The Social Security Administration (SSA) announced that, beginning January 2026, the maximum amount of earnings subject to Social Security tax—$184,500—will rise, up from $176,100 in 2025. The change means high-income workers and employers will pay more in payroll taxes, while the tax rate of 6.2 percent remains unchanged.

Social Security Tax Cap to $184,500

| Key Fact | Detail |

|---|---|

| 2026 Social Security taxable maximum | $184,500 |

| Employee tax rate | 6.2% (unchanged) |

| Maximum employee contribution (2026) | 6.2% × $184,500 = $11,439 |

| Maximum combined (employee + employer) | $22,878 |

| Effective date | January 1 2026 |

The increase of the Social Security taxable wage base to $184,500 reflects wage growth and aims to maintain proportional contributions from higher earners. It sends a message: tax liabilities for high-wage workers will rise modestly, while the tax rate stays the same.

Although meaningful for those affected, the change alone doesn’t resolve the broader funding challenges facing Social Security. Future reforms are likely to address the rising retirement-age population and the program’s long-term sustainability.

Why the Social Security Tax Cap Is Increasing

Understanding the Social Security Tax Cap to $184500

The “Social Security Tax Cap to $184,500” here refers to the raised Social Security taxable maximum of $184,500 for 2026. The cap is adjusted annually based on changes in the national average wage index and the Social Security Act’s indexing provisions. According to the SSA, this ensures that the payroll tax base reflects rising earnings in the economy.

“This adjustment reflects steady wage gains in the U.S. economy,” said Stephen Goss, SSA Chief Actuary, in recent remarks.

“It ensures that higher-income workers continue to contribute proportionally to the system’s long-term funding.”

With this change, earnings up to the new limit will be subject to the 6.2% employee Social Security tax (and matching employer share), while earnings above remain exempt from that portion of the tax.

How Much More High Earners Will Pay

Employee Perspective

For a worker earning at least $184,500 in 2026:

- Employee pays 6.2% of $184,500 → $11,439

- Employer pays the matching 6.2% → $11,439

- Combined contribution per worker → $22,878

This represents an increase of about $521 for employees compared with the 2025 maximum of $10,918.

Self-Employed Workers

Self-employed individuals pay both the employee and employer portions (12.4%) under the Self-Employment Contributions Act (SECA). For 2026 that equals:

- 12.4% × $184,500 → $22,878

This is an increase from about $21,836 in 2025.

What It Means in Plain Terms

Effectively, if you earn above that threshold, you will pay the maximum Social Security tax earlier in the year—at the new limit—and then no further Social Security tax on earnings beyond that. The tax rate remains unchanged, but the ceiling has risen—so the dollar amount paid by those with incomes at or above the cap increases.

Who Is Affected—and Who Isn’t

The change primarily impacts high-income earners: individuals earning above $184,500 and employers who pay payroll taxes on those wages. Workers earning below the threshold see no change in their rate or structure. Moreover:

- The Medicare portion of payroll tax (1.45% each side) still applies to all earnings, with no cap.

- Additional Medicare surtax (0.9%) applies for high earners above $200,000 regardless of the Social Security cap.

Therefore, for high earners, the overall tax burden from payroll taxes slightly increases. For middle- and lower-income workers, the operational rules remain unchanged.

Real-World Impact & Planning Implications

Financial Planning Considerations

- Employers should update payroll systems to reflect the higher taxable maximum before Jan 2026.

- Workers should be aware that higher earnings mean higher Social Security tax liability up to the cap.

- Self-employed professionals should adjust estimated tax payments accordingly.

- While higher contributions modestly increase future benefit credits, the formula is progressive and the marginal boost to benefits for very high earners is small.

Benefit Calculation and Longevity

Since Social Security benefits are based in part on lifetime earnings, paying up to a higher cap could slightly raise future benefits for those who sustain high income for many years. However, the effect is muted under the current benefit formula.

“For high-earners, this means higher payments now—but the extra benefit later is relatively modest compared with the added contribution,” said Alicia Munnell, director of the Center for Retirement Research at Boston College.

