The Social Security Increase will raise Social Security benefits for nearly 75 million Americans in 2026, following a formal announcement by the Social Security Administration (SSA). The 2.8 % increase reflects inflation levels recorded through September 2025 and will automatically adjust retirement, disability and Supplemental Security Income (SSI) payments.

Beneficiaries have been advised to update their information, verify direct deposit details and monitor their earnings to ensure they receive the full adjusted amount without delays.

Understanding the Social Security Increase Increase for 2026

The SSA confirmed that the 2026 benefit adjustment will be 2.8 %, affecting retirement, disability and survivor beneficiaries. According to the official press release, the average monthly retirement benefit will rise by about US$56, bringing typical payments from roughly US$1,998 to US$2,054. (SSA Press Release, 24 October 2025)

Why COLA Adjustments Matter

Cost-of-living adjustments (COLA) are designed to protect retirees and disabled workers against inflation. The index used—the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W)—reflects price changes for essential goods and services, including healthcare, housing, food, transport and utilities.

Updated 2026 Income Thresholds

Following standard annual adjustments, the SSA will update income eligibility limits:

- The maximum taxable earnings limit increases to US$184,500.

- The earnings test limit for beneficiaries under full retirement age (FRA) increases to US$24,480.

- For those reaching FRA during 2026, the limit becomes US$65,160.

These thresholds determine whether benefits will be withheld due to employment income.

Why Action Is Necessary Even Though the Increase Is Automatic

Many beneficiaries assume they need not take any action because COLA updates are automatic. However, administrative issues—incorrect banking details, unreported income, outdated personal information or unmonitored notices—can disrupt the payment.

Administrative Accuracy Reduces Delays

The SSA has recorded increasing numbers of misdirected payments linked to outdated bank accounts and mailing addresses. Such errors can delay benefits for weeks or months.

Income Reporting Matters for Working Beneficiaries

Those working while receiving benefits must report estimated earnings annually. Failing to do so may result in overpayments, which the SSA can reclaim, reducing future payments.

Ensure You Receive the Updated Payment

This section provides a comprehensive guide covering administrative, financial and personal updates.

1. Log into or Create Your “my Social Security” Account

All beneficiaries are urged to maintain an active SSA online account.

Benefits include:

- Immediate access to COLA notices

- Direct messaging from the SSA

- Ability to update details without office visits

- Secure access to benefit estimates and payment information

The SSA confirms COLA notices for 2026 will appear online by late November 2025 for most recipients.

2. Update Banking or Direct Deposit Information

Ensure your:

- Account number

- Routing number

- Bank name

- Payment method preferences

are correct.

Switching to direct deposit is strongly recommended as it:

- Prevents lost checks

- Enables faster access to funds

- Reduces fraud risk

3. Verify Personal Information

Notify SSA immediately if any of the following have changed:

- Address

- Legal name following marriage/divorce

- Household changes

- Disability status

- Dependents or auxiliary beneficiaries

Incorrect records can affect your payment category or the amount of your monthly benefit.

4. Estimate and Report Work Income for 2026

Working beneficiaries below FRA must report estimated annual earnings.

The SSA may withhold US$1 for every:

- US$2 earned above US$24,480 (under FRA)

- US$3 earned above US$65,160 (reaching FRA in 2026)

Failure to update earnings may force the SSA to:

- Reclaim excess payments

- Reduce future deposits

- Delay COLA processing

Financial planners recommend reporting early for administrative accuracy.

5. Review Your COLA Notice Carefully

Your COLA statement includes:

- New monthly benefit

- Medicare Part B deductions

- Credits, offsets or garnishments

- Adjusted earnings limits

- Payment schedule

If there is any discrepancy, contact the SSA within 30 days.

6. Stay Alert to Scams and Fraud Attempts

The SSA warns of substantial increases in scam attempts following COLA announcements.

