Millions of Americans will receive Social Security January 14 payments as part of the federal program’s regular monthly distribution schedule, with checks reflecting the newly applied 2026 cost-of-living adjustment (COLA). The payments follow long-standing rules established by the Social Security Administration and represent the first full month in which higher benefit amounts reach many retirees, people with disabilities, and survivors.

Social Security January 14 Payments

| Key Fact | Detail |

|---|---|

| January 14 payment group | Beneficiaries born on the 1st–10th of any month |

| 2026 COLA | 2.8% increase applied to January payments |

| Programs affected | Retirement, disability, survivor, spousal, and SSI benefits |

| Payment method | Direct deposit or Direct Express card for most recipients |

How Social Security January Payments Are Scheduled

Social Security benefits are paid under a staggered system designed to manage administrative volume and reduce delays. Rather than sending all payments on a single day, the Social Security Administration distributes funds across multiple dates each month.

For the majority of beneficiaries, payment timing depends on date of birth, not benefit type or income level. This system applies to retirement, disability (SSDI), survivor, and spousal benefits.

Under this schedule, recipients born between the 1st and 10th of any month receive their benefits on the second Wednesday. In January 2026, that date falls on January 14.

Beneficiaries born between the 11th and 20th are paid the third Wednesday, while those born between the 21st and 31st are paid the fourth Wednesday.

Why the Wednesday System Exists

The current Wednesday-based schedule was implemented in the late 1990s to improve efficiency and reliability. Before that change, most beneficiaries were paid on the same day, creating processing bottlenecks and a higher risk of delays.

Spreading payments across multiple weeks allows the system to handle deposits more smoothly, especially as the number of beneficiaries has grown to tens of millions nationwide.

Who Is Paid Earlier

Not all recipients follow the Wednesday schedule. Two groups typically receive payments at the start of the month.

First, individuals who began receiving Social Security benefits before May 1997 continue to be paid early under the older system. Second, recipients of Supplemental Security Income (SSI)—a needs-based program for people with limited income and resources—are generally paid on the first of each month.

When the first falls on a weekend or federal holiday, payments are issued earlier. In January 2026, New Year’s Day prompted an adjusted payment date for SSI recipients, resulting in late-December disbursements.

These early payments also reflect the 2026 COLA, even though they arrive before the calendar year formally begins.

How the 2026 COLA Affects January 14 Payments

The 2026 cost-of-living adjustment increases Social Security benefits by 2.8 percent, automatically raising monthly payments without requiring beneficiaries to take action.

The COLA is applied uniformly across benefit categories, meaning retirement, disability, survivor, and spousal benefits all rise proportionally. SSI federal payment limits are also adjusted upward.

For a typical retired worker, the increase amounts to roughly $50 to $60 per month, though actual figures vary depending on work history, earnings record, and benefit type.

Why COLA Is Applied in January

Although the COLA is announced in the fall, it takes effect with January payments. For many beneficiaries, January 14 is the first opportunity to see the higher amount reflected in their deposit.

The increase is permanent and becomes part of the baseline benefit used to calculate future adjustments.

How the COLA Is Calculated

The COLA is based on inflation data measuring changes in consumer prices over time. Specifically, it reflects price movements in goods and services such as food, energy, housing, and transportation.

The adjustment is designed to preserve purchasing power for people living on fixed incomes. When inflation rises, the COLA increases benefits. When inflation is low, adjustments are smaller or, in rare cases, nonexistent.

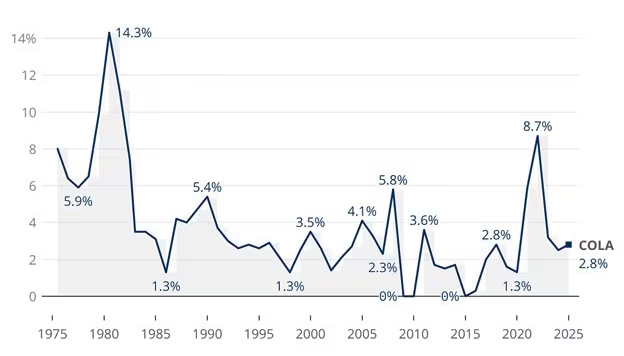

The 2.8 percent adjustment for 2026 follows several years of elevated inflation, though it is lower than some recent increases driven by post-pandemic price surges.

