Former U.S. President Donald Trump has floated a proposal to issue $2,000 payments to Americans, framing the idea as a “dividend” funded by tariff revenue.

Trump’s $2,000 Payment Idea is not law, and no federal agency has authority to issue payments without congressional approval, according to budget experts and legal scholars.

Trump’s $2,000 Payment Idea

| Key Fact | Detail |

|---|---|

| Legal status | Proposal only |

| Payment amount | $2,000 per person (suggested) |

| Funding source | Import tariff revenue |

| Eligibility rules | Not defined |

| Earliest possible timing | Uncertain; likely 2026 or later |

What Is Trump’s $2,000 Payment Idea?

Trump’s $2,000 Payment Idea proposes distributing cash payments directly to Americans using revenue collected from tariffs on imported goods. Trump has described the payments as a way to return money to citizens rather than allowing tariff proceeds to flow into the federal budget.

The proposal has appeared in campaign speeches and public remarks but has not been introduced as legislation. No bill text exists, and no federal agency has received instructions to prepare for implementation.

Budget analysts emphasize that presidential endorsement alone does not create a payment program. “Only Congress can authorize spending,” said Jessica Riedl, a senior fellow at the Manhattan Institute and a former Senate budget aide.

How Tariff Revenue Is Collected and Used

Tariffs are taxes paid by importers when goods enter the United States. The revenue is collected by U.S. Customs and Border Protection and deposited into the Treasury’s general fund.

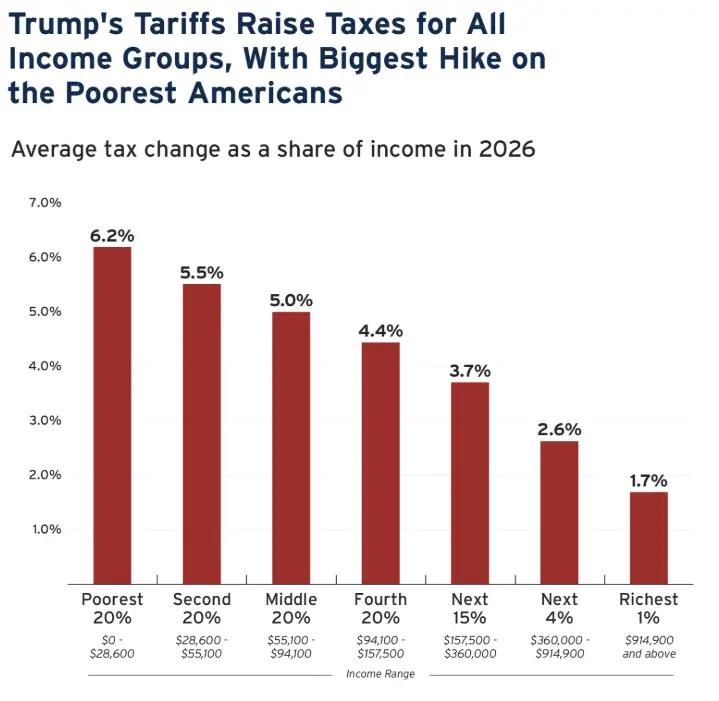

During Trump’s presidency, tariff revenue rose following expanded duties on imports from China and other countries. However, economists note that tariffs are paid primarily by U.S. importers and consumers, not foreign governments.

“Tariffs function like a consumption tax,” said Mary Lovely, a senior fellow at the Peterson Institute for International Economics. “Any dividend funded by tariffs would come from costs borne by Americans elsewhere in the economy.”

Eligibility Criteria For Trump’s $2,000 Payment

No Codified Eligibility Rules

There are currently no legal eligibility standards associated with Trump’s $2,000 Payment Idea. Trump has suggested excluding “high-income” individuals but has not specified income thresholds, filing status, or residency requirements.

Without legislation, federal agencies such as the Internal Revenue Service (IRS) cannot determine eligibility or distribute payments.

What Eligibility Might Look Like If Enacted

Experts say that if Congress were to authorize payments, eligibility rules would likely mirror past federal programs:

• Adjusted gross income limits

• Valid Social Security numbers

• U.S. citizenship or lawful residency

• Tax filing history or benefit records

These assumptions are based on precedent, not official guidance.

