Wells Fargo has agreed to a significant $150 million settlement to resolve a class action lawsuit that accused the bank of improperly charging customers unexpected fees. This settlement comes after claims that Wells Fargo levied fees on accounts without proper disclosure or consent.

If you have been affected by these practices, it’s essential to understand your eligibility for compensation.

Key Facts About the Wells Fargo Class Action

| Key Fact | Detail |

|---|---|

| Settlement Amount | $150 million |

| Nature of Allegations | Unexpected fees, including overdraft charges |

| Eligibility | Customers who were charged fees between [specific dates] |

| Claim Deadline | [Insert Deadline Date] |

| How to Claim | Online application or by mail |

What is the Wells Fargo Class Action Settlement About?

The Wells Fargo Class Action settlement addresses a long-running issue where the bank allegedly charged various fees to its customers without their knowledge or proper consent. These fees, including maintenance and overdraft charges, were applied in ways that customers reportedly weren’t informed of when opening their accounts.

According to plaintiffs, Wells Fargo’s practices violated consumer protection laws and banking regulations by failing to adequately disclose these fees. In the aftermath of this lawsuit, Wells Fargo agreed to pay $150 million to resolve the allegations, compensating those affected by the improper fees.

The settlement will provide restitution to eligible customers who were charged these unexpected fees during a specified period. This class action is part of Wells Fargo’s broader efforts to address customer complaints regarding fee practices, which have been a source of controversy for the bank in recent years.

Background: What Led to the Class Action?

The class action lawsuit stems from various allegations that Wells Fargo charged customers for services without their clear understanding or consent. This is not the first time Wells Fargo has faced accusations of fee-related misconduct.

In fact, the bank has been embroiled in several legal battles over its business practices, with a particularly high-profile case in 2016 involving the creation of unauthorized accounts. That case led to a $185 million settlement and significant reputational damage.

However, this latest class action is focused specifically on unexpected fees, including overdraft and non-sufficient funds charges, which customers argue were applied without proper notice.

In many cases, customers were not made aware that certain fees could be charged or that there were specific requirements they needed to meet to avoid them. The current lawsuit claims that these practices harmed thousands of customers, prompting the $150 million settlement.

What Does the $150M Wells Fargo Class Action Settlement Cover?

The settlement aims to compensate customers who were charged certain unexpected fees, including:

- Overdraft Fees: Customers who incurred overdraft charges on their accounts, sometimes for transactions that may have been processed without clear consent or notification, will be eligible for compensation.

- Non-Sufficient Funds (NSF) Fees: Charges applied when a transaction was attempted without sufficient funds in the account, even when such fees might not have been properly disclosed.

- Maintenance Fees: Bank accounts that were subjected to maintenance or service fees that were not transparently communicated to customers when they opened their accounts.

This $150 million settlement will provide financial restitution to those affected by these fees, based on the documentation and proof provided through claims. The aim is to offer a fair resolution for individuals who were impacted by these charges.

Eligibility Criteria: Who Can Benefit from the Wells Fargo Class Action Settlement?

To qualify for compensation under the Wells Fargo class action settlement, individuals must meet certain criteria. Those eligible for the settlement will be customers who were charged unexpected fees, such as overdraft, maintenance, or NSF fees, during a specified period.

Customers who meet these criteria should review their account statements for charges that fall under these categories and ensure that they were not properly disclosed. The bank will likely notify affected individuals through official channels, but claimants are encouraged to file a claim to ensure they receive the compensation they are entitled to.

Here are some general eligibility guidelines:

- Customers who had an account with Wells Fargo during the defined period of the lawsuit (e.g., from [insert specific dates]).

- Customers who were charged overdraft fees, NSF fees, or other maintenance-related charges without proper disclosure.

- Individuals who have not already received restitution from previous settlements or settlements with other financial institutions involving similar charges.

How to File a Claim For Wells Fargo Class Action

To file a claim for compensation, customers can visit the official Wells Fargo class action settlement website, where they will find the necessary forms and instructions. The steps for filing a claim are relatively simple:

- Visit the Settlement Website: Go to the official website designated for the settlement claims process.

- Provide Your Information: Submit details about your Wells Fargo account, including the type of fees you were charged, and the dates they occurred.

- Submit Supporting Documentation: You may be asked to provide relevant account statements or evidence showing the unexpected fees you were charged.

- Submit the Claim by the Deadline: Be sure to submit the required documents before the specified deadline to ensure your claim is processed.

Filing a claim is typically free and can be done either online or by mailing a completed paper form to the provided address.

What Happens After You File a Claim?

Once your claim has been submitted, Wells Fargo will process the information and determine if you are eligible for compensation. If your claim is approved, you will receive a payout based on the fees that were charged to your account.

