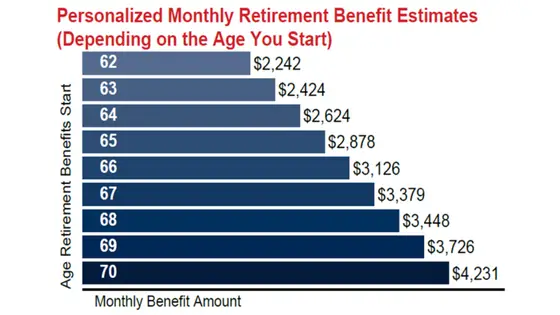

As Social Security benefits continue to serve as a primary source of income for millions of Americans, many beneficiaries remain unaware of a significant rule that could temporarily reduce their monthly payments in 2026.

This rule, known as the earnings test, applies to individuals who claim benefits before reaching their Full Retirement Age (FRA) and continue to work. For many, the earnings test can be an unexpected obstacle that affects their cash flow in retirement, even though the reductions are generally temporary.

In this article, we will explore how the earnings test works, who is affected by it, and strategies to manage or avoid its impact. By understanding this important but often overlooked rule, Social Security beneficiaries can make better-informed decisions about when to claim benefits and how to balance work with their retirement income.

What Is the Social Security Earnings Test and How Does It Work?

The Social Security earnings test applies to individuals who claim Social Security retirement benefits before reaching their Full Retirement Age (FRA), which is 67 for most people born in 1960 or later. This rule affects both retirement benefits and disability benefits, but it does not apply once a person reaches FRA.

The earnings test is designed to ensure that individuals who claim Social Security early, while still working, are not earning more than the income limits set by the Social Security Administration (SSA). In 2026, the earnings test works as follows:

- Before FRA (for those under 67): If you earn more than $24,480 in 2026, your benefits will be reduced by $1 for every $2 you earn above this threshold.

- During the Year You Reach FRA: The limit increases to $65,160 in 2026. For every $3 you earn above this threshold, $1 of your benefits will be withheld. Once you reach FRA, the earnings test no longer applies, and you can earn as much as you like without affecting your benefits.

These rules are important because they help prevent individuals from receiving Social Security benefits if they’re earning a significant income.

However, the SSA will recalculate your benefits once you reach FRA, and any benefits withheld due to the earnings test are added back to your monthly payment in the form of an increased benefit amount.

How This Rule Can Impact Your Social Security Payments

Many retirees assume that their Social Security benefits will remain constant once they start receiving them, but the earnings test can cause a reduction in the amount they receive if they continue working. For example, let’s take a closer look at a typical scenario:

Example:

- John is 63 years old and decides to start receiving Social Security benefits while continuing to work part-time.

- John’s income in 2026 exceeds the $24,480 earnings limit for his age group.

- For every $2 that John earns over the threshold, $1 of his benefits will be withheld.

- If John earns $30,000, the SSA will reduce his benefits by $2,760 for the year (since he earned $5,520 over the $24,480 limit).

While John does not permanently lose this money, he will experience temporary reductions in his monthly checks. This can create cash-flow issues for retirees who are counting on Social Security benefits to cover essential expenses.

However, once John reaches his Full Retirement Age (FRA), the earnings test no longer applies, and his benefits will be recalculated to reflect the previously withheld amounts.

How the Earnings Test Affects Your Lifetime Social Security Benefits

One important thing to understand about the earnings test is that benefits are not permanently reduced if they are withheld. Instead, the SSA recalculates the total benefits at Full Retirement Age (FRA), including the months when benefits were withheld.

The total amount withheld is added back to the recipient’s monthly payments once they reach FRA, although this often results in a lower monthly increase than beneficiaries might expect.

Case Study:

- Maya is 63 years old and works part-time while receiving Social Security benefits.

- She continues to work for two years, earning above the earnings test limit, resulting in a reduction of her monthly Social Security payments.

- At age 65, Maya reaches FRA. The SSA will adjust her monthly benefit to reflect the amount that was temporarily withheld while she was working.

- Even though Maya will receive the previously withheld amounts, the long-term effects of claiming early and working may still impact the total amount she receives over her lifetime.

In the long term, this adjustment helps, but beneficiaries should still be aware that the temporary withholding could reduce monthly income in the earlier years of retirement.

Strategies to Minimize the Impact of the Earnings Test

For individuals planning to work and claim Social Security benefits early, there are several strategies to minimize the impact of the earnings test:

- Delay Claiming Benefits: If possible, delay claiming Social Security until you reach Full Retirement Age (FRA). This eliminates the earnings test altogether and ensures you receive the full amount you are entitled to without reductions.

- Consider a Part-Time Job with Lower Earnings: If you plan to work after claiming benefits, try to keep your earnings below the $24,480 threshold to avoid reductions.

- Increase Contributions to Retirement Accounts: If you can afford to, increase contributions to a 401(k), IRA, or other retirement savings accounts to reduce your reliance on Social Security in the earlier years of retirement.

While these strategies are not always feasible for everyone, they can help reduce the immediate financial impact of the earnings test and give beneficiaries a more predictable cash flow in retirement.

Impact of Taxes on Social Security Benefits 2026

Another often overlooked factor is that Social Security benefits may be subject to taxes if your income exceeds certain thresholds. For individuals whose income — including half of their Social Security benefits — exceeds $25,000 (for single filers) or $32,000 (for joint filers), up to 85% of their Social Security benefits may be taxable.

This additional tax burden can significantly reduce the overall benefit amount retirees receive, especially those who continue to work while claiming Social Security.

What to Do If You Are Affected by the Earnings Test

If you find that your Social Security benefits are being reduced due to the earnings test, here are some steps you can take:

- Monitor Your Earnings: Keep track of your income to ensure it stays below the limit.

- Review Your Benefits Online: Use the Social Security online portal to review your benefit statements and track your earnings relative to the thresholds.

- Consult with a Financial Advisor: If you’re unsure how the earnings test will affect your benefits or if you’re concerned about the impact of taxes on your Social Security, a financial advisor can provide personalized advice.

Related Links

CVS-Aetna Data Leak: $35 Million Payout for Mismanaged Patient Records.

IRS ‘Direct File’ 2026 Expansion: How This New Free Tool Could Change Your Tax Season.

Navigating Social Security in 2026

While the earnings test for Social Security may seem like a small issue, it can significantly affect how much you actually receive in retirement, especially if you are working while claiming benefits. Understanding how it works, when it applies, and how to avoid or mitigate its effects is essential for retirees who wish to continue working.

By preparing in advance, tracking earnings, and seeking professional guidance, you can better manage the timing of your Social Security benefits and avoid unnecessary reductions.