As millions of Social Security recipients prepare for 2026, several important updates are set to impact their monthly benefits, tax obligations, and healthcare costs. The Cost-of-Living Adjustment (COLA), Medicare premium changes, and new earnings limits all play a significant role in how much beneficiaries can expect to receive.

Understanding these changes is essential for planning and managing finances for the year ahead. Here’s everything you need to know about the 2026 updates, including the COLA increase, payment schedules, and potential tax implications.

What is the COLA Increase for 2026?

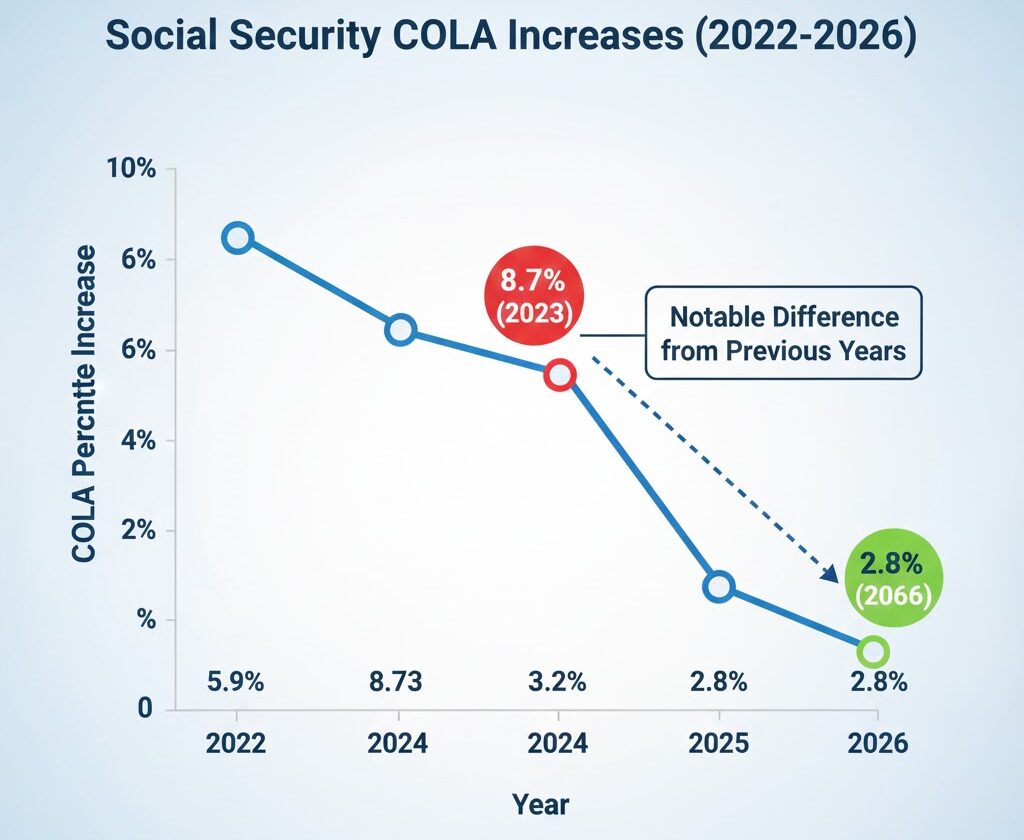

In 2026, Social Security beneficiaries will see a 2.8% Cost-of-Living Adjustment (COLA), which is designed to help benefits keep pace with inflation. COLA is calculated annually based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation in the economy.

For the average retired worker, this means an increase from $2,015 to $2,071 per month. For widowed spouses, the average benefit increases from $1,867 to $1,919. These adjustments are particularly important for retirees who rely on Social Security as their main income source, helping them cope with rising costs of goods and services, such as healthcare and housing.

- SSI recipients will also see a similar adjustment under the 2.8% COLA increase.

This 2.8% increase marks a relatively modest COLA compared to some of the larger adjustments in previous years, but it still helps maintain purchasing power in the face of ongoing inflation.

Social Security Payment Schedule for 2026

Social Security benefits are typically paid on a set schedule, based on the recipient’s birth date. The schedule for 2026 is as follows:

- Born between the 1st and 10th of the month: Payments will be made on the second Wednesday of each month.

