The death of a spouse is an emotionally and financially challenging event, and navigating the rules of Social Security survivor benefits can be overwhelming. For many widows and widowers, Social Security survivor benefits can offer much-needed financial support, but there are critical changes to the rules that survivors must be aware of.

From eligibility age to timing and strategic claiming decisions, understanding these changes can mean a significant difference in the survivor’s long-term financial well-being.

This article outlines 11 important changes to the Social Security survivor rules that are often missed by widows and widowers. It also provides practical insights to help beneficiaries avoid mistakes and ensure they are maximizing their survivor benefits.

Social Security Survivor Rules

| Key Fact | Details |

|---|---|

| Eligibility for Survivor Benefits | Widows and widowers can start receiving benefits as early as age 60 (age 50 if disabled). |

| Changes to Survivor Benefit Claiming Age | Full survivor benefits available at full retirement age (FRA), which ranges from 66-67. |

| Increased Payment Amounts | Widows and widowers can claim up to 100% of the deceased spouse’s benefit at FRA. |

| Windfall Elimination Provision (WEP) Repeal | The WEP now no longer reduces benefits for many widows/widowers with government pensions. |

| Divorce Rules for Survivor Benefits | Divorced spouses may claim benefits if they were married for at least 10 years and are unmarried. |

Understanding Social Security Survivor Benefits

When a spouse dies, the surviving partner is often left trying to understand how to navigate the complex world of Social Security survivor benefits. The rules around eligibility, timing, and payment amounts can be complex, but it is crucial to understand how these changes may impact your financial future.

Widows and widowers may be unaware of the subtle but important rules and changes that influence Social Security survivor benefits.

This article will break down 11 important rules and changes that many widows and widowers often miss, as well as offer financial planning tips and strategies to ensure survivors get the maximum benefit available.

11 Key Survivor Benefit Rules and Recent Changes

1. You Can Claim Survivor Benefits as Early as Age 60

Surviving spouses can begin claiming Social Security survivor benefits as early as age 60 (age 50 if disabled). However, claiming before Full Retirement Age (FRA) means your monthly benefit will be reduced. Claiming benefits earlier results in a permanent reduction in monthly payments.

For example, if you start claiming at age 60, you’ll receive about 71.5% of your deceased spouse’s benefit amount, instead of the full 100% at FRA.

2. Full Survivor Benefits Are Available at Full Retirement Age (FRA)

If you wait until your full retirement age (FRA) to claim survivor benefits, you’ll be eligible for 100% of your deceased spouse’s Social Security benefit. The FRA for survivor benefits ranges between 66 and 67, depending on your birth year.

Many survivors claim earlier because of financial pressures, but delaying benefits until FRA ensures that you receive the maximum monthly amount available.

3. Survivor Benefits Can Be More than Your Own Retirement Benefits

In cases where the deceased spouse earned more than the surviving spouse, the survivor may be eligible to receive the deceased spouse’s higher Social Security benefit. In fact, widows/widowers can receive up to 100% of the deceased spouse’s benefit, which is typically higher than their own retirement benefit.

If you are entitled to both your own retirement benefits and the survivor benefits, you can switch to the higher amount once it becomes more beneficial.

4. The Windfall Elimination Provision (WEP) No Longer Affects Many Widows/Widowers

The Windfall Elimination Provision (WEP), which reduced Social Security benefits for some individuals who also receive pensions from jobs where they did not pay into Social Security, has been repealed for many widows and widowers as part of the Social Security Fairness Act passed in January 2025.

This change means that many widows and widowers who were previously affected by this provision can now receive higher survivor benefits without reductions.

5. Divorced Spouses Can Claim Survivor Benefits

A divorced spouse may also be eligible for survivor benefits if the marriage lasted at least 10 years and the survivor is unmarried. This eligibility applies even if the deceased spouse remarried, as long as the former spouse did not remarry.

Widows and widowers are entitled to 100% of the deceased spouse’s benefits, but divorced individuals must be aware that if they remarry before age 60, they lose their eligibility for survivor benefits.

6. The $255 Lump-Sum Death Benefit

In addition to monthly survivor benefits, Social Security provides a $255 lump-sum death benefit to eligible survivors, typically paid to the widow/widower or dependent children. The benefit can be a helpful cushion in the immediate aftermath of a spouse’s death, but it must be claimed within two years of the death.

7. Survivor Benefits Can Be Stopped If You Remarry Before Age 60

If you remarry before age 60, you typically lose eligibility for survivor benefits. However, if you remarry after age 60 (or 50 if disabled), your survivor benefit will not be affected, and you can continue receiving benefits. It’s important for widows and widowers to be aware of this rule when considering remarriage.

8. Caregivers for Children Can Qualify for Survivor Benefits at Any Age

A surviving spouse who is caring for a child under age 16 (or a disabled child) can receive survivor benefits at any age, regardless of their own age. This rule ensures that the surviving parent receives critical financial support while caring for the child.

9. Survivor Benefits Are Impacted by Earnings While You Work

If you are under full retirement age and working while receiving survivor benefits, your monthly payment may be reduced if your earnings exceed a certain threshold. For 2026, this threshold is $21,240. For every $2 you earn over this limit, Social Security will withhold $1 of your benefits.

10. Children’s Survivor Benefits Stop at Age 18

Children who are receiving survivor benefits will typically stop receiving them when they turn 18, unless they are still in high school, in which case they can receive benefits until age 19. Disabled children, however, may be eligible to continue receiving survivor benefits indefinitely, as long as they remain disabled.