Comparison With Past Federal Payments

The U.S. issued direct stimulus payments during the COVID-19 pandemic under legislation passed in 2020 and 2021. Those payments were authorized through bipartisan votes and implemented by the IRS.

Trump signed two of those stimulus bills into law. Each included detailed eligibility formulas, payment caps, and clawback provisions.

By contrast, Trump’s $2,000 Payment Idea lacks statutory authority, administrative rules, and budget scoring. Economists stress that without those elements, payments cannot occur.

How Payments Would Actually Be Distributed

IRS, Treasury, or Social Security?

If enacted, payments would most likely be distributed by the IRS, using tax return data, as occurred with pandemic stimulus checks. Alternative mechanisms could include Treasury-issued checks or prepaid debit cards.

Using the Social Security Administration (SSA) is considered unlikely, since SSI and Social Security benefits operate under separate legal frameworks.

“The delivery system matters,” said Elaine Maag, a senior fellow at the Urban Institute. “Each option affects speed, accuracy, and fraud risk.”

Funding Gaps and Budget Math

Is Tariff Revenue Sufficient?

Issuing $2,000 payments to even half of U.S. adults would cost hundreds of billions of dollars. Annual tariff revenue typically falls well short of that amount.

According to nonpartisan estimates, tariff revenue alone could fund only a limited or highly targeted payment program unless supplemented by borrowing or spending cuts.

“The math does not work for universal payments,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget.

Economic Effects and Inflation Concerns

Supporters argue that direct payments could help households cope with high living costs. Critics warn that large cash transfers risk fueling inflation if consumer demand increases rapidly.

Federal Reserve officials have previously linked pandemic-era stimulus to inflationary pressures, though they note it was one factor among many. “Direct payments can be effective relief,” said Jason Furman, former chair of the Council of Economic Advisers. “But they are not cost-free.”

Legal and Constitutional Constraints

Congressional Power of the Purse

The U.S. Constitution grants Congress exclusive authority over federal spending. Even a sitting president cannot issue payments without legislative approval.

Legal scholars note that attempting to redirect tariff revenue without congressional authorization would almost certainly face court challenges. “There is no shortcut here,” said Kate Stith, a constitutional law professor at Yale University.

International and Trade Implications

Trump’s proposal intersects with broader trade policy. Tariffs remain a contentious tool, with allies and trade partners closely watching U.S. policy signals.

Trade experts warn that expanding tariffs to fund domestic payments could provoke retaliation or complicate trade negotiations. “Trade policy is not just a revenue tool,” said Lovely of the Peterson Institute. “It has diplomatic consequences.”

Risks of Fraud and Misinformation

The IRS has repeatedly warned about scams falsely promising stimulus payments. Officials say unverified claims about $2,000 checks increase the risk of fraud.

“No payments are being issued,” the IRS has stated in past advisories related to stimulus rumors. Experts urge the public to rely on official government announcements.

Scenario Analysis: What Would Have to Happen Next

For Trump’s $2,000 Payment Idea to move forward, several steps would be required:

- Legislation introduced in Congress

- Committee review and budget scoring

- Passage by both chambers

- Presidential signature

- IRS and Treasury implementation

Until then, the proposal remains speculative.

Related Links

January 2026 SSI Will Arrive Early — Why the Payment Comes in December Instead

The Social Security Rule Many People Miss and How It Can Lower Your Payment – Check Details

Trump’s $2,000 Payment Idea has generated public interest amid economic uncertainty, but significant legal, fiscal, and administrative hurdles remain. Until Congress acts, the proposal exists as a policy outline rather than a funded program, with its future dependent on legislative and economic realities.

FAQs About Trump’s $2,000 Payment

Is Trump’s $2,000 payment approved?

No. There is no law authorizing such payments.

Who would qualify?

Eligibility has not been defined and would require legislation.

When could payments be issued?

No timeline exists. Implementation would likely take months after passage.

Is this guaranteed?

No. It remains a proposal.