The Social Security Administration (SSA) has confirmed that millions of Americans will receive their monthly Social Security benefits earlier than expected in February 2026, with payments starting on February 3.

Most recipients can expect their checks to arrive by February 11, but eligibility for these payments depends on various factors, including birth dates, when benefits began, and payment methods. This article breaks down who qualifies for the early payments, how to track and receive them, and important steps to take if you notice any issues with your disbursement.

SSA Confirms Early February 2026

| Key Fact | Detail/Statistic |

|---|---|

| Who Will Get Payments Early | Payments scheduled for February 3 are being released early for many beneficiaries. |

| Who Gets Paid on February 11 | Recipients born between the 1st and 10th of the month qualify for payment on February 11. |

| Who Won’t Get Paid on February 11 | SSI recipients and those who began benefits before May 1997 will not receive payments on February 11. |

Understanding the Social Security Payment Schedule

The SSA’s payment schedule for Social Security benefits is carefully organized based on each recipient’s date of birth and benefit status. The February 2026 payment dates follow a pattern where recipients born on specific days of the month will receive their benefits on designated Wednesdays.

February 2026 Payment Dates

- February 3 — For beneficiaries who began receiving benefits before May 1997, and those who receive both Social Security and Supplemental Security Income (SSI) benefits.

- February 11 — For individuals born between the 1st and 10th of any month.

- February 18 — For individuals born between the 11th and 20th.

- February 25 — For individuals born between the 21st and 31st.

The payment schedule is part of a well-established system designed to streamline benefit distribution while keeping the financial infrastructure of the SSA and the Treasury manageable.

Who Will Receive Payments on February 11?

1. Beneficiaries Born Between the 1st and 10th of the Month

If your birth date falls between the 1st and 10th of any month, you are scheduled to receive your Social Security payment on February 11, 2026. This applies to a wide range of Social Security recipients:

- Retirement Benefits: If you are retired and receive benefits based on your own work history.

- Social Security Disability Insurance (SSDI): If you are receiving SSDI benefits due to a qualifying disability.

- Survivor Benefits: If you receive benefits based on the work record of a deceased spouse or parent.

This date is critical for many who rely on Social Security to meet everyday expenses.

Who Will Not Receive Payments on February 11?

1. Beneficiaries Who Started Receiving Benefits Before May 1997

The SSA maintains a legacy payment system for those who started receiving Social Security benefits before May 1997. These recipients receive payments on the third day of each month, so those eligible under this category received their payment on February 3, 2026.

2. Supplemental Security Income (SSI) Recipients

SSI recipients follow a separate payment schedule, with their funds being issued on the 1st of each month. If the 1st of the month falls on a weekend or holiday, SSI payments are released on the previous business day. Since February 1, 2026, was a Sunday, SSI payments were issued early on January 30, 2026.

This schedule also applies to individuals receiving both SSI and Social Security benefits. These individuals will receive their Social Security payment on their normal payment date (based on birth date), while their SSI payment was issued early.

Understanding Social Security Payment Methods

1. Direct Deposit

The SSA strongly encourages beneficiaries to use direct deposit as it is the most secure and timely method of receiving Social Security payments. Direct deposit ensures funds are transferred directly to your bank account on the scheduled payment date, eliminating delays associated with paper checks.

2. Prepaid Debit Cards (Direct Express)

For those without a bank account, the Direct Express card provides an alternative method to receive Social Security benefits. This prepaid debit card is issued by the SSA and allows beneficiaries to access their payments immediately. It’s a reliable option for those who do not want to rely on paper checks.

3. Paper Checks

While paper checks are still an option, they are increasingly discouraged due to delays in postal services. Direct deposit is both faster and more reliable, with payments arriving promptly on the scheduled dates.

What to Do If Your Payment Is Late

If you have not received your payment on the expected date, there are steps you should follow to resolve the issue:

- Wait 3 Business Days: The SSA advises waiting up to three business days for potential banking delays before raising a concern.

- Check Your Bank: Contact your bank to confirm if the payment was delayed or if there is an issue on their end.

- Verify Your Payment Date: If you’re unsure of your payment date, check the SSA’s official payment calendar or my Social Security account for confirmation.

- Contact the SSA: If the payment has not appeared after the waiting period, contact the SSA through their toll-free number at 1-800-772-1213 for assistance.

The Impact of Social Security Payments on Personal Finances

For millions of Americans, Social Security benefits represent a significant portion of their monthly income. Timely payments are crucial for paying for necessities such as rent, healthcare, food, and utilities. Missing or delayed payments can cause financial strain, especially for seniors or those living on a fixed income.

