The Social Security Administration (SSA) will implement a 2.8% cost-of-living adjustment (COLA) in January 2026, increasing monthly payments for more than 71 million Americans. The Social Security Boost Coming in 2026 matters for retirees, disabled workers, and survivors who rely on timely benefits.

Officials and financial experts say beneficiaries should review their personal records, monitor earnings, and prepare for possible Medicare cost changes to ensure they receive the increase without delay.

Social Security Boost Coming in 2026

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA increase | 2.8% for Social Security & SSI |

| Average monthly gain | About $56 for retired workers |

| New earnings limit (under FRA) | $24,480/year |

| Maximum taxable earnings | $184,500 in 2026 |

What the Social Security Boost Coming Means for 2026

The Social Security Boost Coming in 2026 reflects the annual COLA that adjusts Social Security benefits based on inflation. The figure is calculated using the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which the U.S. Bureau of Labor Statistics tracks.

The SSA announced the 2026 increase after reviewing inflation patterns between the third quarter of 2024 and the third quarter of 2025.

How the COLA Is Determined

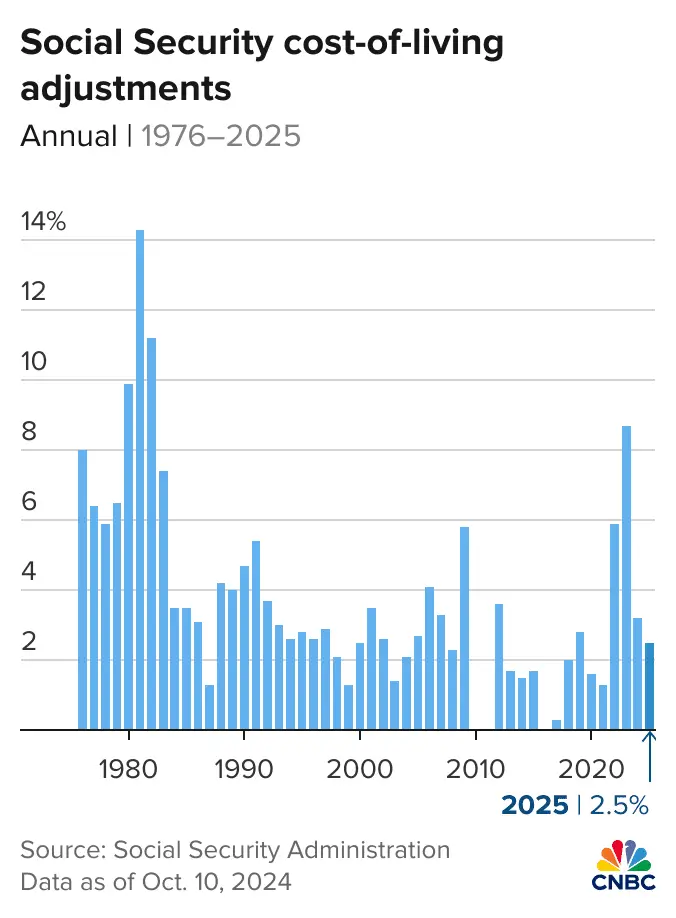

According to the SSA, COLA adjustments help ensure that benefits keep pace with the rising cost of essential goods, including housing, medical care, and food. The 2026 increase is smaller than the unusually high 8.7% adjustment in 2023 but aligns with the nation’s current moderate inflation rates reported by the Bureau of Labor Statistics.

Impact on Retirees and Other Beneficiaries

The SSA estimates that the average retirement benefit will rise to roughly $2,071 per month. Individuals receiving disability benefits and survivor benefits will also see proportional increases. For Supplemental Security Income (SSI) recipients, the adjustments begin on December 31, 2025.

What You Must Do Now to Get Your Increase on Time

Create or Update Your “my Social Security” Account

The SSA encourages beneficiaries to use its secure online portal. Officials say that digital notices are delivered faster and reduce the chance of missed mail. Users should confirm their delivery preferences before the agency finalizes its annual COLA mailing deadlines.

Verify Personal and Direct Deposit Information

Experts recommend reviewing:

- Bank account and routing numbers

- Mailing address

- Phone number and email

- Third-party representative payee information

Any incorrect details could delay payment or prevent delivery of key notices.

Ensure Your Earnings History Is Correct

Economists emphasize that a beneficiary’s lifetime earnings record determines their monthly benefit. Missing or incorrect wage data can reduce long-term income. Reviewing past W-2s and tax filings helps identify discrepancies.

Understand Earnings Limits if You Are Working

Workers collecting benefits before reaching full retirement age (FRA) must comply with earnings limits. In 2026, beneficiaries under FRA may earn up to $24,480 without reducing payments. Those reaching FRA in 2026 have a higher limit of $65,160. Exceeding these limits triggers temporary benefit withholding.

Plan for Medicare Cost Changes

Healthcare policy analysts note that Medicare Part B premiums typically rise most years. Although the COLA increases gross benefits, higher medical deductions can shrink net payments. Beneficiaries enrolling in Medicare for the first time in 2026 should evaluate premium projections, plan offerings, and enrollment deadlines.

Economic and Policy Context Behind the 2026 Increase

Inflation Trends Shaping the Adjustment

Economists from leading institutions have noted that CPI-W inflation moderated throughout 2024 and 2025. This stability influenced the 2.8% adjustment. According to analysts at prominent research centers, lower energy prices and slower housing cost growth contributed to the trend.

Why the COLA Still Matters Despite Moderate Inflation

Advocacy groups point out that older Americans continue to face outsized costs in healthcare and housing. Diminishing savings and rising prescription drug costs have created financial pressure for many retirees, making accurate benefit adjustments essential.

Long-Term Solvency Concerns

Reports from the Congressional Budget Office and the Social Security Trustees suggest that the trust fund faces long-term challenges as the U.S. population ages. While no changes affect 2026 benefits, lawmakers continue to debate potential reforms, including payroll tax adjustments or benefit formula changes.

What This Means for Different Groups

Retirees

Most retirees will see modest increases. For individuals with higher Medicare premiums or out-of-pocket medical spending, net gains may be slimmer.

Disability Beneficiaries

Those receiving Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI) will also benefit from the adjustment. Advocates emphasize the importance of updating employment information promptly to avoid payment delays.

Future Retirees

Workers planning retirement in 2026 should factor the new COLA and wage base changes into their calculations. Financial planners recommend reviewing retirement timelines to optimize benefit amounts.

Related Links

SNAP Recipients on Edge: Trump’s New Demands Could Slash Full Benefits in Dozens of States

Flight Cancellations Surge as Shutdown Threat Grows—How Travel May Grind to a Halt Nationwide

Forward-Looking Assessment

Analysts expect inflation to remain moderate through 2026, but economic conditions remain uncertain. As policymakers weigh long-term reforms, beneficiaries are advised to stay informed and maintain accurate records with the SSA. Ensuring clean, updated personal information is the best step to avoid delays and receive the full adjustment.

FAQ About Social Security Boost Coming in 2026

Q1: When will I see the 2026 COLA in my payment?

Most beneficiaries will receive increased payments beginning January 2026, while SSI recipients receive the adjustment in late December 2025.

Q2: Do I need to apply to receive the COLA?

No. COLA increases are automatic but depend on accurate personal and bank information being on file.

Q3: Will Medicare premiums reduce my net increase?

Possibly. Medicare premiums vary by income and can offset part of the COLA.