The U.S. government has acknowledged that Most Social Security Checks Are Capped at $2,000 Social Security payments for most retirees hover near a practical cap of about $2,000 per month, a figure confirmed through recent Social Security Administration (SSA) disclosures and federal data releases.

While no formal cap exists at that level, the finding underscores a structural gap between the program’s legal maximum benefits and what the average American retiree actually receives.

Most Social Security Checks Are Capped at $2,000

| Key Fact | Detail |

|---|---|

| Average Social Security retirement benefit is about $1,908 per month | Most retirees fall near this practical “cap” |

| Legal maximum benefit at age 70 is above $5,000 per month | Achievable only with high, long-term earnings |

| Over 50% of retirees rely on Social Security for most of their income | Highlights importance of benefit size |

| Benefits are based on 35 years of indexed earnings | Few workers meet the maximum thresholds |

Why the Most Social Security Checks Are Capped at $2000 Claim Emerged

The claim that Social Security checks are “capped” at $2,000 spread rapidly after the SSA’s recent release of updated average benefit statistics. According to the agency’s Monthly Statistical Snapshot, the average retirement benefit paid in early 2025 was about $1,908, placing most retirees near the widely cited $2,000 benchmark.

While not an official cap, the level functions as a functional ceiling for the vast majority of beneficiaries due to the program’s benefit formula.Federal officials have not issued a direct announcement framing the figure as a cap. Instead, the number reflects the outcome of decades-long wage patterns, inflation adjustments, and contribution histories.

The SSA’s methodology uses a worker’s highest 35 years of inflation-adjusted earnings, which limits the prospects for significant benefits among Americans with lower or inconsistent lifetime earnings.

What the Government Data Actually Show

The Difference Between the Average and the Maximum

Although headlines have focused on the $2,000 figure, the SSA confirms that the legal maximum benefit in 2025 is more than twice that amount. Workers who retire at age 70 after earning at or above the taxable maximum over a long career can receive over $5,000 per month.

However, only a small fraction of retirees meet these conditions. According to SSA data, fewer than 6% of retirees receive benefits at or near the legal maximum because reaching that level requires:

- consistently high earnings,

- at least 35 years of such earnings,

- delaying retirement to age 70, and

- paying the maximum Social Security tax annually.

This gap between the theoretical maximum and the practical reality is what gives the $2,000 figure its influence.

Why the Average Retiree Receives About $2,000

This functional “cap” reflects multiple factors shaping retirement outcomes.

Lifetime Earnings Are the Dominant Factor

Social Security benefits are calculated through the Primary Insurance Amount (PIA) formula, which weighs a worker’s average indexed monthly earnings. The formula is progressive: lower earners receive proportionally higher benefits relative to their income, but high earners do not gain benefits at the same rate.

Wage Stagnation Limits Growth

Economists at the Federal Reserve Bank of St. Louis have documented long-term slowdowns in real wage growth for middle-income workers. Because benefits depend directly on wage histories, stagnant wages compress benefit levels around the $1,900–$2,100 range.

Many Workers Claim Early

Dozens of SSA reports show that most Americans claim benefits before reaching full retirement age. Early claiming reduces monthly payments by up to 30%, and those reductions are permanent.

Why the $2,000 Level Matters for Retirees

Social Security Is the Main Income Source for Many

According to the SSA and Census Bureau, about 50% of retirees rely on Social Security for at least half of their income. For roughly one in four retirees, it represents 90% or more of all retirement income. A functional cap at $2,000 means millions rely on a modest, fixed income amid rising costs of living.

Rising Prices Reduce Purchasing Power

The Bureau of Labor Statistics (BLS) reports that retirees face higher-than-average inflation due to medical and housing expenses. A $2,000 monthly benefit in 2025 buys significantly less than the same amount a decade earlier, making the practical cap especially consequential.

Delayed Retirement Is Increasing

Retirement-age Americans have continued working longer to compensate for limited Social Security income. The Department of Labor notes steady increases in labor-force participation among adults aged 65 to 74, a trend strongly linked to concerns about benefit adequacy.

Public Misunderstanding of Social Security Caps

The emergence of headlines describing the $2,000 figure as a “cap” highlights widespread confusion about how Social Security works. Unlike private pensions, Social Security does not set a uniform check size. Instead, it calculates a personalized amount based on indexed lifetime earnings, claiming age, and cost-of-living adjustments (COLAs).

