Social Security is the backbone of retirement income for millions of Americans, and 2026 is shaping up to be another year of important shifts in how those monthly checks are calculated, taxed, and adjusted. Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits is not just a policy topic; it is about how comfortably you will be able to pay for groceries, housing, and healthcare in the coming year. With inflation still a concern, medical costs edging higher, and work patterns changing in later life, understanding these four key changes can help you protect every dollar you are entitled to.

At the same time, Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits captures how different elements of the system move together: the annual cost-of-living adjustment (COLA), the full retirement age rules, the earnings limit for people who work while claiming, and the taxable wage base that determines how much of a worker’s income is subject to Social Security tax. When these four levers shift, your gross benefit, your take-home income, and even your long-term retirement plan can all be affected. The better you understand these changes now, the easier it becomes to avoid surprises when your 2026 benefit notice arrives.

Social Security in 2026

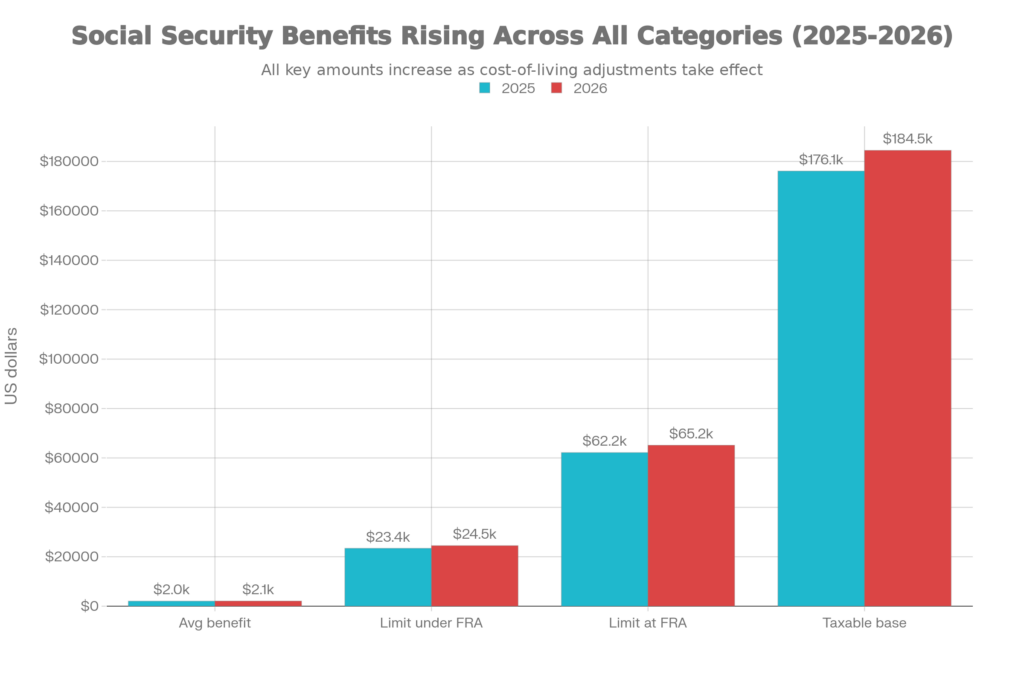

| Area | 2025 | 2026 | Practical Impact On You |

|---|---|---|---|

| COLA increase | 2.5% | 2.8% | All Social Security and SSI checks rise by 2.8%, giving the average retired worker a modest bump. |

| Average retired worker benefit | About $2,015/month | About $2,071/month | Typical retiree gets roughly $50–$60 more each month before Medicare and taxes. |

| Full retirement age (new cohort) | 66 years 10 months | 67 years | You must wait longer for an unreduced benefit or accept a bigger cut if you file at 62. |

| Earnings limit (under full retirement age) | Around $23,400/year | Around $24,480/year | You can work and earn a bit more before temporary withholding applies. |

| Earnings limit (reaching full retirement age) | Around $62,160/year | Around $65,160/year | Higher limit gives near‑retirees more space to earn without heavy benefit reductions. |

| Social Security taxable wage base | $176,100 | $184,500 | High earners pay payroll tax on more income, supporting higher potential benefits later. |

Social Security In 2026: Four Important Changes That Will Affect Monthly Benefits

Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits can be thought of as four main questions:

- How much more will your monthly check go up because of COLA?

- How does the full retirement age affect the size of your benefit?

- How much can you earn from work without losing part of your check in 2026?

- How do changes in the taxable wage base and related rules affect current workers and future retirees?

Each of these changes touches a different group: current retirees, people planning to claim soon, workers who want to stay employed while collecting benefits, and high earners paying into the system today. Taken together, they decide whether you actually feel a real raise in 2026 or just see numbers go up on paper while costs and deductions quietly eat away most of the gain.

Increase In Social Security Benefits

- The first big change coming with Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits is the new cost-of-living adjustment. COLA is designed to keep your benefit roughly in line with inflation so that rising prices do not silently erode your buying power year after year. For 2026, the adjustment lifts the average retired worker’s benefit to just over the two-thousand-dollar mark each month.