The compensation may be issued via check or direct deposit, depending on the available options in the settlement process. It is important to ensure the accuracy of the information provided in your claim to avoid delays or disqualification.

Wells Fargo will send updates on your claim status, and you should retain any documentation related to the process for future reference.

Legal Implications: Why is This Settlement Significant?

The $150 million Wells Fargo settlement has broader legal implications for both the bank and the financial industry. While the settlement addresses customer grievances, it also serves as a significant reminder of the legal consequences financial institutions face when they fail to adequately disclose or justify fees.

This case is another example of the growing scrutiny on the banking industry, particularly regarding transparency in fee structures. In recent years, regulatory agencies, including the Consumer Financial Protection Bureau (CFPB), have intensified their focus on fee-related complaints against banks and other financial institutions.

This settlement may also help pave the way for similar lawsuits against other financial institutions that have faced similar accusations of hidden or unexpected fees.

Impact on Wells Fargo

Although the $150 million settlement is a substantial amount, it represents a small fraction of Wells Fargo’s total earnings and assets. Nevertheless, the settlement could have significant reputational consequences for the bank, especially considering its past scandals.

Wells Fargo has already been the subject of several regulatory investigations and lawsuits over its business practices, and this latest settlement could further harm its public image.

Wells Fargo has expressed its commitment to improving customer service and transparency, acknowledging that its previous practices were insufficient. The settlement, however, may be viewed as a reminder of the continuing need for greater accountability in the banking industry.

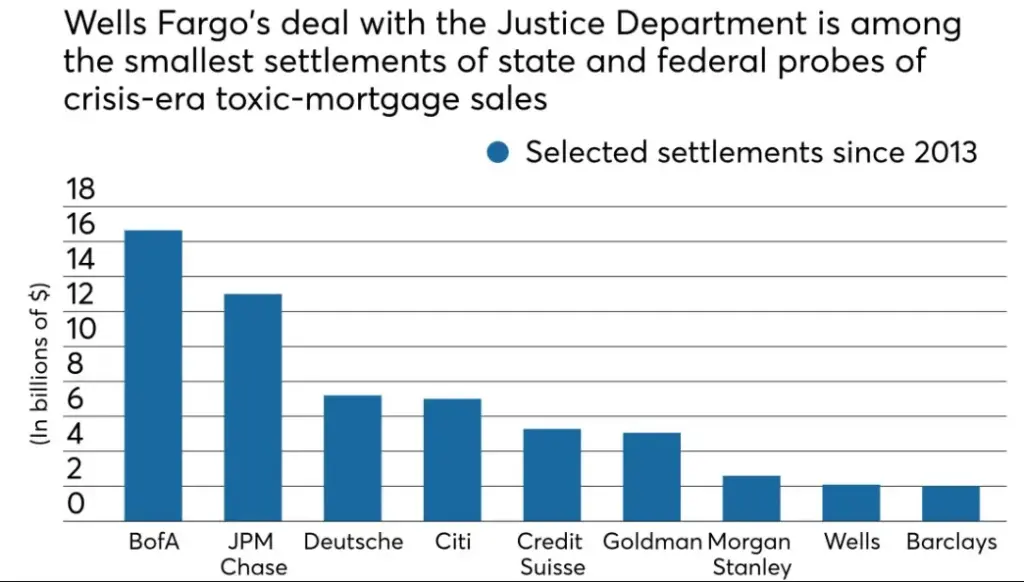

How Do Other Banks Compare?

Wells Fargo is not alone in facing legal action over unexpected fees. In recent years, major banks like Bank of America, JPMorgan Chase, and Citibank have also faced similar class action lawsuits involving deceptive fee practices. These cases reflect a growing trend of financial institutions being held accountable for hidden fees that may be difficult for customers to detect.

For example, in 2019, Bank of America agreed to settle a class action lawsuit for $66 million related to excessive overdraft fees. Similarly, JPMorgan Chase and Citibank have both settled claims over unclear or unfairly applied fees in past years.

As financial institutions face increasing public and regulatory scrutiny, it is likely that more customers will demand clearer disclosures and fairer fee practices. The Wells Fargo settlement serves as an example of what can happen when institutions fail to meet these expectations.

Related Links

Social Security Payments on January 14: Will You Receive a Check? Check Eligibility Criteria

What You Need to Do Now

If you believe you have been affected by unexpected fees from Wells Fargo, it is essential to file a claim before the deadline. Review your account statements for any charges that may qualify, and follow the steps to submit your claim.

Although the $150 million settlement cannot undo the harm caused by these practices, it offers a financial remedy to affected customers.

As the banking sector continues to evolve, customers should remain vigilant about their rights and continue to advocate for greater transparency and fairness.