Broader Policy and Long-Term Context

The cap adjustment is one of many structural levers in the Social Security system. According to the SSA’s 2025 Trustees Report, the Old-Age, Survivors, and Disability Insurance (OASDI) trust funds may be unable to pay full scheduled benefits by 2034 unless Congress acts.

Policy options include:

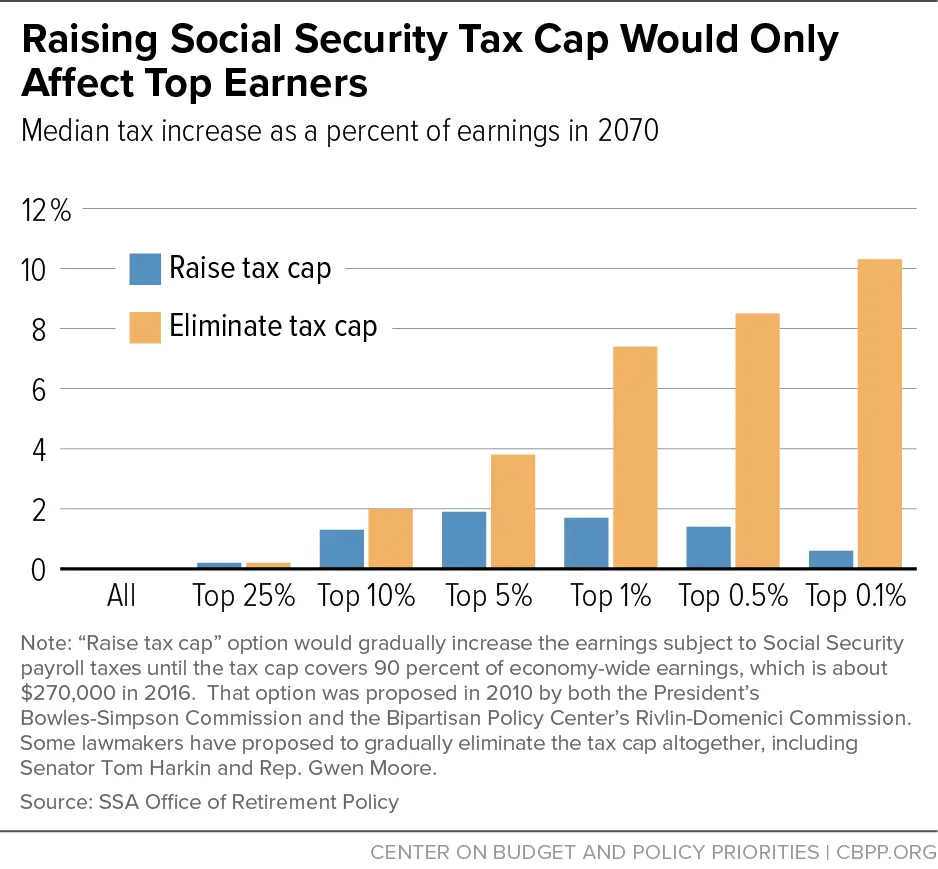

- Further raising or eventually eliminating the payroll tax cap—some models call for taxing 90% of earnings by the 2030s.

- Adjusting benefit formulas or retirement ages.

- Changing the tax rate.

The raise to $184,500 is consistent with wage-indexing law, but analysts view it as a partial measure, not a complete solution for long-term solvency.

Global Comparison

Many advanced economies index pension tax bases to wage growth or inflation. For instance, Canada and Germany increase contribution ceilings annually. The U.S. approach—adjusting the wage base annually—places it in line with global peers. Still, proposals to further increase or remove the cap reflect growing policy interest worldwide in broadening funding bases for social insurance systems.

FAQs

Q1: Does this mean all workers pay more Social Security taxes in 2026?

No. Only earnings above the previous cap of $176,100 but below the new cap of $184,500 (for high earners) increase the tax obligation. Workers earning less than $184,500 have no change in rate or ceiling.

Q2: Does this change my Social Security benefit?

Potentially slightly—higher taxed earnings up to the ceiling will be used in benefit-calculation formulas, but benefit increases will be modest relative to added contributions.

Q3: Do my Medicare taxes change?

No. The Medicare tax rate and structure remain unchanged in 2026 and apply to all earnings regardless of caps.