For millions of Americans who rely on Social Security benefits, knowing the payment schedule is essential. The December 2025 payment schedule has several important dates, particularly for those receiving Supplemental Security Income (SSI), and includes adjustments tied to the 2026 Cost‑of‑Living Adjustment (COLA).

Here’s everything you need to know about December’s payments, the double SSI checks, and the impact of 2026’s COLA increase.

1. Social Security Payment Dates for December 2025

Social Security payments are typically scheduled by the birthdate of the recipient, and December 2025 is no different. Payments for retirement, disability, and survivor benefits follow these general dates:

Social Security Payment Dates for December 2025:

- December 3, 2025: For beneficiaries receiving benefits before May 1997 or those who receive both Social Security and SSI.

- December 10, 2025: For recipients with birthdays on the 1st–10th of the month.

- December 17, 2025: For recipients with birthdays on the 11th–20th.

- December 24, 2025: For recipients with birthdays on the 21st–31st.

These dates reflect the regular Social Security payment schedule. It’s important to note that the December 24 payment will still be based on 2025 benefit levels, meaning the 2026 COLA does not apply to payments received in December.

2. Double SSI Payments in December 2025

A significant feature for SSI recipients in December 2025 is the issuance of two SSI payments. This happens because January 1, 2026, falls on a federal holiday (New Year’s Day), which would normally delay the January payment. To avoid any delays, the Social Security Administration (SSA) issues two payments in December.

Double SSI Payments in December 2025:

- December 1, 2025: Regular December 2025 SSI payment.

- December 31, 2025: Early January 2026 payment issued due to New Year’s Day falling on January 1.

This double payment ensures that SSI recipients still get their January payment early, but there will be no additional SSI payment in January 2026. This early payment includes the new 2026 COLA rates.

Why This Matters for SSI Recipients

For SSI recipients, receiving two payments in December may seem like a boost, but it’s important to understand that January’s payment is brought forward, so there won’t be another payment in January. Recipients should plan their budgeting accordingly.

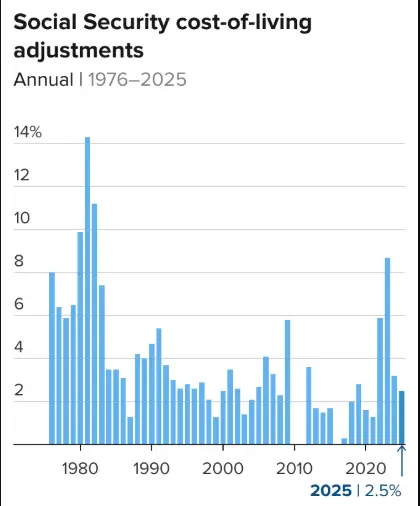

3. Impact of 2026 COLA Increase on Social Security Payments

The Cost-of-Living Adjustment (COLA) for 2026 has been set at 2.8%. This increase is designed to help Social Security beneficiaries keep up with inflation and rising costs of living.

How the 2026 COLA Will Affect Payments:

- The 2.8% COLA will apply to all Social Security benefit types, including retirement, disability, survivor benefits, and SSI.

- The COLA affects December payments for SSI recipients (paid on December 31), and the first payments reflecting the COLA for most retirees and other Social Security beneficiaries will arrive in January 2026.

For example, an individual receiving $1,000 per month in Social Security benefits could see an increase of about $28 per month starting in January 2026. This increase will help beneficiaries manage inflation, which can erode purchasing power, particularly for those living on fixed incomes.

Why COLA Matters for Retirees and SSI Recipients

The COLA adjustment directly impacts retirees’ purchasing power. As living costs rise, especially for healthcare and everyday expenses, the COLA increase helps cushion the effects of inflation.

Even though a 2.8% increase might seem small, it can make a significant difference, especially for those with long-term financial planning on a fixed budget.

4. Full Breakdown of December 2025 Payment Schedule

Here’s a quick reference table summarizing the December 2025 payment schedule, including the double SSI payment and regular Social Security dates:

| Benefit Type | Payment Date | Details |

|---|---|---|

| Regular Social Security Payments | December 3, 2025 | For those receiving benefits before May 1997. |

| Regular Social Security Payments | December 10, 2025 | Birthdays on 1st–10th. |

| Regular Social Security Payments | December 17, 2025 | Birthdays on 11th–20th. |

| Regular Social Security Payments | December 24, 2025 | Birthdays on 21st–31st (2025 levels). |

| SSI Payment (December) | December 1, 2025 | Regular payment for December 2025. |

| SSI Payment (January 2026) | December 31, 2025 | Early January payment, includes COLA adjustments. |

What to Expect with the 2026 COLA Impact

The 2.8% COLA will first be reflected in January 2026 payments for most recipients. However, SSI recipients will see the COLA increase in the December 31, 2025 payment.

5. Key Considerations and Tips for Beneficiaries

1. Holiday Payment Adjustments

If you’re an SSI recipient, make sure to watch for two payments in December, and remember there will not be an additional January payment. It’s important to budget accordingly, considering the larger December disbursement.

2. Direct Deposit and Mailing Options

To avoid delays, ensure your Direct Deposit information is updated with the Social Security Administration (SSA). Direct deposit recipients typically receive their benefits earlier, while those receiving checks in the mail should account for potential delays during the holiday season.

3. Managing Your Benefits Efficiently

The COLA increase, while modest, can still help ease the burden of rising living costs. Review your monthly budget to make sure your adjustments are allocated to the most essential expenses, especially as inflation affects both food and healthcare costs.

4. Maximize Your Social Security Benefits

If you’re nearing retirement, this is a good time to explore delaying your Social Security benefits for as long as possible. For every year you delay benefits beyond your full retirement age, your monthly benefit will increase by 8% per year until you reach age 70. These extra payments can provide significant financial security over the long term.

5. Understanding Tax Implications

For retirees working while receiving Social Security benefits, working may increase your taxable income, and higher income may make a portion of your benefits taxable. Make sure you understand how your earnings could impact your overall tax situation, and plan accordingly.

Related Links

January SSI Payment Comes Early in 2026: Why the Date Shifts and What Changes

December 24 Social Security Payments: Who Is Scheduled to Receive a Check

The December 2025 Social Security payment schedule offers a structured and predictable timeline for both Social Security recipients and SSI beneficiaries.

With the double SSI payment in December and the 2026 COLA increase kicking in, retirees and individuals with disabilities can expect adjustments that may help alleviate the strain of rising living costs. As always, make sure to stay updated on any changes to your benefits and adjust your financial planning accordingly.

FAQs About Social Security December 2025 Payment

Q: Why are there two SSI payments in December 2025?

A: Because January 1 is a federal holiday, the December 31 payment includes the January 2026 payment, ensuring that recipients don’t miss a payment.

Q: When will my Social Security payment reflect the 2026 COLA increase?

A: The COLA increase will first be reflected in January 2026 payments for most recipients. However, SSI recipients will see the COLA increase in the December 31, 2025 payment.

Q: How much will the 2026 COLA increase my Social Security benefit?

A: The 2.8% COLA will increase benefits by about $28 per $1,000 of monthly Social Security payments.