- Born between the 11th and 20th of the month: Payments will be made on the third Wednesday.

- Born between the 21st and 31st of the month: Payments will be made on the fourth Wednesday.

Additionally, Supplemental Security Income (SSI) payments often arrive earlier than usual, with some recipients receiving their 2026 SSI benefits on December 31, 2025, due to holiday scheduling. This is particularly relevant for those who may rely on SSI to cover basic living expenses.

Earnings Limits and Tax Implications for 2026

For many working retirees, 2026 will bring higher earnings limits, affecting how much of their Social Security benefits are withheld based on earned income.

- Maximum Taxable Earnings: The earnings subject to Social Security tax will increase to $184,500 (up from $176,100 in 2025). This means higher earners will contribute more to the system through payroll taxes.

- Earnings Limit for Working Beneficiaries: For individuals under Full Retirement Age (FRA), the earnings limit will rise to $24,480. If you exceed this amount, $1 will be withheld for every $2 you earn above the limit.

- Higher Earnings Limit for FRA: If you reach FRA in 2026, you can earn up to $65,160 before any withholding occurs. After reaching FRA, you can earn any amount without reduction in your Social Security benefits.

These changes are critical for beneficiaries who plan to continue working while receiving Social Security benefits. It’s important to track earnings carefully to avoid benefit reductions.

Rising Medicare Premiums in 2026: What You Need to Know

While COLA increases help boost Social Security benefits, Medicare premiums often offset part of that increase. In 2026, Medicare Part B premiums will rise to $202.90 per month, up from $185.50 in 2025.

- Medicare Part B covers outpatient services, doctor visits, and preventive care. The deductible for Part B services will also increase, meaning beneficiaries will have to pay more out-of-pocket before Medicare begins to cover costs.

Although the increase in Part B premiums impacts many beneficiaries, it’s especially significant for those with lower Social Security benefits, as the higher premium will take up a larger percentage of their increase. Additionally, some recipients may see their net Social Security benefits reduced due to these premium hikes.

For those enrolled in Medicare Part D (prescription drug coverage), premiums and deductibles may also see changes, affecting how much individuals pay for their medications.

Special Groups: How Will They Be Affected?

Different Social Security beneficiaries will experience the changes in varying ways. Here’s how some specific groups are impacted:

- Widows and Widowers: In 2026, survivor benefits will see similar COLA increases. For a widow or widower receiving Social Security benefits, the 2.8% COLA means a modest boost in monthly payments.

- Disabled Workers: The 2.8% COLA will also apply to disabled workers receiving Social Security Disability Insurance (SSDI). For disabled beneficiaries who depend on Social Security as their main income source, the COLA increase is crucial for keeping up with rising living costs.

Understanding the specifics of how COLA impacts these groups is essential for financial planning.

What Else Should Recipients Watch in 2026?

- State-Specific Adjustments: Social Security benefits may be subject to state taxes. Some states, such as California, do not tax Social Security benefits, while others, like Nebraska, may tax them. It’s important to check your state’s tax laws to understand how they could affect your Social Security income.

- Filing and Benefit Age: If you plan to delay your Social Security benefits beyond your Full Retirement Age (FRA), you could receive delayed retirement credits, which increase your benefits by up to 8% per year.

- Long-Term Program Sustainability: While the COLA increase helps now, long-term Social Security sustainability remains an issue. As the U.S. population ages, Social Security’s trust fund is projected to deplete by 2034, leading to potential benefit cuts. Policymakers are likely to propose reforms to address these challenges, but beneficiaries should be aware of potential changes in the future.

Related Links

Social Security Tax Rules by State – Check Which States Will Tax Your Benefits in 2026

Planning for 2026 and Beyond

The 2026 Social Security updates — from the COLA increase to Medicare premium hikes and adjusted earnings limits — provide both opportunities and challenges for recipients. Staying informed about when payments are received, how premiums impact benefits, and understanding tax implications will be crucial for maximizing your Social Security benefits in 2026.

With the 2.8% COLA increase providing relief against inflation, beneficiaries will see some extra funds, but rising healthcare costs and the ongoing debate about Social Security’s long-term sustainability are factors recipients must also plan for.

By keeping up to date with these updates, Social Security recipients can better manage their finances and anticipate changes.