If you’ve ever signed up for what seemed like a harmless free trial on some supplement or skincare product, only to get slammed with monthly charges you never agreed to, the Wells Fargo $33 million settlement might put some cash back in your pocket. This Wells Fargo $33 million settlement stems from a class action lawsuit accusing the bank of helping shady companies process those sneaky recurring payments through its merchant accounts. It’s a big deal for anyone who got tricked into subscriptions dating back to 2009, and with the claim deadline looming in early 2026, now’s the time to check your old statements.

The Wells Fargo $33 million settlement covers U.S. consumers enrolled in recurring billing by specific Apex, Triangle, and Tarr entities using Wells Fargo’s payment processing. These groups pushed “risk-free” trials for over 70 products like diet pills, beauty creams, e-cigs, and hair growth aids, then hit cards with full prices and auto-renewals without clear notice. Eligibility requires proof of charges from listed companies since 2009; no prior FTC refunds for Apex/Triangle? File now for pro rata shares from the $33 million pot after fees. Recent 2025 court filings show notices mailing out by December, with thousands already eyeing claims amid rising class action awareness.

Wells Fargo $33 Million Settlement

| Aspect | Details |

|---|---|

| Settlement Amount | $33 million total fund |

| Eligibility Period | Enrollments from 2009 to present |

| Key Entities | Apex, Triangle, Tarr groups (full lists on settlement site) |

| Claim Deadline | March 4, 2026 |

| Payment Options | Pro rata with docs (based on losses); up to $20 flat without docs (min $10) |

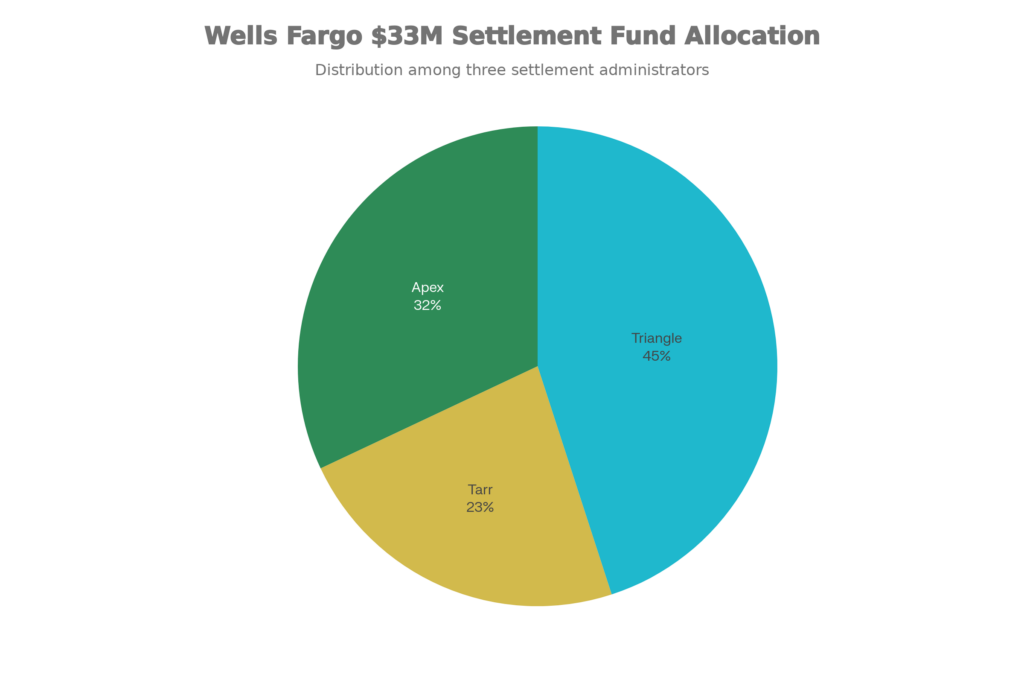

| Fund Allocation | 45% Triangle, 32% Apex, 23% Tarr (after fees up to $11M attorneys, $3M expenses) |

| Final Hearing | March 26, 2026 |

Who Can File A Wells Fargo Class Action Claim?

Think back to those late-night ads promising a free bottle of acai berry pills or wrinkle cream, just pay shipping. You did, and boom monthly hits started showing up. The Wells Fargo $33 million settlement targets folks enrolled by Tarr, Triangle, or Apex companies since 2009, where Wells Fargo handled the billing. Over 70 products qualify, from keto supplements to vaping gear, as long as the charges processed through the bank’s merchant services.

If you snagged an FTC refund for Apex or Triangle scams already, you’re covered automatically for those no extra form needed. Tarr victims or partial refunds? Submit details matching the official entity lists on the settlement site. Court docs from late 2025 note the class spans millions potentially affected, with preliminary approval locked in November. This setup makes the Wells Fargo $33 million settlement accessible to everyday people who might not realize they were victims until now.

Digging deeper, the lawsuit paints a picture of companies like Apex Marketing pushing dietary aids such as garcinia cambogia extracts or green coffee bean supplements. Triangle Trading targeted skincare with anti-aging creams and eyelash serums, while Tarr Enterprises focused on e-cigarette refills and male enhancement pills. Each had slick websites promising no-risk trials, but fine print buried the subscription traps. Wells Fargo’s role? Providing the merchant accounts that let these charges fly under the radar for years.

What if you disputed charges back then and got refunds from your card issuer? You might still qualify if the original enrollment fits the criteria. The settlement administrators will sort it out, but having records strengthens your case. With consumer awareness spiking in 2025 thanks to viral TikToks and Reddit threads about class actions more people are uncovering these old hits. Don’t sleep on this; the Wells Fargo $33 million settlement could mean real money if your names on those lists.

