As rising costs push more Americans to retire overseas, understanding Social Security Benefits Abroad has become increasingly critical.

While most retirees can receive U.S. Social Security payments outside the country, eligibility rules, banking logistics, and international restrictions can disrupt income if beneficiaries fail to comply with federal requirements.

Social Security Benefits

| Issue | What Retirees Should Know |

|---|---|

| Payments abroad | Retirement and disability benefits usually continue overseas |

| Restricted countries | Payments barred in select sanctioned nations |

| SSI payments | Generally stop after 30 days abroad |

| Payment method | Direct deposit is standard |

| Medicare | Does not cover most overseas care |

A Growing Trend: Why More Retirees Are Living Abroad

Over the past decade, international retirement has shifted from niche to mainstream. According to SSA data, more than 700,000 Americans now receive Social Security payments while living outside the United States, a number that has steadily increased alongside globalization, remote banking, and rising U.S. living costs.

Retirees cite affordability, healthcare access, and lifestyle factors as primary motivators. Southern Europe, Latin America, and Southeast Asia remain among the most popular destinations.

Yet experts caution that moving abroad without understanding benefit rules can lead to unexpected payment suspensions. “Social Security works globally—but not automatically,” said one former SSA policy analyst. “Compliance matters.”

How Social Security Benefits Abroad Actually Work

At its foundation, Social Security is an earned benefit funded through payroll taxes. The Social Security Administration pays retirement and disability benefits based on work history, not residency.

For eligible retirees, living overseas does not reduce benefit amounts. Payments remain tied to lifetime earnings and claiming age, just as they would inside the United States. However, the SSA applies additional oversight once beneficiaries leave U.S. territory for more than 30 consecutive days.

Who Can Receive Benefits While Living Overseas

U.S. Citizens

Most U.S. citizens can receive Social Security retirement or disability benefits abroad indefinitely, provided they remain eligible and respond to SSA correspondence. Citizenship offers the broadest access to international payments.

SSA officials emphasize that “citizenship does not eliminate reporting responsibilities.” Address updates, marital changes, and work activity must still be reported.

Non-U.S. Citizens

For non-citizens, rules are more restrictive. Benefits may stop after six consecutive months abroad unless the recipient qualifies for an exception or lives in a country covered by a U.S. totalization agreement.

These limitations often affect long-term residents and dual-status retirees who incorrectly assume permanent residency guarantees continued payments.

Countries Where Social Security Payments Are Restricted

Despite broad global coverage, Social Security Benefits Abroad are not payable everywhere. U.S. sanctions and Treasury regulations prohibit payments to certain countries, including Cuba and North Korea.

Other countries may experience intermittent restrictions due to banking instability, compliance concerns, or diplomatic shifts. Retirees living in such regions must sometimes route payments through third-country banks or U.S. accounts.

Policy experts warn that geopolitical developments can change payment eligibility with little notice. “Sanctions evolve,” one international law specialist noted. “Retirees should build flexibility into their financial planning.”

How Retirees Receive Payments Overseas

Direct Deposit as the Global Standard

Direct deposit is now the primary method for distributing benefits abroad. Payments can be sent to U.S. banks or foreign financial institutions participating in international direct deposit programs. Paper checks are largely phased out due to theft risks and postal unreliability. In some countries, checks are no longer issued at all.

Currency Conversion and Fees

Benefits are paid in U.S. dollars, but foreign banks typically convert funds to local currency. Exchange rates and transaction fees can slightly reduce monthly income. Financial advisers recommend maintaining a U.S. bank account as a backup, especially in regions with volatile banking systems.

Compliance, Questionnaires, and Payment Suspensions

SSA routinely sends eligibility questionnaires to beneficiaries living abroad, often every one to two years. These forms confirm that recipients are alive, eligible, and not engaged in disqualifying work.

Failure to respond can result in suspended benefits. While payments can usually be reinstated, missed months may create hardship. “Most suspensions occur because people ignore mail,” said a former SSA field officer. “Not because they’re ineligible.”

Supplemental Security Income: A Major Limitation

Supplemental Security Income (SSI) follows different rules. Unlike retirement benefits, SSI generally cannot be paid if the recipient remains outside the United States for more than 30 consecutive days.

This distinction is critical for low-income retirees. SSI is residency-based and intended to support individuals living within U.S. borders.

Totalization Agreements and International Work Credits

The United States has totalization agreements with more than two dozen countries. These agreements prevent workers from paying into two systems simultaneously and allow foreign work credits to count toward eligibility.

However, benefit amounts are still calculated under U.S. law. Foreign credits may help retirees qualify, but they do not increase monthly payments beyond earned U.S. wages.

Taxes: A Dual-Country Reality

U.S. citizens must continue filing federal tax returns while abroad. Depending on income, up to 85 percent of Social Security benefits may be taxable.

Host countries may also tax benefits, depending on local law and treaty protections. Tax specialists strongly advise retirees to seek professional guidance before relocating.

Healthcare Coverage Outside the U.S.

Medicare generally does not cover routine medical care outside the United States. Retirees abroad rely on local public systems, private insurance, or out-of-pocket payments. Healthcare access is often cited as a benefit of overseas retirement, but coverage varies widely by country and legal status.

Common Mistakes Retirees Make Abroad

Experts consistently highlight recurring errors:

- Failing to notify SSA of address changes

- Ignoring eligibility questionnaires

- Closing U.S. bank accounts prematurely

- Assuming Medicare applies overseas

- Misunderstanding non-citizen restrictions

“These mistakes are avoidable,” said one retirement policy researcher. “But the consequences can be severe.”

Fraud, Cybersecurity, and Identity Protection

Retirees abroad face increased fraud risks, including phishing schemes targeting Social Security recipients. SSA warns beneficiaries never to share personal information via unsolicited emails or phone calls.

Using secure banking channels and monitoring accounts regularly is essential, especially in regions with weaker consumer protections.

The Role of U.S. Embassies and Consulates

While embassies do not administer Social Security, they assist retirees with documentation, identity verification, and communication with SSA offices. Consular services can be particularly important during medical emergencies or political instability.

Related Links

Ashley HomeStore Class Action Settlement – Who May Qualify for a Share of the $750,000 Fund

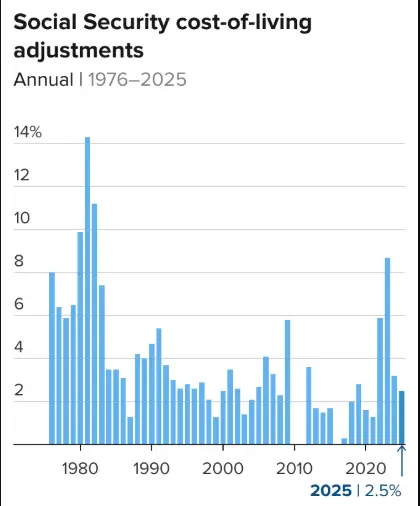

Looking Ahead: Policy and Payment Stability

As overseas retirement grows, policymakers continue to assess payment systems, fraud prevention, and digital verification methods. While no major reforms are imminent, SSA officials acknowledge the need for modernization.

“International beneficiaries are no longer the exception,” one senior official said. “They are part of the system’s future.”

Social Security Benefits Abroad remain a reliable income source for most retirees who plan carefully and comply with federal rules. Yet living overseas introduces complexities that demand attention, documentation, and financial flexibility.

For retirees considering life beyond U.S. borders, understanding these rules is not just prudent—it is essential.