Additionally, many beneficiaries rely on the early February payments to make necessary purchases before the middle of the month. With inflation and rising costs of living, ensuring that these payments arrive on time allows recipients to plan their budgets effectively.

Social Security and the Broader Economic Context

Social Security is the cornerstone of income security for many older Americans. For approximately 40% of retirees, Social Security benefits make up at least half of their income. The 2.8% cost-of-living adjustment (COLA) implemented in 2026 is essential to maintain the purchasing power of recipients in an inflationary environment.

As of 2026, average retirement benefits are approximately $2,074.53 per month. While this amount may seem substantial, it often doesn’t cover the full cost of living in major cities or regions with high housing costs. As such, beneficiaries must make careful decisions about how to allocate their funds.

Upcoming Changes in the Social Security System

As of March 2026, the SSA is planning to implement some technology-driven improvements to enhance efficiency and customer experience. These changes are expected to streamline online services and improve the process for applying for benefits, though they will not affect the payment schedule.

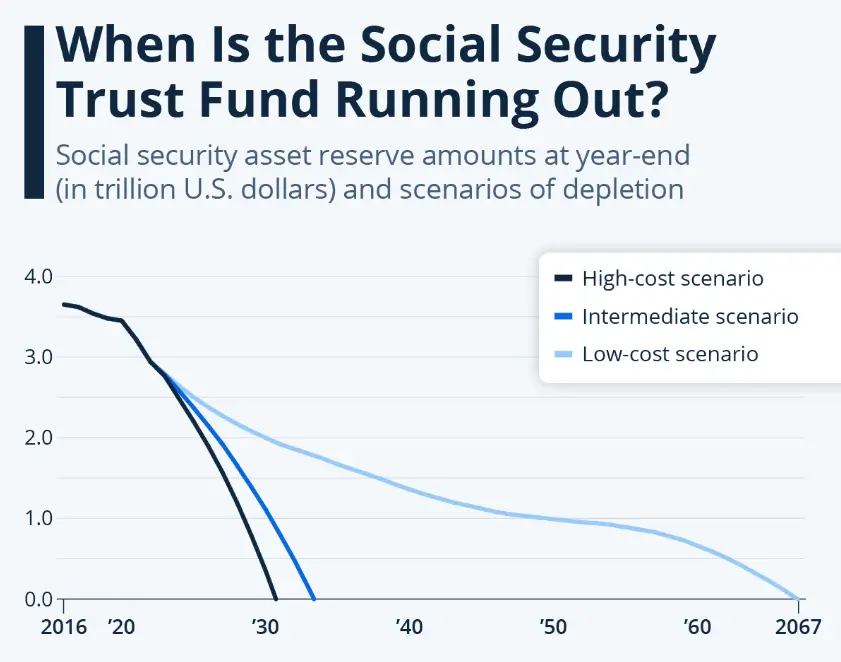

Additionally, there are ongoing legislative discussions about potential Social Security reforms aimed at addressing long-term sustainability challenges, such as increasing the payroll tax cap or adjusting the age of eligibility. Beneficiaries should keep informed about any changes that may affect their benefits in the coming years.

Related Links

More Than 100 Million Americans Now Use the My Social Security Online Portal

February 2026 Payment Rumors — Sorting Fact From Fiction on Deposits and Refunds

The early February 2026 Social Security payments provide essential support for millions of beneficiaries. Knowing when to expect your payment is critical for personal financial planning.

For those who qualify for the February 11 payment, it’s important to stay informed about your specific eligibility criteria, especially given the variations based on birth date and benefit type.

By utilizing direct deposit, keeping track of your scheduled payments, and knowing how to address payment discrepancies, Social Security recipients can ensure they are receiving their benefits on time, reducing unnecessary stress and financial disruptions.

FAQs About SSA Confirms Early February 2026 Payment

Q: What determines when my Social Security payment will be issued?

A: Your payment date is determined by your birth date and the date you started receiving benefits. Individuals born between the 1st and 10th of the month will receive their payment on February 11, 2026.

Q: What should I do if I don’t receive my payment on time?

A: Wait three business days for possible delays, then check your bank or SSA account. If the issue persists, contact the SSA.

Q: How can I receive my Social Security payments faster?

A: Direct deposit is the fastest and most reliable method. The SSA also offers a prepaid Direct Express card for those without bank accounts.