In 2026, millions of Americans will see a notable increase in their monthly Social Security benefits, thanks to a 2.8% cost-of-living adjustment (COLA). This adjustment, which is designed to keep benefits aligned with inflation, will result in higher payments for both retired workers and people with disabilities.

However, the impact will vary across the United States. In five states, retirees could see their monthly benefits rise by as much as $2,000 or more, thanks to higher average Social Security payouts and demographic factors unique to each region.

The COLA Boost for Social Security in 2026

The 2026 COLA increase will directly affect nearly all Social Security beneficiaries, including retirees, those with disabilities, and Supplemental Security Income (SSI) recipients. This year’s COLA increase of 2.8% follows a trend of gradual inflation adjustments. It’s significant for seniors, as it helps counterbalance the rising costs of goods and services.

- The average monthly Social Security benefit for retired workers will rise to $2,071, marking an increase of $56 from 2025.

- SSI payments will increase to $994 for individuals and $1,491 for couples.

- Social Security benefits for workers claiming at full retirement age (FRA) will see an additional $200‑$300 on average.

Why the 2026 COLA Is Important

While the 2.8% increase may sound modest, the total impact will vary significantly based on each person’s individual benefit amount. Those receiving higher benefits will see a larger increase in dollar terms, with some states experiencing larger-than-average gains due to regional wage differences and historical benefit levels.

Five States to See Significant Social Security Increases in 2026

While the 2.8% increase applies uniformly across the country, beneficiaries in certain states will see a more pronounced rise due to the higher average Social Security benefits in these regions.

In states with more retirees and generally higher costs of living, monthly Social Security payments could see significant boosts — potentially exceeding $2,000 for some individuals. The states most likely to see the biggest increases in 2026 include:

1. Connecticut

Connecticut is home to one of the highest average Social Security benefits in the nation. With a significant retiree population and high wages across many industries, residents in Connecticut are expected to see notable COLA increases.

- Expected monthly benefit rise: Up to $2,000+ annually.

2. New Jersey

New Jersey’s Social Security benefits are also among the highest in the country. With its proximity to major metropolitan areas like New York, many residents receive significant retirement income, which will see a substantial boost in 2026.

- Expected monthly benefit rise: Between $1,800 and $2,000+ annually.

3. New Hampshire

New Hampshire’s retiree population, combined with high average Social Security payouts, positions it as one of the states most likely to see large increases in 2026. Retirees here will benefit from the COLA increase due to their relatively higher income levels.

- Expected monthly benefit rise: Around $2,000 annually.

4. Delaware

Delaware, known for its sizable retiree community, will also see substantial increases in Social Security payments in 2026. Many retirees in the state rely heavily on Social Security, making this COLA adjustment particularly impactful.

- Expected monthly benefit rise: Up to $2,000 annually.

5. Maryland

Maryland rounds out the list of states poised for major Social Security benefit increases. The state has a high concentration of wealthier retirees who will benefit from the COLA adjustment, as their monthly benefit amounts are already substantial.

- Expected monthly benefit rise: Up to $2,000+ annually.

Why Some States See Larger Social Security Increases

The cost-of-living adjustment (COLA) is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI‑W), which measures inflation. However, Social Security payments are also influenced by other regional factors, which explain why certain states see larger dollar increases:

- Higher State Median Benefit Amounts: States with high average earnings tend to have retirees with higher benefit payouts. As the COLA applies to these higher amounts, the absolute increase is larger.

- Inflation Variances: The CPI-W is a national index, but inflation impacts different regions differently. Some states, particularly those with high housing and healthcare costs, see more inflationary pressure, which can drive larger COLA adjustments.

- State Demographics: States with a higher proportion of older retirees, especially those who depend on Social Security as their primary income, are more likely to see a larger boost from the COLA.

Other Social Security Changes in 2026

In addition to the COLA increase, there are other key changes to Social Security in 2026 that may affect retirees:

- Medicare Part B Premium Increases: Medicare premiums are projected to rise in 2026, which could offset some of the COLA gains, particularly for beneficiaries who rely on Medicare for healthcare costs.

- Higher Earnings Limits: For workers under full retirement age, the amount of earnings allowed before Social Security benefits are reduced will increase. This means some working beneficiaries can earn more without sacrificing their Social Security payments.

- Taxable Earnings Cap: The taxable earnings cap will increase to $184,500 in 2026, meaning more income will be subject to Social Security payroll taxes.

How Retirees Should Prepare for the 2026 Increase

While the 2.8% COLA increase is beneficial for retirees, there are other important factors to consider:

- Review Your Medicare Costs: Be aware of any increase in Medicare Part B premiums, which could reduce the net benefit of the COLA.

- Plan for Healthcare Costs: Many retirees face rising medical expenses, which will continue to affect how much of the COLA adjustment goes toward day-to-day living costs.

- State-Specific Guidance: Retirees in states with larger-than-average benefit increases should also look at how state taxes or other local regulations affect their retirement income. Some states have tax policies that impact how Social Security benefits are taxed.

Related Links

IRS Sending $1,390 Relief Payments in January 2026 — Check Your Eligibility & Payment Date

January 2026 Social Security COLA Update – How the 2.8% Increase Changes Monthly Payments

Looking Ahead: The Long-Term Outlook

The Social Security boost in 2026 will help millions of retirees manage the increasing costs of living. However, the 2.8% COLA increase is just one piece of the larger puzzle. Retirees in states like Connecticut, New Jersey, New Hampshire, Delaware, and Maryland will see the most significant boosts, with some potentially receiving up to $2,000 or more in increased benefits.

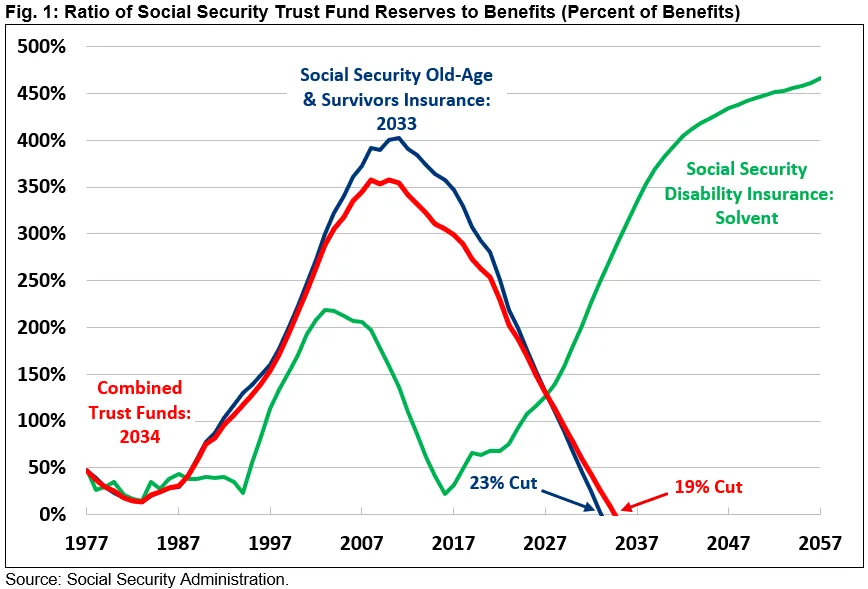

As inflation continues to affect purchasing power, Social Security remains a critical source of income for millions. However, the long-term sustainability of the Social Security program is still a topic of debate. Policymakers will need to address funding challenges, especially as the number of beneficiaries grows and the population ages.

In the coming years, further COLA adjustments may be necessary to keep pace with rising costs, but this will require careful management of the Social Security Trust Fund.