Why People Believe There Is a Cap

Several factors contribute:

- The most common benefit amounts cluster tightly around $2,000.

- News reports often highlight averages without clarifying the distinction between average and maximum.

- Many retirees never see amounts above the benchmark, reinforcing the belief that $2,000 is an official limit.

According to retirement policy analysts, public expectations remain shaped by incomplete or misunderstood information.

Expert Perspectives on the Implications

Financial Planners Stress Preparation

Certified financial planners interviewed by major news organizations such as CNBC and The Wall Street Journal consistently advise that retirees understand the gap between potential and typical benefit amounts. Their guidance emphasizes saving outside Social Security to offset the modest size of the average check.

Researchers Warn of Broader Policy Challenges

University researchers studying aging populations warn that benefit levels concentrated around $2,000 raise concerns about long-term retirement security. With life expectancy rising, a fixed benefit amount creates increasing financial strain, especially for retirees with limited savings or high healthcare needs.

z

The SSA has stressed that annual cost-of-living adjustments aim to protect purchasing power, though COLAs do not always keep pace with price increases in healthcare and housing — the two largest expense categories for older adults.

How Retirees Can Assess Their Own Benefit Outlook

- Check Earnings History: The mySocialSecurity portal provides lifetime earnings records, which should be reviewed for errors.

- Understand the Trade-Offs of Claiming Age: Delaying from age 62 to age 70 can increase monthly benefits by up to 76%, according to SSA calculations.

- Consider Part-Time Work and Credits: Earning additional credits before retirement can raise your benefit amount, especially if you replace years of low income within the 35-year average formula.

- Plan for Inflation: Financial planning experts recommend modeling scenarios that consider rising expenses and modest Social Security adjustments.

Related Links

New Social Security Proposal Targets High-Income Beneficiaries — Major COLA Cuts on the Table

Medicare Rates for 2026 Set to Surge — What Will Your New Monthly Cost Be?”

Legislative Context and Future Policy Considerations

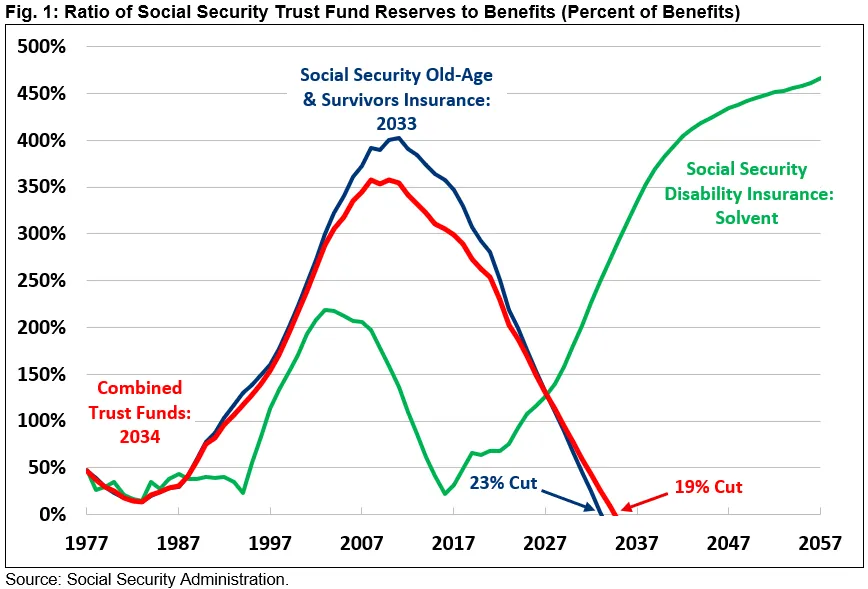

Congress continues to debate long-term Social Security reforms, including adjustments to payroll taxes, benefit formulas, and retirement ages. While none of the major proposals currently include a $2,000 cap, lawmakers acknowledge that the average-benefit level plays a significant role in retirement insecurity.

Policy analysts from nonpartisan organizations such as the Pew Research Center and the Center on Budget and Policy Priorities argue that rising average benefit needs could reframe future debates about the program’s solvency and adequacy.

As the SSA publishes updated benefit data showing typical payments concentrated around the $2,000 mark, the distinction between a functional cap and the legal maximum matters more than ever. The figure does not represent an official limit, but it captures the financial reality of millions of retirees relying on Social Security as a primary source of income amid rising economic pressures.