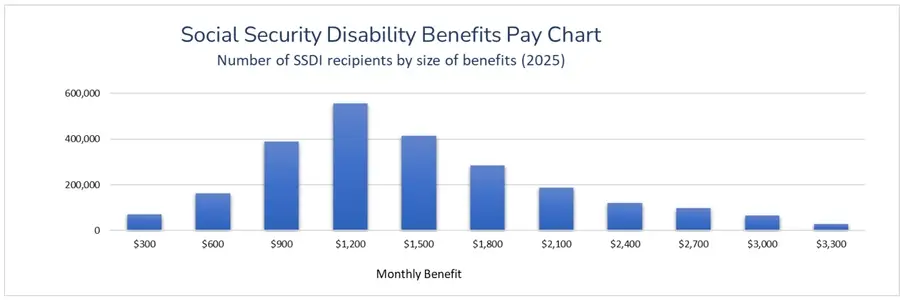

For millions of Americans who rely on Social Security Disability Insurance (SSDI), February 2026 is an important time to know exactly when your payment will arrive and how much you can expect.

With a 2.8% cost-of-living adjustment (COLA) impacting SSDI recipients this year, it’s critical to understand how these changes will affect your monthly payment, the exact deposit dates, and any potential issues that may arise.

This article provides comprehensive insights into SSDI February checks, including payment schedules, maximum benefit amounts, and more.

How SSDI Payments Are Scheduled in February 2026

Payment Dates Based on Birth Date

The Social Security Administration (SSA) uses a birth date system to determine when SSDI payments will be deposited. For those who began receiving SSDI after May 1997, payments are scheduled based on the recipient’s birthday. In February 2026, the payment dates for SSDI recipients are as follows:

- Born 1st–10th: Payment deposited on Wednesday, February 11, 2026

- Born 11th–20th: Payment deposited on Wednesday, February 18, 2026

- Born 21st–31st: Payment deposited on Wednesday, February 25, 2026

Legacy SSDI Recipients

For recipients who began receiving benefits before May 1997, the payment schedule is different. These recipients receive payments on the third of the month (or the preceding business day if the third falls on a weekend or holiday). Therefore, for February 2026, these payments will be issued on Friday, January 30, 2026.

Impact of the 2.8% COLA on SSDI Benefits

The COLA increase of 2.8% in 2026 means that SSDI recipients will see a modest increase in their monthly payments. For example, the maximum monthly SSDI benefit for individuals with long work histories will rise to $4,152.

This increase is particularly beneficial for those who rely on their SSDI benefits to meet basic living expenses, especially in light of rising inflation. However, it’s important to note that not all recipients will receive the maximum amount.

Your SSDI benefit depends on your lifetime earnings and contributions to Social Security. The average SSDI recipient will receive approximately $1,630 per month, depending on their work history and the amount they paid into Social Security over their career.

Other Forms of Financial Assistance for SSDI Recipients

In addition to SSDI, many recipients may also qualify for Supplemental Security Income (SSI), especially if they have limited income or resources. In 2026, the maximum SSI benefit is:

- $994 per month for an individual

- $1,491 per month for a couple

These additional funds can help cover the cost of living for those who are unable to work due to disabilities. For recipients who are eligible for both SSDI and SSI, their combined payments will not exceed the federal maximum.

Why Direct Deposit Is Crucial for Timely Payments

The fastest way to receive your SSDI payment is by setting up direct deposit. Payments made via direct deposit are usually processed on time and deposited directly into your bank account on the scheduled date.

Paper checks, on the other hand, can be delayed due to mailing issues, and many recipients find them less secure than electronic transfers. If you have not yet set up direct deposit, it’s recommended that you do so to avoid unnecessary delays.

You can update your payment preferences by logging into your My Social Security account or by contacting the SSA directly.

Common SSDI Payment Issues and Avoid Them

Several issues can delay SSDI payments. Here are some of the most common:

- Missing or Incorrect Direct Deposit Information: If the SSA does not have your correct bank account information, your payment will be delayed. It’s important to regularly update your information with the SSA.

- Filing Errors: Filing errors, such as incorrect names, Social Security numbers, or mismatched records, can result in delayed payments. Make sure your application is correct before submission.

- Discrepancies in Tax Filing: If you have not filed taxes correctly, the SSA may delay your payments until it resolves the issue.

- SSA Backlogs: While the SSA has worked to improve its efficiency, certain times of the year — especially during peak filing periods — may still see delays due to backlogs in processing.

Understanding Tax Implications of SSDI Payments

While SSDI benefits are generally not taxable for most recipients, higher-income individuals may still be subject to taxation on a portion of their benefits. According to the IRS:

- If your total combined income (which includes SSDI benefits) exceeds $25,000 for an individual or $32,000 for a couple, you may be required to pay taxes on up to 50% of your SSDI benefits.

Taxpayers who receive SSDI should keep in mind that SSDI benefits may be included in their gross income for purposes of calculating federal income tax liability. However, many individuals will not exceed the income threshold required to trigger taxes.

Track Your SSDI Payment Status

It’s essential to keep track of your SSDI payment to ensure it’s deposited on time. You can check your payment status through several methods:

- SSA’s Online Portal: The My Social Security account allows beneficiaries to access detailed information about their benefits, including payment schedules and account balances.

- IRS2Go App: This mobile app provides updates on your federal payments, including SSDI benefits.

- Direct Express® Card: If you use a Direct Express® debit card, you can check your balance and monitor payment activity online.

Contact the SSA for Payment Issues

If you encounter issues with your SSDI payment, you can contact the Social Security Administration (SSA) for assistance. The SSA offers several ways to reach them:

- Phone: Call the SSA at 1-800-772-1213 for questions about your benefits or issues with your payment.

- Online: You can manage most of your information through your My Social Security account.

- In Person: The SSA also provides in-person services at local offices; however, appointments may be required.

Important: Be Prepared

When reaching out to the SSA, ensure you have your Social Security number and other relevant information on hand to speed up the process.

Related Links

Bank of America Bonus 2026 – How to See If You Qualify for the Surprise $1,000 Payout

VA Health Overhaul 2026 – Inside the $4.8 Billion Plan Transforming Veteran Care

For February 2026, SSDI recipients should expect their payments to be deposited according to the SSA’s scheduled dates based on their birth date. With the 2.8% COLA increase, SSDI payments are adjusted to better meet the needs of recipients in the face of rising living costs. To avoid delays, be sure to update your banking information and ensure your return is free of errors.

Tracking your payments and staying informed about any changes to your payment schedule will help ensure you receive your SSDI benefits on time.