11. Survivor Benefits Can Be Maximized with Strategic Timing

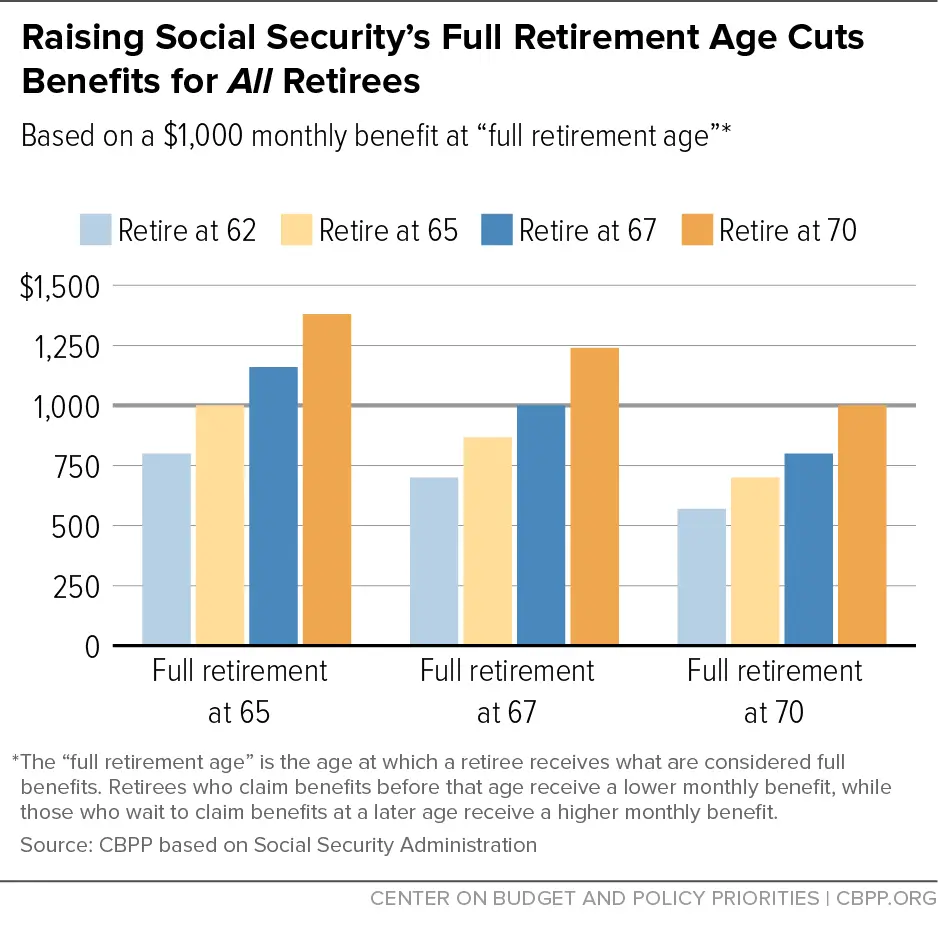

Widows and widowers can maximize their survivor benefits by strategically timing when to claim. For example, it may be beneficial to claim survivor benefits first and delay claiming your own retirement benefits until age 70, when your retirement benefit will reach its maximum amount due to delayed retirement credits.

Survivors can also switch from survivor benefits to their own retirement benefits once they surpass the survivor benefit amount, increasing their lifetime income.

Common Mistakes and Misunderstandings About Survivor Benefits

Failing to Plan for Survivor Benefits

One common mistake is claiming survivor benefits too early, which reduces the monthly benefit amount. It’s critical to understand the trade-off between early claiming and waiting for full retirement age (FRA) to receive the full benefit. In many cases, widows and widowers can benefit from waiting to maximize their payments.

Not Reviewing Eligibility After Remarriage

Another overlooked rule is that remarriage before age 60 typically disqualifies the surviving spouse from survivor benefits. However, remarriage after age 60 or 50 (if disabled) doesn’t affect eligibility. Widows and widowers should ensure they are fully aware of how remarriage will affect their benefits.

Related Links

Social Security Benefits Strategy – 3 Smart Steps to Increase Your Monthly Retirement Check

Social Security Payment Pause – Why No Checks Are Being Sent This Week and What Happens Next

The rules surrounding Social Security survivor benefits are intricate, and recent changes to eligibility, claiming age, and special provisions can significantly affect widows and widowers. By understanding the 11 key changes, knowing when and how to claim benefits, and planning for potential issues like earnings limits or early claims, surviving spouses can ensure they make informed financial decisions.

For many, Social Security survivor benefits are a crucial part of their financial safety net. Understanding these benefits fully can help widows and widowers maximize their financial security in the years following the loss of a spouse.

FAQs About Social Security Survivor Rules

Q1: At what age can I start claiming survivor benefits?

A1: You can begin claiming survivor benefits at age 60, but your benefits will be reduced. Full benefits are available once you reach full retirement age (FRA), which is between 66 and 67.

Q2: How does remarriage affect my survivor benefits?

A2: If you remarry before age 60, you generally lose eligibility for survivor benefits. However, remarriage after age 60 (or 50 if disabled) does not affect eligibility.

Q3: Can I receive survivor benefits if I was married for less than 10 years?

A3: No, you must have been married for at least 10 years to qualify for divorced spouse survivor benefits.