Millions of Americans who claim Social Security retirement benefits before reaching full retirement age lock in permanent reductions, but federal rules allow only two narrowly defined Social Security early claim fixes that can reduce or undo those cuts under specific conditions.

These provisions, outlined by the Social Security Administration (SSA), offer limited relief for early filers who can repay benefits or continue working, though both options carry financial, health, and timing constraints that many retirees find difficult to meet.

Social Security Early Claim Fixes

| Key Fact | Detail |

|---|---|

| Maximum early reduction | Up to 30% if claimed at age 62 with FRA of 67 |

| Rescission window | 12 months after first claiming |

| Earnings test recovery | Withheld months credited back at FRA |

Understanding Early Social Security Benefit Reductions

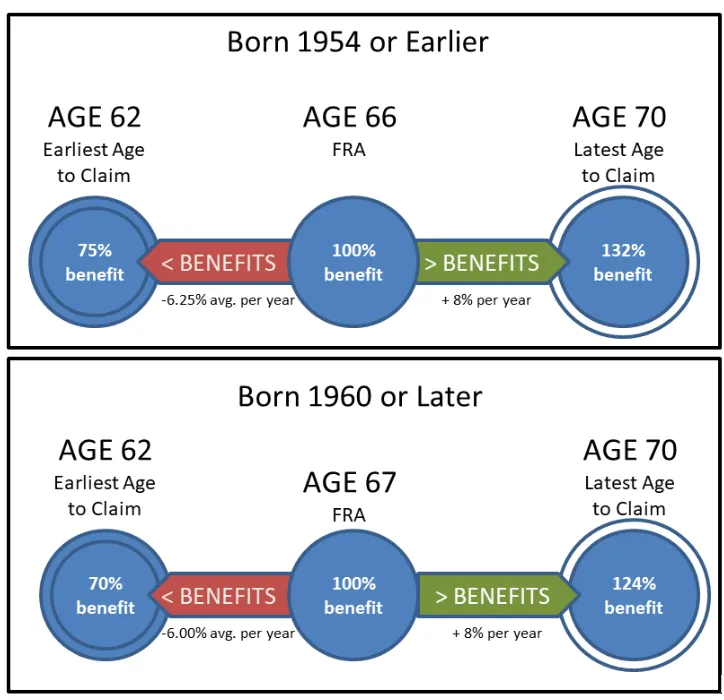

Under federal law, workers can begin collecting retirement benefits as early as age 62. However, doing so before reaching full retirement age results in a permanent reduction in monthly payments.

According to the Social Security Administration, individuals with a full retirement age of 67 receive roughly 30% less per month if they claim at 62. The reduction reflects longer expected payment periods and is designed to keep lifetime payouts roughly equal regardless of claiming age.

Once benefits begin, the lower payment generally lasts for life. However, federal regulations allow two exceptions that function as Social Security early claim fixes.

What often surprises retirees is that these reductions are not reversible through delayed retirement credits alone, nor are they adjusted for changing health, market downturns, or inflation shocks. The rules are rigid, and the system prioritizes administrative clarity over flexibility.

Why So Many Americans Claim Early

Despite the penalties, early claiming remains common. SSA data show that roughly one-third of retirees still begin benefits at age 62.

Experts cite several overlapping reasons. Many workers leave the labor force earlier than planned due to layoffs, caregiving responsibilities, or health issues. Others underestimate how long they will live or overestimate their ability to delay income.

“There is a strong behavioral element,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “People fear missing out on benefits if they delay, even though delaying often leads to higher lifetime income.”

Income inequality also plays a role. Lower-income workers, who often experience poorer health and shorter life expectancies, are statistically more likely to claim early, even though the reductions hit them hardest over time.

Fix One: Withdrawing and Repaying an Early Claim

The first option allows beneficiaries to withdraw their Social Security claim within 12 months of their initial application.

This process, known formally as a “withdrawal of application,” treats the early filing as if it never occurred. The individual can later reapply at full retirement age or beyond, securing a higher monthly benefit.

However, the Social Security Administration requires full repayment of all benefits received. This includes payments issued to spouses or dependents based on the worker’s record.