- In practical terms, that means most retirees will see a modest increase in their monthly check, usually in the range of a few dozen dollars rather than hundreds. That extra amount can help cover higher bills at the supermarket, rising utility costs, or an increase in property taxes. However, it is important to remember that COLA is not a bonus or gift; it is meant to keep you from falling behind when everyday expenses go up.

Alteration In Full Retirement Age

- The second major change is the continued shift in full retirement age, often abbreviated as FRA. For those turning 62 in the next few years, full retirement age is now effectively 67. This matters because your FRA is the reference point the Social Security Administration uses to decide whether your monthly benefit is reduced or increased. If you claim before FRA, your check is reduced permanently; if you delay beyond FRA, your benefit grows each year until age 70.

- With FRA locked in at 67 for the new cohort in 2026, claiming at 62 now leads to a larger permanent cut than it did for earlier generations whose FRA was 65 or 66. This is one of the subtle but powerful aspects of Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits. It pushes you to think more carefully about whether you can afford to wait, especially if you have other income sources, good health, and a family history of longer lifespans.

Increased Earnings While Receiving Benefits

- The third key change involves how much you can earn from work while receiving Social Security before reaching full retirement age. Many people ease into retirement with part-time work or a side job, and the earnings test rules decide how that income affects your check. In 2026, the earnings limit for those under FRA all year edges up, allowing you to earn a bit more without triggering benefit withholding.

- Here is how it works in simple terms: if you are under full retirement age for the entire year and your job income stays below the annual limit, your Social Security benefit is paid in full. If you go over that limit, the Social Security Administration temporarily withholds part of your benefit, typically one dollar for every two dollars you earn above the threshold. Once you reach full retirement age, the test no longer applies, and your benefit is recalculated to credit back those withheld months so it is more of a timing issue than a permanent loss. For people approaching retirement, this is one of the most important practical angles of Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits.

Higher Tax Contributions For Current Workers

The fourth major change that shapes Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits is the increase in the Social Security taxable wage base. This is the maximum amount of your earnings that are subject to the 6.2% Social Security payroll tax. In 2026, that ceiling climbs again, meaning higher‑earning workers and their employers will pay Social Security tax on a larger share of their paychecks.

For someone earning below the cap, this change might not be noticeable. But for people who consistently earn near or above that wage base, it means a bit more money going into the system now, and the potential for somewhat higher benefits later, since Social Security uses your taxed earnings history to calculate your eventual benefit. It is another reminder that the program is constantly adjusting under the surface as wages, inflation, and demographics shift.

How To Adjust Your Strategy For 2026

With all four of these levers moving at once, 2026 is a smart time to revisit your Social Security strategy. Start by looking at your estimated benefit and asking a few key questions:

- Do you plan to keep working, and if so, will your income cross the new earnings limit?

- Are you deciding between claiming now or waiting a year or two, especially with full retirement age set at 67 for your age group?

- How will the new COLA and any Medicare premium changes affect the net amount you actually receive each month?

For many people, coordinating Social Security with savings, part‑time work, and pensions offers more value than focusing on any single number. A slightly higher check in 2026 will help, but the bigger gains often come from choosing a smart claiming age, controlling taxes in retirement, and avoiding unnecessary benefit withholding. Thinking through Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits in this way turns a set of abstract rules into a practical plan.

December 18 Payments Explained: Who Is Receiving the $1000 Checks

Common Mistakes To Avoid In 2026

A few recurring mistakes can quietly cost retirees money when rules change:

- Claiming early without understanding how much the permanent reduction will be compared with waiting closer to full retirement age.

- Ignoring the earnings test, taking on extra work, and then being shocked when checks are temporarily reduced.

- Looking only at the gross benefit increase from COLA and overlooking higher Medicare premiums or taxes that shrink the net amount.

Avoiding these pitfalls starts with reading your annual benefit notice carefully and, ideally, logging into your online Social Security account to see updated estimates. If your situation is complex such as having a younger spouse, a pension from non‑covered work, or plans to work heavily in your 60s it can be worth speaking with a financial planner who understands the 2026 rules in detail.

FAQs on Social Security in 2026

Will my Social Security check definitely go up in 2026?

For most people, yes. The 2026 COLA raises all types of Social Security benefits, including retirement, survivor, disability, and SSI.

Does working in 2026 mean I will lose my Social Security benefits?

You do not lose your benefits permanently, but if you are under full retirement age and earn over the annual earnings limit, part of your benefit can be withheld temporarily.

How does the higher full retirement age affect me?

With full retirement age effectively at 67 for newer retirees, claiming at 62 now means a larger permanent reduction than it did for earlier generations.

How can I make the most of Social Security in 2026: Four Important Changes That Will Affect Monthly Benefits?

Start by reviewing your updated benefit amount, then factor in expected Medicare costs, taxes, and any work income.