As nontraditional work becomes a defining feature of the modern labor market, millions of Americans face the same question: No Formal Job? How Informal Workers Can Still Build Social Security Retirement Credits.

While Social Security is based on taxed earnings, experts say informal, gig, and cash-based workers can still qualify for retirement benefits—if they take deliberate steps to formalize their income.

Social Security Retirement Credits

| Key Fact | Detail |

|---|---|

| Credits required | 40 lifetime credits qualify most workers for retirement |

| How credits are earned | Income subject to Social Security taxes |

| Common risk | Unreported income earns no credits |

The Rise of Informal Work in the United States

Informal work—once associated mainly with cash-based jobs—now spans a broad range of activities. Freelancers, app-based gig workers, home caregivers, tutors, artists, and small-scale entrepreneurs often earn income outside traditional payroll systems.

Labor researchers note that while informal work offers flexibility, it often lacks built-in protections such as retirement benefits. Social Security, however, does not exclude informal workers outright. Instead, it relies on a single criterion: whether income is reported and taxed.

How Social Security Retirement Credits Work

The retirement system administered by the Social Security Administration assigns credits based on covered earnings. Workers earn credits by reaching an annual earnings threshold, which is adjusted each year.

A worker can earn up to four credits per year. Most people need 40 credits—roughly 10 years of work—to qualify for retirement benefits. Once earned, credits do not expire for retirement purposes.

Why Informal Income Often Falls Through the Cracks

The most common reason informal workers fail to earn credits is simple: their income is never reported. Cash payments, side jobs, or freelance work that is not declared on tax returns does not trigger Social Security taxes. As a result, the income never appears in the worker’s earnings record.

Retirement advocates say many workers discover these gaps only when they apply for benefits decades later, at which point correcting records can be difficult.

The Primary Path: Self-Employment Income

Turning informal work into covered earnings

Self-employment is the most common route for informal workers to earn credits. When workers report net self-employment income, it becomes subject to Self-Employment Contributions Act (SECA) taxes.These taxes cover both the employee and employer share of Social Security and Medicare. Paying them ensures the income counts toward retirement credits.

According to the Internal Revenue Service, even modest self-employment earnings can generate credits if they meet the annual threshold.

Gig Economy Workers: What Counts and What Doesn’t

Platform-based workers often receive 1099 tax forms rather than W-2s. This classification means no payroll taxes are withheld automatically. Gig income counts toward Social Security only if workers:

- File tax returns reporting that income

- Pay SECA taxes

- Maintain accurate income records

Failing to complete these steps leaves workers outside the Social Security system, regardless of how many hours they work.

Real-World Scenarios: How Informal Workers Build Social Security Retirement Credits

Case 1: A freelance graphic designer

A designer earning $15,000 annually through freelance projects reports income and pays SECA taxes. Each year, she earns the maximum four credits.

Case 2: A caregiver paid in cash

A caregiver paid informally by a household earns income but does not report it. Despite years of work, she earns no credits until income is formally reported.

These examples highlight that eligibility depends not on job type, but on reporting and taxation.

Disability and Survivor Benefits for Informal Workers

Social Security retirement is not the only program affected by credits. Disability and survivor benefits also rely on covered earnings. Workers with insufficient credits may be ineligible for disability benefits if illness or injury prevents future work.

Similarly, survivors may receive reduced or no benefits if the deceased worker lacked sufficient credits. This risk underscores why early and consistent reporting matters.

Spousal and Caregiver Considerations

Some informal workers may qualify for benefits based on a spouse’s earnings record. Spousal benefits can provide retirement income even if the individual has limited work history. However, these benefits depend on marital status, duration of marriage, and the spouse’s eligibility.

Informal caregiving work itself does not generate credits unless paid and reported. Advocates have long argued that unpaid caregiving disproportionately affects women’s retirement security.

Military, Religious, and Excluded Employment

Certain forms of work fall outside standard Social Security coverage. Some religious groups opt out, and specific categories of employment have unique rules.

Military service generally counts toward Social Security, even though it operates under separate systems. Workers with mixed employment histories should review their records carefully to understand how different periods are credited.

Fixing Missing or Incorrect Earnings Records

The SSA allows workers to correct earnings records, but documentation is required. W-2s, tax returns, or business records can be used as proof. Experts recommend checking earnings statements regularly. Errors become harder to fix as time passes, especially if records are lost.