“This option is effectively a reset button,” said Martha Shedden, president of the National Association of Registered Social Security Analysts. “But the repayment requirement means it is only realistic for people with sufficient savings or other income.”

Federal rules permit only one withdrawal per lifetime. The policy exists largely to correct administrative mistakes or unexpected changes in financial circumstances, not as a routine planning strategy.

Fix Two: Working Enough to Offset Early Benefits

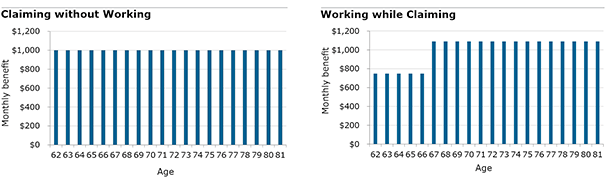

The second fix applies to people who continue working while receiving early Social Security benefits.

Before reaching full retirement age, beneficiaries are subject to the earnings test. In 2025, the Social Security Administration withholds $1 in benefits for every $2 earned above an annual limit of approximately $23,400. In the year a worker reaches full retirement age, a higher threshold applies.

While the withheld benefits may feel like a loss, the agency recalculates payments at full retirement age. Months in which benefits were withheld are effectively removed from the early-claim penalty calculation.

“If enough months are withheld, the permanent reduction shrinks,” said Munnell. “In some cases, it can be eliminated entirely.”

This adjustment does not require repayment, but it does require sustained earnings above the threshold, which may be unrealistic for workers in physically demanding jobs or those with declining health.

Why No Other Social Security Early Claim Fixes Exist

Once the 12-month withdrawal window closes and if insufficient benefits are withheld through work, early claim reductions become permanent.

The Social Security Administration does not allow partial reversals, hardship exemptions, or retroactive adjustments outside these two mechanisms. Delayed retirement credits earned after full retirement age increase benefits but do not erase early-claim reductions.

“These rules are strict, and many retirees misunderstand them,” said Munnell. “Planning ahead is critical because there are no second chances beyond what the law allows.”

From a policy standpoint, the rigidity reflects concerns about system abuse, administrative complexity, and cost predictability. Allowing broad reversals would increase program expenses and complicate actuarial assumptions.

How Early Claiming Affects Different Groups

The impact of early claiming is not evenly distributed.

Workers with higher lifetime earnings and better health are more likely to delay benefits, maximizing monthly payments. Lower-income workers, disproportionately including minorities and those in manual labor roles, often claim early out of necessity.

Women, who live longer on average, face a higher risk of outliving reduced benefits, particularly if they claim early after caregiving interruptions that already lowered their earnings record.

“This is where Social Security intersects with broader inequality,” said Shedden. “Early claiming can lock in disadvantage for decades.”

International Context: How the U.S. Compares

Other advanced economies also reduce benefits for early retirement, but many offer more flexible adjustment mechanisms.

Several European systems allow partial reversals, health-based exceptions, or automatic recalculations tied to life expectancy. The U.S. system remains comparatively strict, favoring administrative simplicity over individualized outcomes.

Policy analysts note that as longevity increases unevenly across income groups, pressure may grow to reconsider how early-claim penalties are structured.

2026 COLA Increase Begins – Check January Social Security Payment Dates

What Happens Next for Current and Future Retirees

As baby boomers continue retiring in large numbers, early claiming remains common, even as concerns grow about the long-term solvency of the Social Security trust fund.

The Social Security Administration encourages individuals to review claiming options carefully and consult official benefit calculators before filing. Financial planners increasingly urge workers to treat claiming age as a core retirement decision, not a default choice.

Future reforms could alter benefit formulas, but under current law, the two existing Social Security early claim fixes remain the only paths to reversing early-filing penalties.

FAQs About Social Security Early Claim Fixes

Can I fix an early Social Security claim after one year?

No. After 12 months, withdrawal is no longer permitted.

Do delayed retirement credits cancel early reductions?

No. They increase benefits but do not remove early-claim penalties.

Is repayment optional when withdrawing a claim?

No. Full repayment is mandatory under federal rules.

Does working after FRA restore early reductions?

No. Adjustments occur only up to full retirement age.

Can Congress change these rules in the future?

Yes, but any changes would require new legislation and would likely apply prospectively.