How Much Is The Wells Fargo $33 Million Settlement Payment?

Exact payouts from the Wells Fargo $33 million settlement depend on claims filed and your proof. Documented losses like statements showing $50 in unreimbursed charges earn pro rata slices: 45% of net fund for Triangle, 32% Apex, 23% Tarr. Flat claims without docs top at $20, but could dip to $10 minimum if too many piles in. Attorneys take up to $11 million, admin $3 million, leaving the rest for class members. Service awards hit $15,000 for named plaintiffs. With 2025 trends showing high claim volumes in similar suits (like Wells Fargo’s prior $185M mortgage deal), expect reductions file docs for max share. Let’s break it down: suppose the net fund lands at $19 million after cuts. A Triangle victim proving $100 in losses might snag around $45 from their pool slice, depending on total claims.

Real-world math gets fuzzy with thousands filing. Early estimates suggest average payouts could range $15-75 for documented cases, based on parallel settlements this year. Flat filers might see $12-18 after redistribution. The beauty? No cap on documented claims, so big losers could pocket hundreds. Keep in mind taxes payouts count as income, so set aside 20-30% if you’re in a high bracket. This Wells Fargo $33 million settlement stands out because it prioritizes fairness: heavier victims get more. Unlike some suits where everyone gets pennies, pro rata keeps it equitable. Track your potential via the settlement calculator on the official site once claims roll in it’s a game-changer for planning.

How To Claim A Class Action Rebate

- Grab your claim form online at the settlement site or mail it to the Portland admin by March 4, 2026. Enter your notice ID/PIN if you got one, list products/dates, and pick PayPal, Venmo, Zelle, or check. For bigger bucks, scan in statements proving charges minus refunds.

- Double-check everything typos kill claims. Save your confirmation email. Opt-out or object by March 5 if it doesn’t fit. Payouts roll out 60-90 days post-final approval, eyeing summer 2026 if no appeals snag it. Step-by-step: First, visit the site and search your email for “Wells Fargo settlement notice.” No notice? Self-identify by company/product lists.

- Next, gather docs: download statements from your bank’s app (most go back 7-10 years easily). Describe the scam: “Ordered free trial of ReviveSkin cream from TriangleTrading.com in 2015, charged $89.95 monthly for 6 months.” Upload PDFs, hit submit. Boom confirmation in minutes.

- Pro users swear by organizing a folder per entity. If tech-challenged, call the hotline (toll-free, staffed weekdays). The Wells Fargo $33 million settlement process mirrors big tobacco or Facebook data suits smooth if you prep. Watch for phishing scams, only use official links.

Is Proof or Documentation Required To Submit A Claim?

The Wells Fargo $33 million settlement’s flat $20 option just needs your enrollment story no receipts required. But documented claims shine, pulling from the pro rata pool with bank statements, emails, or charge disputes as backup. Admins cross-check against entity lists from 2009-present. Weak proof defaults to flat. Pro tip: snapshot those 15-year-old statements now; digital banking makes it easier than digging boxes. What counts? Credit/debit statements with merchant names like “Apex Direct LLC” or product descriptors. Emails confirming “trial enrollment”? Gold. Even dispute letters from your bank help prove losses. No docs? You’re not shut out 25-50% of each pool reserves for flat claims. But why settle for $20 when $100+ beckons? 2025 data from similar cases shows documented filers average 4x more. Start with free tools: Mint or your bank’s export feature pulls years of history instantly.

Important Dates For Wells Fargo $33 Million Settlement

- Circle March 4, 2026, for claims miss it, miss out. Opt-out/objection due March 5; final hearing March 26. Notices dropped by December 2025, per court order. Post-approval, payments ship in 60 days, potentially July 2026. Track updates on the official site; appeals could stretch it. Wells Fargo $33 million settlement joins 2025’s wave of bank suits, underscoring consumer wins.

- Calendar it: January 2026 for doc hunts, February for filing. Mid-March for any last-minute tweaks. This timeline gives breathing room amid holiday chaos, but procrastination kills claims yearly.

Items That May No Longer Be Allowed Under SNAP – Check EBT Card Rules Updates

Why Did This Class Action Settlement Happen?

- Wells Fargo bankers allegedly knew Apex, Triangle, and Tarr were running shell games opening 150+ accounts for fake owners, laundering millions from “free trial” traps. Lawsuits claim the bank ignored red flags for fees, letting scams thrive on supplements and beauty fads. No fault admitted, but the $33 million buyout ends years of fights. It’s part of broader 2025 scrutiny on banks aiding recurring billing fraud, echoing FTC crackdowns.

- FTC busted Apex/Triangle in 2019, clawing back $18M. But Tarr slipped through, and Wells Fargo processed it all. Plaintiffs argued the bank enabled “negative option marketing” abuses, where silence equals consent. Internal memos (unsealed in discovery) showed execs debating risks yet prioritizing merchant revenue. The settlement? A pragmatic exit, avoiding trial bombshells.

Today, it signals banks must vet clients harder amid Biden-era consumer protections ramping up.

FAQs on Wells Fargo $33 Million Settlement

Who qualifies for the Wells Fargo $33 million settlement?

Anyone charged recurring fees by listed Apex, Triangle, or Tarr entities via Wells Fargo since 2009, excluding prior full FTC refunds.

Do I need documents for a Wells Fargo $33 million settlement claim?

No for $20 flat; yes, for higher pro rata based on losses.

How much will I get from the Wells Fargo $33 million settlement?

$10-$20 flat without proof; more with docs, pro rata after fees.

Is the Wells Fargo $33 million settlement approved yet?

Preliminary yes (Nov 2025); final hearing March 26, 2026.