Americans who plan to work while on Social Security in 2026 will face updated federal earnings limits that could temporarily reduce benefit payments for those who claim retirement benefits early.

The changes, tied to wage growth and inflation adjustments, affect millions of retirees who remain in the workforce while drawing Social Security income.

Working While on Social Security in 2026

| Key Rule | 2026 Threshold | Applies To |

|---|---|---|

| Earnings limit (under FRA) | $24,480 | Beneficiaries under full retirement age |

| Earnings limit (year reaching FRA) | $65,160 (before FRA month) | Beneficiaries reaching FRA in 2026 |

| Benefit reduction rate | $1 for every $2 or $3 over limit | Early claimants |

| Earnings limit after FRA | No limit | All beneficiaries |

What the Retirement Earnings Test Does—and Does Not Do

The retirement earnings test is often misunderstood. It does not prevent retirees from working, nor does it permanently reduce benefits. Instead, it temporarily withholds a portion of benefits from individuals who:

- Have claimed Social Security retirement benefits, and

- Have not yet reached full retirement age (FRA), and

- Earn wages or self-employment income above federal limits.

The Social Security Administration (SSA) emphasizes that benefits withheld under this test are later restored through higher monthly payments once full retirement age is reached.

Updated Earnings Limits for 2026

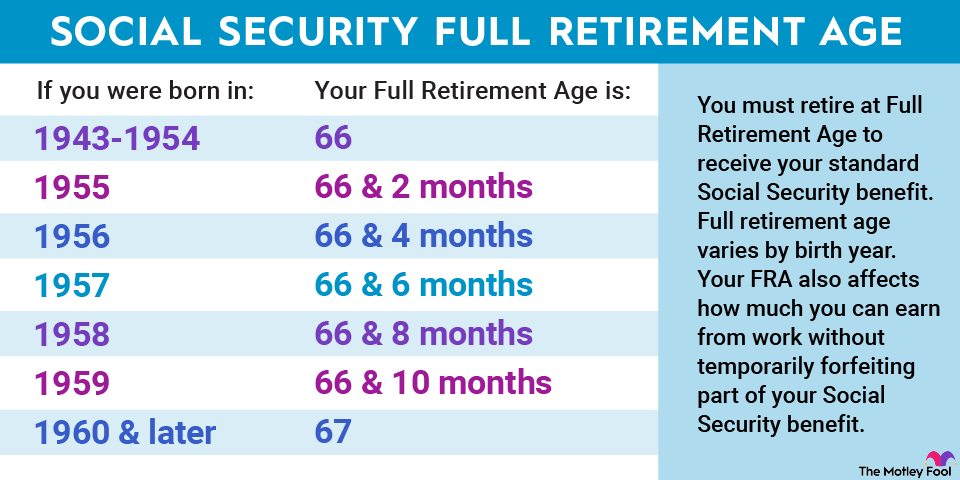

Beneficiaries Under Full Retirement Age

For beneficiaries who will be under full retirement age for all of 2026, the annual earnings limit is $24,480. For every $2 earned above that threshold, $1 in Social Security benefits is withheld. The SSA typically withholds full monthly payments until the required amount is reached.

Beneficiaries Reaching Full Retirement Age in 2026

A higher earnings limit applies during the year a beneficiary reaches FRA. In 2026, individuals may earn up to $65,160 before the month they reach full retirement age. Above that amount, the SSA withholds $1 for every $3 earned over the limit. After the FRA month, no earnings limit applies.

After Full Retirement Age: No Penalty for Working

Once full retirement age is reached, beneficiaries may earn unlimited income from work without any reduction in retirement benefits. This rule applies regardless of job type, hours worked, or income level.

Are Withheld Benefits Lost?

No. Benefits withheld under the earnings test are not forfeited. When a beneficiary reaches full retirement age, the SSA recalculates their benefit to credit back months in which payments were reduced or withheld. This results in a higher ongoing monthly benefit. In effect, the earnings test operates as a deferral mechanism rather than a penalty.

How Continued Work Can Increase Benefits

Working longer can sometimes raise Social Security benefits. The SSA calculates retirement benefits using a worker’s highest 35 years of earnings. If a beneficiary earns more in later years than in earlier ones, those higher wages can replace lower-earning years in the benefit formula.

As a result, some working beneficiaries see automatic benefit increases, even before reaching full retirement age.

Self-Employment, Gig Work, and the Earnings Test

Self-employment income counts toward the earnings limit, but it is calculated differently. The SSA uses net earnings, meaning gross income minus allowable business expenses. However, income reporting errors are more common among self-employed beneficiaries, increasing the risk of overpayments.

Gig workers, including independent contractors and platform-based workers, are subject to the same rules and must report earnings accurately.

Spousal and Survivor Benefits While Working

The earnings test also applies to spousal and survivor benefits claimed before full retirement age. If a spouse or survivor receives benefits and works while under FRA, the same earnings limits and withholding rules apply. However, once FRA is reached, those benefits are no longer affected by work income.

This distinction is especially important for widows and widowers who return to work after claiming survivor benefits early.

Reporting Earnings and Avoiding Overpayments

The SSA requires beneficiaries to report changes in earnings promptly. Failure to do so can result in overpayments, which the agency is legally required to recover. Recovery typically occurs through reduced future benefits, though beneficiaries may request repayment plans or waivers in limited circumstances.

The SSA advises beneficiaries to:

- Estimate earnings conservatively

- Report changes as soon as they occur

- Keep documentation of wages and hours worked

Why the Earnings Limits Rise Over Time

Unlike benefit amounts, which are adjusted for inflation, earnings limits are tied to national wage growth. As wages increase across the economy, the SSA raises the thresholds to reflect changing labor market conditions. Economists say the trend reflects longer working lives and shifting retirement norms.

Broader Context: Americans Working Longer

Labor force participation among Americans aged 65 and older has risen steadily over the past two decades.

Longer life expectancy, rising healthcare costs, and insufficient retirement savings have pushed many retirees to remain employed. The SSA says the program’s structure is designed to accommodate these realities without discouraging work.

Related Links

Alaska Confirms Expanded SNAP Use in Rural Areas, Including Hunting and Fishing – Check Details

$1,776 Military Payments Explained: What’s Authorized and Who May Be Eligible

Common Misconceptions About Working and Social Security

- “Working means I lose my benefits.” False. Benefits may be temporarily withheld, not lost.

- “All income counts toward the limit.” False. Only wages and self-employment income count.

- “The earnings test applies forever.” False. It ends at full retirement age.

Looking Ahead

As more Americans choose to work past traditional retirement ages, understanding how employment affects Social Security benefits has become increasingly important. The 2026 updates reinforce a central reality of the system: work is permitted, but timing, earnings, and reporting accuracy matter.