For many Americans relying on Supplemental Security Income (SSI), the arrival of payments in January and February 2026 will be earlier than usual. This early deposit shift is a scheduled adjustment due to New Year’s Day and other holidays.

Understanding why this happens and how it impacts recipients is essential for managing finances and ensuring timely budgeting.

Why January and February SSI Payments Are Early in 2026

SSI payments are normally scheduled for the 1st of each month. However, when the 1st falls on a weekend or federal holiday, payments are disbursed on the prior business day to avoid delays. In 2026, this timing will affect both January and February payments.

- January 1, 2026, falls on a Friday, which is a federal holiday (New Year’s Day).

- Because the 1st of January is a holiday, the January 2026 SSI payment will be deposited early on December 31, 2025 — the last business day of the year.

This early payment will ensure that beneficiaries have their funds for the start of the year without delay. However, it can create confusion, as it’s not an extra payment, but simply a shift in the deposit schedule due to the holiday.

Similarly, February 1, 2026, falls on a Sunday, another reason for an early payment. The February 2026 SSI check will arrive on January 30, 2026, the last business day of January.

How Does This Affect SSI Beneficiaries?

The early payments do not represent extra money or a “bonus check.” Instead, they are standard monthly payments arriving ahead of schedule. While this may feel like a windfall, it is simply a matter of the Social Security Administration (SSA) adjusting payment dates based on holidays and weekends.

- January and February checks are simply being distributed early, and beneficiaries should not expect additional payments beyond the normal amount unless they are impacted by other SSA programs, such as those receiving Supplemental Security Income (SSI) under special conditions.

- For beneficiaries, this means they may see two payments in the span of a few weeks — one at the end of December and another at the end of January.

No Extra Money, Just Adjusted Dates

Beneficiaries should take care to remember that while the payments are arriving early, they still reflect regular monthly benefits that are adjusted for cost-of-living increases. Therefore, it’s essential to account for these early deposits in personal budgeting plans.

Why Early SSI Payments Are Necessary

This early payment schedule ensures that beneficiaries don’t face a delayed or missed payment during times when financial institutions are closed, such as holidays or weekends. This ensures consistent cash flow for recipients who rely on SSI payments for everyday expenses.

The Social Security Administration (SSA) follows a standard payment schedule, but this flexibility in adjusting for holidays ensures that recipients are not negatively impacted by the calendar. The SSA also issues payments early for cases when the 1st of the month falls on a holiday weekend.

In 2026:

- December payments (for January) were made on December 31, 2025, due to January 1 falling on a Friday (New Year’s Day).

- February payments (for February) will be made on January 30, 2026, since February 1 falls on a Sunday.

How Does New SSI Early Payments Compared to Previous Years?

The early payments in 2026 follow a well-established pattern used by the Social Security Administration to accommodate weekend and holiday payment dates. Similar adjustments have occurred in past years, and beneficiaries can expect the same shift for future years when the 1st of the month falls on a weekend or holiday.

For instance, when January 1, 2025 fell on a Wednesday, the payment was made on January 1 itself (since it wasn’t a weekend or holiday). In comparison, the early deposit system in 2026 is simply another predictable part of the SSA’s payment timing policy.

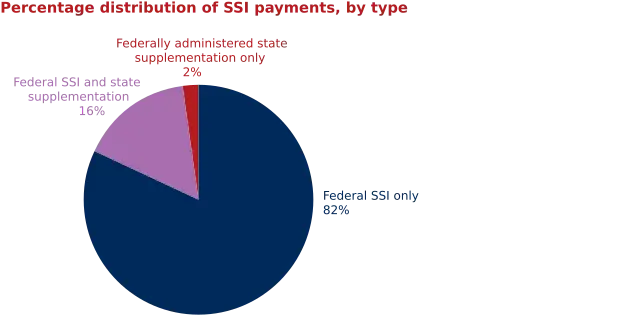

Special Considerations for Different SSI Recipients

Not all SSI recipients are the same. The early payment system is the same for individual recipients and couples, but it’s essential to note how other government benefits may impact the timing or receipt of payments.

For example, individuals receiving Medicaid, or those with other specific benefits tied to SSI, might have slightly different processing times. However, in general, the early payments will be consistent for all beneficiaries within this category.

Track SSI Payments

For those who want to stay informed about when payments will arrive, there are a few simple tools available:

- SSA’s Online Portal: By logging into the official mySocialSecurity account, recipients can get up-to-date information on their payment schedule and any changes.

- Bank Account Statements: Payments are typically deposited directly into the beneficiary’s bank account, making it easy to monitor arrivals in real-time.

State-Specific Concerns

In some states, there could be additional regulations or specific delays affecting the disbursement of SSI payments. For example, if state holidays or local regulations differ, some payments might experience minor delays.

It’s important to be aware of state-specific announcements or consult local Social Security offices for guidance.

Related Links

January 2026 Social Security COLA Update – How the 2.8% Increase Changes Monthly Payments

SNAP Policy Update Ahead – What the Agriculture Secretary Says Could Change Next

The Role of Direct Deposit in Managing Early Payments

Direct deposit is the most efficient way to ensure timely payments. For beneficiaries who still receive paper checks, there may be additional delays due to mailing schedules around the holidays. Direct deposit ensures payments are received on time, including early payments like those in December 2025 and January 2026.

Looking Ahead: Why Early Payments Matter for Beneficiaries

The Social Security Administration (SSA) plays an important role in ensuring timely and predictable payments for millions of people who depend on SSI. By making early payments in December and January, the SSA ensures that beneficiaries are not left without funds during holiday closures.

With the 2.8% COLA increase, recipients will benefit from more robust payments, even if the payment dates shift. However, beneficiaries should take care not to confuse the early payments as additional funds. The January and February checks are simply timely deposits that reflect the same monthly benefits, arriving earlier to adjust for the holidays.