Fraud indicators include:

- Requests for personal data via phone calls

- Threatening messages demanding immediate payment

- Emails claiming issues with your COLA update

- Fake websites mimicking SSA portals

The SSA will never:

- Ask for bank information by phone

- Request gift cards or cash

- Threaten arrest

Use only official SSA channels for communication.

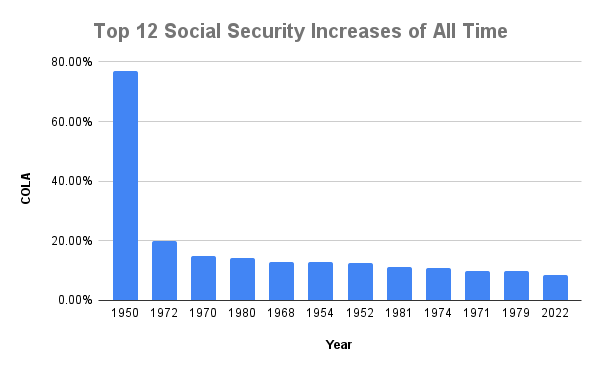

How the 2026 Increase Compares to Recent Years

The 2026 adjustment is moderate when compared to high-inflation years.

| Year | COLA % | Economic Context |

|---|---|---|

| 2022 | 5.9% | Post-pandemic inflation surges |

| 2023 | 8.7% | Highest COLA in four decades |

| 2024 | 3.2% | Moderation amid slower inflation |

| 2025 | 2.6% | Continued inflation cooling |

| 2026 | 2.8% | Modest inflation rebound |

Experts note that while inflation has stabilised, the cost of essentials has remained elevated, especially for older Americans.

How the Increase Affects Medicare and Taxes

Medicare Part B Premium Interaction

Many beneficiaries worry that rising Medicare Part B premiums will absorb the COLA increase.

While the 2026 premium has not yet been announced, retirees should expect:

- Modest increases based on healthcare inflation

- Possible reduction in net COLA benefit

Taxation of Benefits

Some beneficiaries may enter higher tax brackets because of higher income thresholds.

Up to 85 % of Social Security income may be taxable for individuals with significant additional income.

Expert Analysis: What the Increase Means for Retirees

Dr Elaine Roberts, economist at the University of Michigan, explains:

“The 2026 COLA reflects a stabilising economy, but seniors still face higher-than-average inflation in areas such as healthcare and housing.”

Mark Herrera, policy analyst at AARP, adds:

“Beneficiaries must focus on administrative preparedness. A COLA only provides value when received correctly.”

These insights emphasise the dual importance of policy and personal responsibility.

Broader Policy Context: Social Security’s Long-Term Outlook

Trust Fund Sustainability

The Social Security Trustees’ Report projects that the retirement trust fund may become depleted around 2033, prompting debates around:

- Payroll tax adjustments

- Retirement age changes

- Benefit formula revisions

While this provides short-term stability, long-term structural reforms remain unresolved.

Role of Inflation Policy

The 2026 COLA mirrors the broader inflation moderation seen across the U.S. economy.

Experts caution that future COLAs may remain modest unless another inflation surge occurs.

Related Links

Deadline Today — Octapharma Data Breach Claims Worth Up to $5,000 Close Shortly

New York Residents May Receive $400 Payments — Full Eligibility Details Inside

Checklist: What To Do Before January 2026

- Create or update your “my Social Security” account

- Verify direct deposit details

- Update personal information

- Report work income for 2026

- Review COLA notice immediately

- Monitor Medicare premium updates

- Protect yourself from scams

- Track January 2026 payment deposit date

The Social Security Increase for 2026 will provide essential financial relief, though challenges such as healthcare costs, inflation volatility and long-term trust-fund pressures remain.

Beneficiaries can maximise their benefit by proactively updating their information, monitoring their accounts and understanding the broader implications of the COLA. Completing the recommended steps now will help ensure a smooth transition into the 2026 payment cycle.