Why the COLA Matters to Beneficiaries

For many recipients, Social Security is not supplemental income but a financial foundation. A substantial share of retirees rely on Social Security for at least half of their monthly income, while a significant portion depend on it for nearly all of their earnings.

Even modest increases can help offset rising costs for essentials such as groceries, utilities, and prescription drugs.

However, some advocacy groups argue that the COLA does not fully reflect the spending patterns of older Americans. Healthcare costs, in particular, often rise faster than general inflation, placing added pressure on retirees and people with disabilities.

Interaction With Medicare and Other Deductions

While the COLA increases gross benefit amounts, some recipients may see a smaller net increase due to deductions.

Medicare Part B premiums are commonly deducted directly from Social Security payments. If premiums rise, part of the COLA may be absorbed by higher healthcare costs.

The “hold harmless” provision protects many beneficiaries from seeing a reduction in their net payment, but it does not apply to everyone, particularly higher-income recipients or those newly enrolled in Medicare.

Payment Methods and Reliability

Most beneficiaries receive payments through direct deposit, which is widely considered the safest and fastest option. Others use the Direct Express debit card, designed for recipients without traditional bank accounts.

Paper checks are still issued in limited cases, though they are increasingly rare and more susceptible to delays.

Payments typically arrive overnight on the scheduled date, though processing times can vary slightly depending on the financial institution.

Common Issues Beneficiaries Encounter

Although most payments are delivered on time, some recipients experience delays due to outdated banking information, address changes, or administrative reviews.

Incorrect deposits are often resolved within a few business days once reported. Beneficiaries are advised to wait at least one full business day before contacting the Social Security Administration if a payment does not appear.

Maintaining updated contact and banking details is one of the most effective ways to avoid disruptions.

What Beneficiaries Should Do Now

Recipients should review their updated benefit amounts ahead of January payments, particularly if they rely on Social Security to meet fixed monthly obligations.

Budgeting for the year ahead can help account for inflation-sensitive expenses such as utilities, insurance premiums, and medical costs.

Beneficiaries may also wish to retain their annual benefit notice for tax planning and record-keeping purposes.

Broader Context: Social Security’s Financial Outlook

The January 14 payments and the 2026 COLA arrive amid ongoing debate about the long-term financial health of the Social Security program.

Demographic shifts, including an aging population and lower birth rates, are placing increased strain on the system. Policymakers continue to discuss potential changes, ranging from tax adjustments to benefit formula revisions.

No immediate changes affect January payments, but the broader discussion underscores the importance of the program to millions of households.

Maximum Social Security Benefit 2026 – The Exact Income Level You Need to Reach the Top Payment

Looking Ahead

As recipients receive their January 14 payments with the COLA applied, attention will soon turn to broader economic trends and how inflation evolves throughout the year.

For now, the adjustment provides incremental relief, reinforcing Social Security’s role as a stabilizing force for retirees, people with disabilities, and survivors navigating a changing economic landscape.

FAQs About Social Security January 14 Payments

Who receives Social Security on January 14?

Beneficiaries born between the 1st and 10th of any month, excluding early-payment groups.

Does SSI follow the same schedule?

No. SSI is typically paid at the start of the month and follows separate timing rules.

Does the January 14 payment include the 2026 COLA?

Yes. All January 2026 payments reflect the 2.8 percent cost-of-living adjustment.

Will everyone see the same dollar increase?

No. The increase is percentage-based, so higher benefits receive larger dollar increases.