Fraud and Misinformation Risks

As awareness grows, so do scams. The SSA warns against individuals or services claiming they can “buy” Social Security credits or enroll workers without reported income. No legitimate mechanism exists to purchase credits directly. Credits can only be earned through taxed income.

Policy Debate and the Future of Informal Work

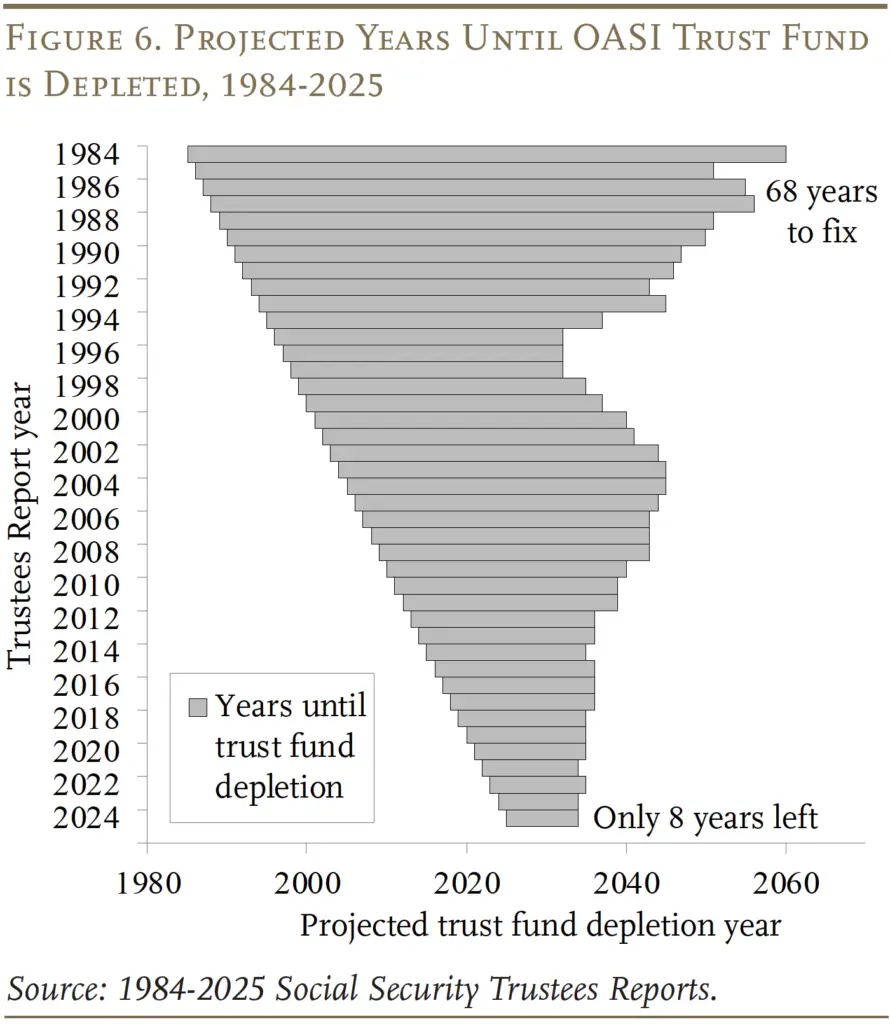

Policymakers continue to debate how to adapt Social Security to a changing labor market. Some proposals would simplify reporting or expand coverage for nontraditional workers. For now, the system remains earnings-based. Responsibility rests largely with workers to ensure their income is formalized.

Retirement Planning Beyond Social Security

Even with sufficient credits, Social Security typically replaces only part of pre-retirement income. Informal workers often rely more heavily on personal savings. Individual retirement accounts, simplified pension plans, and other savings vehicles can supplement Social Security, though they do not generate credits.

Related Links

Social Security Retirement Age Shift Begins in 2026 — What Future Retirees Should Know

As informal work reshapes the American economy, understanding how Social Security credits are earned has become essential. While the system favors reported income, it still offers flexible paths for workers without formal jobs—provided they take proactive steps to formalize earnings and protect long-term retirement security.

FAQs About Social Security Retirement Credits

Can volunteer or unpaid work earn credits?

No. Only income subject to Social Security taxes counts.

Is there an age limit for earning credits?

No. Credits can be earned at any age with taxable earnings.

Do credits ever expire?

For retirement benefits, credits do not expire once earned.